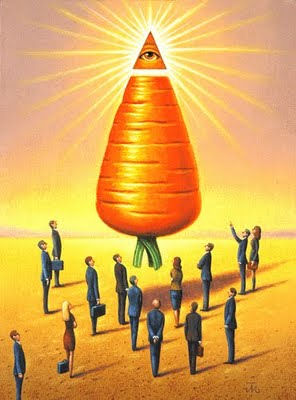

The US Dollar as a weapon: debt and devaluation

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

Subordination to the money markets

Hans-Peter Martin and Harald Schumann write[1]:

"Subordination to the money markets ... leads to an attack on democracy. It is true that every citizen still has a voice. Politicians must still try to reconcile the interests of all social layers in order to win a majority, whether in Sweden, the United States or Germany. But once the elections are over, the decisive factor is what economists euphemistically call the right of money to vote. It is not a question of morality. Even professional fund managers are only carrying out instructions by seeking the highest possible return on capital placed in their care, but their superior power now allows them to challenge every step forward in social equality that has been painfully achieved in a hundred years of class struggle and political reform." (p.69)

Interest rates

"The dramatic imbalance [makes] large parts of the world economy dependent upon the state of things in America itself. Since 1990 traders and economists have been pointing out that, in the end, conditions in the dollar area alone determine the evolution of world interest rates. In the spring of 1994, for example, all the signs in Germany pointed towards a conjunctural downturn. According to current economic thinking, the resulting weak demand for credit should have led to falling interest rates, an indispensable condition for investment to recover. But the US economy still had rising growth , and interest rates suddenly shot up on the US securities market. Interest rates promptly rose in Europe too, above 7 per cent, which was further 'bad news' for the economy in general. A year and a half later Germany was again sunk in recession and the same story repeated itself, as US factories were reportedly working to full capacity. Even the Bundesbank's lowest base rate for a decade changed nothing. It is true that Germany's defenders of the currency lent more than ever to the banks and enabled companies to raise 7 per cent more in credits in 1995 than in the previous year; but the cheap capital immediately flowed out to foreign markets that showed a higher return. Helmut Hesse, member of the central banking council of the Bundesbank, soberly remarked that 'the capacity of issuing banks on their own to bring down interest rates' had unfortunately 'faded away'.

Dollar on collision course with other currencies

The dependence of the dollar area puts Washington's finance and currency policy-makers in a powerful position, one which more and more often sets them on a collision course with other countries. Exchange rates are a guage of the relationship of forces in the latent war for financial-economic supremacy.; When the dollar fell by as much as 20 per cent against the yen and mark in the first four months of 1995, this threw the machinery of the world economy into chaos and triggered a new recession in Europe and Japan. Portfolio managers panicked and converted their investments into marks and yen, so that the fall was not limited to the dollar but all European currencies lost value against the franc and the mark. Suddenly the foreign income of German companies was worth much less than they had calculated. Daimler, Airbus, Volkswagen and thousands of others wrote figures in red and announced that in future they would prefer to invest abroad. Once again specialist magazines such as Business Week, Handelsblatt and The Economist described the 'impotence of central banks' in face of the vicissitudes of the trillion-dollar currency market, whose daily turnover is almost twice as high as the combined reserves of all central banks. Objectively the rapid fall in exchange rates did not appear justified. The actual purchasing power of the dollar corresponded more to a value of 1.80 marks than to the 1.36 at which it was being traded. Moreover, for short-term loans on the money market, the interest rate was 1 per cent higher than for the now top-class mark and yen. Economists of every stripe were at a loss to understand. Marcel Stremme, currency expert at the German Institute for Economic Research in Berlin, even thought that 'there is no logical explanation' for the exchange rate of the dollar. The IMF's leading economist Michael Mussa could only remark that 'the markets are acting crazy'.

How the US benefits from falling dollar

Illogical? Irrational? Insiders in the currency game see it very differently. Klaus-Peter Möritz, for instance, then head of currency trading at the Deutsche Bank, briskly interpreted the decline of the dollar as 'a conscious political strategy on the Americans' part' to overcome export weaknesses by making their products cheaper on overseas markets. The exchange rated had thus become a weapon in the struggle with Japan and Germany for a share of the world market.

This sounds like a conspiracy theory, but it is also quite plausible. The great majority of global players in the money market are American institutions with a worldwide infrastructure. They evidently do not dance to the tune of the US government, but they bow most gladly to the aims of the Fed and its chairman, Alan Greenespan. Besides, the hardiest speculators do not cross swords with the world's largest bank of issue, because its dollar reserves are unlimited. 'It's enough for a Fed director to call up a Congressman and tell him that the US has no interest in stabilizing the greenback,' argues Möritz. The dealers soon get the picture and take care of the rest. this strategy is also indirectly supported by the two most powerful men in America. Thus, during th world dollar crisis in April 1995, President Clinton let it be known that the USA might 'do absolutely nothing' to stop it falling. Shortly before, at a congressional hearing, Greenspan had held out the prospect of a drop in the base rate that never materialized. In both cases there was an unmistakable signal to the markets that the central bank and the government wanted the dollar to fall. The Frankfurt professor of economics Wilhelm Hankel also sees the decline of the dollar as just 'clever US currency politics'. In a world of weak currencies plagued by inflation, the dollar is in danger of becoming overvalued, so that by talking it down Washington's money-guards 'transfer the problem to other countries'. This is clearly also how Helmut Kohl's advisers see things. Contrary to his usual caution with regard to the Big Brother across the Atlantic, the chancellor personally protested at Washington's obstructive currency policy and openly described it as 'quite unacceptable' - with pretty mediocre results.

How the rest of the world suffers

The economic statistics for 1995 record the victory of the dollar strategists. In Germany the economy grew at only half the expected rate, and the weakness of the dollar was the spur for mass redundancies. Even harder hit was Japan, whose trade surplus with the United States shrank by three-quarters in just twelve months. the country stank from recession into deflation and the numbers without work doubled. Greenspan and Treasury Secretary Rubin dropped their hard line only in autumn 1995, when they could be sure of the desired result. In September the central banks of the three countries again began to support the dollar with concerted purchases: the exchange rate slowly moved back up and was hovering around 1.48 marks by summer 1996.

The currency markets are therefore not at all crazy: they follow Alan Greenspan's baton. The cluelessness of experts, on the other hand, simply shows how their theories ignore the fact that, even in the cyberspace of world money, the actors are people who either wield or must submit to power and its accompanying interests. Not all central banks are equally impotent before the Moloch of the market. Rather, they are inserted into a clear hierarchy of size. At the gop is the Federal Reserve. Next come th Bank of Japan and the Bundesbank, which in turn dominate their neighbours in the yen and Deutschmark zones."

[1] This article features an extract from pp 69 and 71-73 of the Pluto Press Australia edition of Hans-Peter Martin and Harald Schumann, The Global Trap, Globaliation and the assault on prosperity and democracy, translated by Patrick Camiller and first published in English by Zed Books, London, 1997.

Recent comments