Centro Properties Group owes banks nearly $4 billion - Ex-chairman didn't see 'debt bombshell' coming.

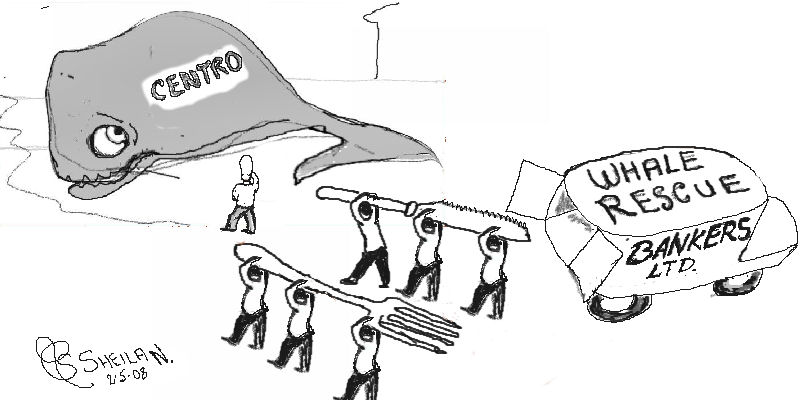

The Australian Financial Review (Thursday May 1st 2008) saw fit to feature the perilous circumstances of Centro on its front page, with a follow up on page 47, captioned, "Lolling like a beached whale in a receding tide" - the tide being financial investment and customers. How, you may wonder, could someone in charge of borrowing billions from banks, to deploy energy and resources for billion dollar developments, be apparently so energy and resources naive that they could fail to see the fossil-fuel related "debt bombshell coming"?

Yet, this is ex-Centro CEO, Brian Healey's explanation for beaching the Centro Shopping Centre Group colossus.

What struck this writer is that Centro is in charge of moving enormous quantities of materials all round the world, in order to build its many massive shopping centres. Surely someone in this commercial colossus would have noticed the rising cost of making concrete and transporting rocks and wood and glass, and running the bulldozers and cranes and tools on construction sites?

How many people in charge of government, how many economists, CEO's and even engineers, are either incapable of applying energy-resources theory to reality or still believe fairy-tales about man's ingenuity excepting modern economies from thermodynamic limits?

It seems that an awful lot of people in the global society of the 'developed world' really believe that our economies have literally 'dematerialised', i.e. are relying on less and less fuel and materials. What must such ‘cornucopians’ make of some other features in the same edition of the Fin Review? A long article about food shortages feeding conflict, another about the incompetent assessment and management of Australia’s food basket, the Murray Darling Basin, and one about how all the signs point to ours being the era of petroleum depletion.

"For the record, supply constraints keep oil prices moving in one direction." This article (from the New York Times) cites Fatih Birol, the chief economist with the International Energy Agency, saying, "'According to normal economic theory, and the history of oil, rising prices have two major effects'. 'They reduce demand and they induce oil supplies. Not this time."

And the article goes on to explain what many people not distracted by consumerism and with normal powers of observation have been increasingly aware of for the past 15 years. Oil discoveries are diminishing in size and in quality or accessibility, whilst economic growth, based on population growth, is being encouraged in the third world and in the English speaking first world, by growth economics ideologues in government and big business. The Centro business, to such observers, is indicative, in its reliance on land-speculation and population growth, of a kind of blindness to reality and a faith in an economic illusion.

It is as mysterious as the recurrent drive of pods of whales to beach themselves.

The financial media is full of gruesome stories lately. Centro's predicament may well symbolise much of the investment and development world's predicament. Not just business, but governments and whole economies, may also find themselves high and dry like beached whales. Whales need water to swim in, humans need air and food to survive, and our modern economies need oil. The Fin Rev quotes CIBC World Markets analyst, Jeff Rubin: 'The outlook for oil supplies signals a period of unprecedented scarcity.'"

The day after payment was due, new CEO, Glenn Rufrano, was still trying to finalise an extension from the numerous banks involved in funding Centro’s debt, all of them dealing with companies in similar trouble, in a system of circular financing.

In a world where the US and other governments subsidise farmers to grow corn for biofuels with precious fossil-fuel based fertilisers, causing famines, and nations go to war for oil, and mortgages rise due to engineered population growth and land speculation by multinational developers, how could you just expect people to go on shopping?

Add comment