(Illustration adapted from Goya's Saturn devouring his children)

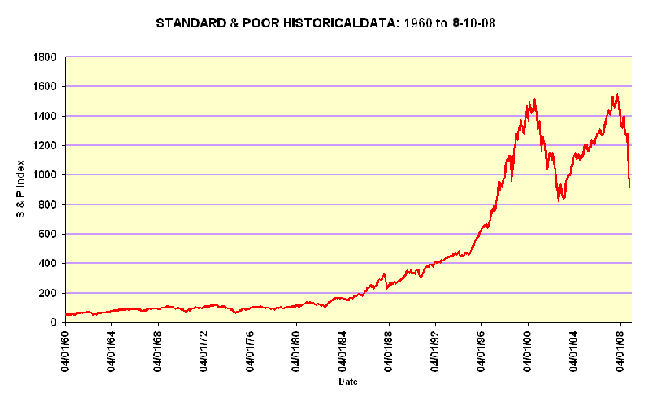

[Note: This article was updated on 12 Oct 08 with S&P Graph]

Are we there yet?

Global decline in total fuel available should manifest in reduction of total global economic activity.

Does the stock-market sector decline represent a reaction to decline in total economic activity resulting from high oil prices?

(Source is "Oil Price History and Analysis," WTRG Economics' Energy Economist Newsletter, www.wtrg.com/prices.htm. Prices are in 2006 dollars.)

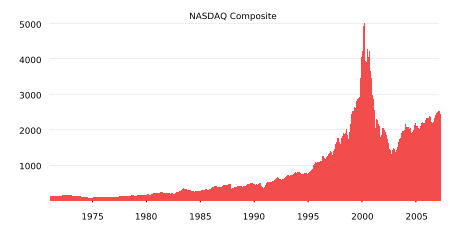

The Dot Com led bubble in the stock market topped in early 2000 then fell pretty much continuously until 2003. Between 2000 and 2003, the market lost approximately 45%. In early 2003, Enron and Worldcom made the global market look as if it was really unraveling. Things looked so grim over 2000-2003 that everyone was very pessimistic. Oil prices had also begun to climb in 2000, but remained well below the levels of 1973 and 1979 oil shocks and dirt cheap compared to prices in 2008. (See diagram). It has also been suggested [1] that the Year 2K preparations had temporarily boosted the popularity of Dot Coms.

On the eve of the Iraq invasion the stock market reached bottom. When the US invaded Iraq, it bounced back.

(Historical NASDAQ composite graph adapted from www.nationmaster.com/encyclopedia/Nasdaq-Composite)

The speculative "dot-com bubble" in information technology over 1995-2001, with its spectacular correction made its former status seem so obviously artificial, that it was expected that the share market would return to more real trading volumes. Instead the market doubled between 2001 and 2006, equivalent to 14% compound interest in that time.

Property Bubble

Much of this 2001-2006 bubble was predicated on

a) inflated land values which relied on a bull property development market, incorporating new suburbs, new shopping complexes, new roads, and population growth to fuel demand

b) cheap commodities (oil and materials)

The ‘boom’ in property development increased demand for materials and oil, but oil production barely increased at all. So, prices went up. They went up robustly for materials, but they increased spectacularly for oil, as well as increasing for every other form of fuel, energy and electricity – including, coal, gas and uranium.

When fuel and materials prices rose, the margin for profit in property development dropped. One of the ways that industry tends to mitigate the rising cost of fuel and materials is by reducing the cost of labour. Unfortunately, having converted a huge part of the economy to land speculation based on property development, wage reduction had to result in reduction of consumption of property as a commodity, notable by desperate lending and debt repackaging, which accelerated mortgage defaults.

Stock market sound and fury signifying nothing?

The stock-market is an institution which can only survive on an economic surplus sufficient to support the fees it takes from investments. Whilst economic activity, much of it in the property development industry, was growing by up to 14%, fees of 1-3% seemed wearable and the size of the stock market industry grew just like the size of the real-estate industry did with the globalization and acceleration of land-transactions, assisted by new debt-packaging ‘commodities’ like sub primes. But, if real economic activity drops to 2-3% or below, such fees are untenable. To continue to exist in its current size and draw those kinds of fees, or any fees at all, the stock market must radically downsize.

Is what we are seeing in part the cutting back of personnel, agencies and activities in this sector itself?

How low can the level of economic activities go?

If economic activity is only responding to short-term price variations in a bear market, rather than to total global petroleum limits, then we might expect market indicators in general to continue to see-saw and prices to see-saw. If it is responding to long-term depletion then the level should begin to see-saw between lower and lower parameters since economic activity will not be able to recover in the forseeable future. Any fuels called in to replace petroleum oil and gas will lack that crucial adaptability to our wheeled and air-transport dependent economy. Any developing new technologies for transport will require new infrastructures on a scale which will be difficult and probably impossible to provide without the vast petroleum reserves that the economy has depended on since WW2

Global per capita oil peak was 1979

Oil production has not been keeping up with population growth since 1979 and there are signs that it may not be keeping up with economic activity either. There has been widespread belief – the ‘dematerialisation theory’- that the economy became less dependent on oil and other energy since the 1970s oil shocks and so had increased economic production despite declining increase in oil production.[2]

Does increased efficiency really mean economic ‘decoupling’ from energy?

It is true that industry became less profligate in its use of energy and that real mechanical and technological efficiencies were achieved. A case can also be made that developed economies reduced the amount of fuel calories/joules they used per unit of production since 1973. There is however little or no real evidence to support the idea that using fewer fuel joules amounts to getting more work from less energy.

Investigation indicates that, in reality, industries began to be more careful about the kinds and forms of fuel they used for production, instead of just using any fuel for any operation. Calories and joules in themselves do not accurately reflect the real usefulness of different fuels. Adaptability of particular fuels to different kinds of production is crucial.[2]

Thus, as oil became more costly, we mostly stopped burning it in our home heaters and turned to coal, because coal could immediately be adapted for heating or electricity creation, but not so easily adapted to drive cars and planes. Because oil was immediately available to drive cars and fly planes, it was largely reserved for wheeled and air transport. An early exception to this rule was South Africa when oil was not available due to political embargos, and so oil was made from coal despite huge energy costs entailed by coal liquefaction. No doubt the slave labour conditions in South Africa assisted the economy to adapt.

We now see many more examples of this costly production of synthetic oil from coal, simply because the cost and supply of petroleum is increasingly problematic. China has been making oil from coal for several years now and Australia and other countries are also encouraging investment in this technology. It is not that the process of turning coal to oil has become substantially more efficient, it is that our expectations for economic production have diminished, although governments still rarely admit this. The effect of producing oil from coal will be higher cost for all industrial production using this coal-oil and a reduction in the amount, rate and profit margin of industrial production. As in South Africa, economies newly resorting to coal-oil will rely on reducing the cost of labour in production.

Allocation of resources; wealth and fuel distribution

There was actually a global decline in economic growth from 1973 onwards, but first-world countries did not register this because access to fuels and energy was privileged for them and blocked for third world populations. So it was possible for many of us in the so-called developed economies to believe that there had been a complete recovery from the 1973 and 1979 oil shocks.[2]

Those of us who looked seriously at the decline in living standards, quality of life, ecological health, democracy and political stability in the third world were less confident in the façade of business as usual. Recently signs of similar declines in standards are apparent in the first world.

Oil depletion back on the intellectual radar

When the concept of peak oil came back on the radar, especially via groups like Jay Hanson’s energyresources [ AT ] yahoogroups.org in the late 1990s, people who had been aware of the 1973 oil shock were ready to investigate Hubbert Peak calculations of timing of world oil peak and depletion and to look out for market and other signals of peak production not meeting human economic and population demands.

Relationship between prices, depletion and demand

Oil prices are often interpreted as an indicator of geological depletion, but they are not reliable in the short term because speculation may drive these prices up, higher costs may cause short term increases in production because more money is available for production, and higher costs will reduce demand for oil, which will eventually cause oil-sellers to lower their prices.

It was generally felt that oil prices in an era of true geological depletion would follow a zig-zag course of supply and demand responses, where high prices would result in what is known as ‘demand destruction’, but would rise again as necessity reasserted demand.

Eventually oil would become a precious fuel and all those things in our economies which formerly relied upon oil would cease to exist except perhaps in some relic industrial communities which might manage to retain strategic access to remaining reserves.

The situation with the ‘First World’ since 1973 and 1979 could represent an early version of such a relic community monopolizing remaining reserves. The method of monopolization could be identified as market sequestration via currency manipulation. Having a currency equal to US dollars, OPEC standard currency from 1974, became the test for inclusion in the monopolizing countries. Oil became very expensive for any country whose currency was of low value vis a vis the USD.

Ironically Russia, which was the first developed country to fall below this access standard, now dominates considerable, if declining, oil and gas reserves, and the US, whose enormous reserves began to decline in the early 1970s, now roams the world in growing desperation, seeking to dominate other peoples’ reserves. Now with its dollar also losing sway, its capacity to monopolise oil reserves via currency domination looks increasingly moot..

Are high oil prices an indicator that total oil supply is now not adequate to keep total world economic activity going at its recent rate?

C.J. Cleveland, R.K. Kaufmann, and D.I. Stern's research cited in [3] seemed to show clearly that fuel prices were closely aligned with the economic productivity of the uses they were put to. Expensive petroleum fuels are associated with the most productive industries. This would suggest that as petroleum prices rise there will not be much room for real adjustment by these industries. Passing on the costs to the consumer will result in 'demand reduction', which will result in a slowing of the economy and a smaller stock market index score. Basically, less petroleum means a smaller, slower economy.

The US and other countries' attempts to throw money at the banks in order to induce them to lend for renewed investment are made in the hope that the money will cause a response. Is the absence of response an indication that the banks cannot find any good investments to place? A failure to respond to this credit stimulus may signify that we really have reached a nexus of oil reserves and economic margins, meaning that continuous economic growth and material progress are now things of the past.

What to do?

What slack remains in our economic system?

Time.

The pace of economic transactions now requires specialised industries and staff to keep up with. Ordinary people and processes cannot deal with the pace and impact of economic growthism on their environments. Governments have sacrificed democratic engagement to laissez-faire economics because they lack the manpower and time to dedicate parliaments to monitoring and controlling the rate of human engineered material change and disturbance. The languishing world property markets reached extremes of market propulsion before their current collapse.

A slowing down of the economy would be a godsend, but only if we adapt democratically to it.

We can adapt to a smaller, slower economy by forgiving debt, relocalising economies, and working and producing less material things. Operations on a large scale, such as internationally, including telecommunications and travel, should probably become the province of governments to operate, subject to democratic controls. A new, slow and smaller economy cannot afford massive property development just for the sake of cash profits, and it would have to relinquish the daily importation of food and materials from impoverished countries for continuous hectic economic activity. It would have to adapt to local supplies for most things.[4] Population policies, instead of encouraging rapid growth, would need to take advantage of the natural tendency to rein in growth when economic indicators clearly predict shrinking opportunity. We could take advantage of the aging population to slow down activity, anchor communities, and reduce demand. Instead of attempting to replace age with youth through high immigration, we can look forward to the passing of the babyboom through the Australia's demographic intestine and plan for an overall much smaller population.

One thing is for sure, we need a change in political elites, and by that I mean a change in CEOs and mainstream media owners, just as much as in all levels of government. We have been ruled by an elite with an uncritical faith in a reality-divorced notion of continuous economic growth and coasian cash economics. They are not equal to the task of adapting to thermodynamic realities and the system they support disregards serious input from any citizen not endorsed by their own corporate mediatocracy.

Any Australian having read Wizard Home Loans/Malcolm Turnbull's contribution to the Housing Affordability Inquiry should realise that the much touted genius of Turnbull is only an eidetic reflection of the kind of progress ideology and cash paradigm on which the financial community has pinned its successful ploy for total deregulation, privatisation and ecological vandalism on a grand scale. The opposition offers little or no relief in this leader to our current problems.

Further questions to be answered are: What is the relationship between NASDAQ, Dow Jones, the Australian All Ordinaries, the Hang Seng, FTSE and other stock market measures and total global economic activity?

Contributions to candobetter.org on this and other aspects of the global credit crisis are welcome. Submit them to the “Comments” here or send them to james [ AT ] candobetter org or sheila [ AT ] candobetter org and we will consider publishing them on the front page.

REFERENCES:

Acknowledgement: Thanks to Ilan Goldman for help in describing the recent gains and losses on the market. Thanks to Quark for help with better graph data.

[1] en.wikipedia.org/wiki/Dot-com_bubble (Accessed 8-10-08)

[2] Sheila Newman, “101 Views from Hubbert’s Peak” in The Final Energy Crisis, 2nd Edition, Pluto Press, 2008, citing A. Maddison, Monitoring the World Economy 1820–1992, OECD, Paris, 2000.

[3] Sheila Newman, “101 Views from Hubbert’s Peak” in The Final Energy Crisis, 2nd Edition, Pluto Press, 2008, citing C.J. Cleveland, R.K. Kaufmann, and D.I. Stern, “Aggregation and the Role of Energy in the Economy,” Ecological Economics, vol. 32, issue 2 (2000),

pp. 301–17

[4] Sheila Newman, “101 Views from Hubbert’s Peak” in The Final Energy Crisis, 2nd Edition, Pluto Press, 2008, citing Clive Hamilton, Growth Fetish, Allen & Unwin, Australia, 2003; Pluto Press, London, 2005, last chapter, especially, pp. 218–20:

Relocalization is obviously the best way to develop the solidarity and self-suffi ciency to reorganize work.

Political commentator and climate activist Clive Hamilton writes in Growth Fetish,

"Reduction in working hours is the core demand for the transition to postgrowth society. Overwork not only propels overconsumption but is the cause of severe social dysfunction, with ramifi cations for physical and psychological health as well as family and community life. The natural solution to this is the redistribution of work, a process that could benefit both the unemployed and the overworked."He remarks that “Moves to limit overwork … directly confront the obsession with growth at all costs,” and talks about the liberation of workers “from the compulsion to earn more than they need.”

Because growth is sustained by a constant “barrage of marketing and advertising” Hamilton wants advertising taxed and removed from the public domain, and television broadcast hours limited so as to “allow people to cultivate their relationships, especially with children.”

Add comment