Paul Keating's Unfortunate Legacy?

"The WTO can no longer ignore what is happening behind its magnificent structure of complex trade rules. The persistence of opposite exchange-rate misalignments, of countries with overvalued currencies and others with undervalued ones, for long periods is eroding the multilateral trading system. The WTO cannot remain silent to such reality. The core principles of its construction – transparency, predictability and confidence – are under question. The strengthening of trade rules, with the negotiation of instruments to neutralise the effects of exchange rates, is fundamental to the existence of the WTO. Otherwise, the WTO might become a diplomatic-juridical fiction – void of economic reality." Ref: Effects of exchange-rate misalignments on tariffs

"The WTO can no longer ignore what is happening behind its magnificent structure of complex trade rules. The persistence of opposite exchange-rate misalignments, of countries with overvalued currencies and others with undervalued ones, for long periods is eroding the multilateral trading system. The WTO cannot remain silent to such reality. The core principles of its construction – transparency, predictability and confidence – are under question. The strengthening of trade rules, with the negotiation of instruments to neutralise the effects of exchange rates, is fundamental to the existence of the WTO. Otherwise, the WTO might become a diplomatic-juridical fiction – void of economic reality." Ref: Effects of exchange-rate misalignments on tariffs

I recently received a partisan political joke. Although it was funny, the punch line was about one side of politics being innumerate idiots (and, by implication, the other not). This inspired me to argue that it is the collective innumeracy of all politicians that we need to address; not assignment of blame to one side of politics as if that will solve a problem that all the major political parties collaborate to cause. One example: No shortage of foreign cars in Australia..............

This site lists some of Paul Keating's achievements whilst in office:

http://static.moadoph.gov.au/ophgovau/media/images/apmc/docs/24-Keating-Web.pdf

Here are three of them:

- Architect of the deregulation of the Australian economy

- The Government floated the Australian currency and allowed foreign banks to operate in Australia from 1983

- Achieved a general lowering of tariff levels

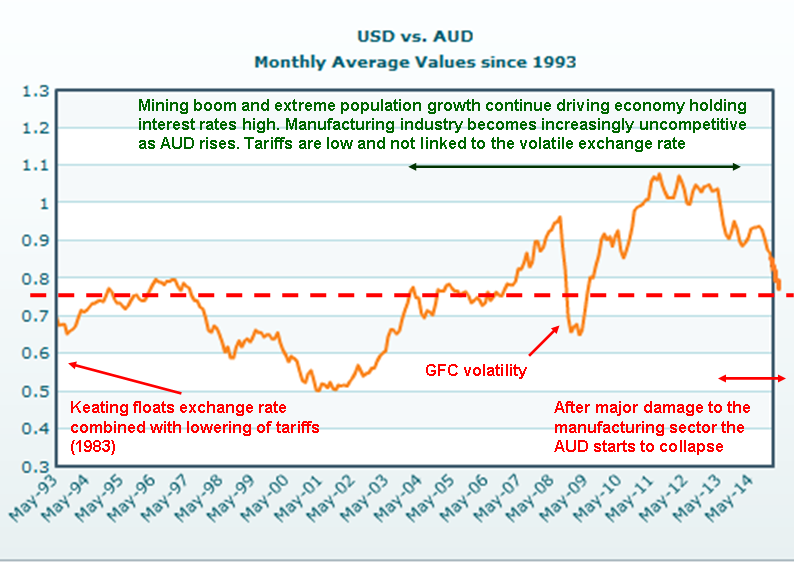

Paul Keating floated the AUD and sought to reduce protectionism in favour of free trade. Despite his many laudable qualities was this a failure of strategic economic management?

Shouldn't extreme population growth have delivered improving, rather than deteriorating, economies of scale for manufacturing?

This link explains what is actually a very simple concept. There is logic in floating tariffs to compensate for floating exchange rates: Effects of exchange-rate misalignments on tariffs

In 2013 General Motors, in its trade negotiations with China, sought to link the exchange rate to the tariff structure used for motor vehicle trade between China and the US for obvious reasons. Perhaps Australia had been a learning experience for GM, rendering them Forex Punch Drunk?

Think about it. When the AUD was worth USD 0.60 the car import tariff was 5%. When the AUD was at parity with the USD the effective tariff would have had to rise to 75% for the Australian car industry to maintain the same level of competitiveness against cheaper imports. Exporting would still have been hard, but the size of the domestic market for Australian cars might have been maintained while the Australian dollar remained strong. The automobile industry was not causing the exchange rate misalignments. They were beyond its control.

From 1998 to 2003 the average AUDUSD exchange rate was around 0.6. Let's consider a car costing USD10,000 imported over that period. (10,000 x 1.05 Duty)/0.6 = AUD17,500.

Over the period since 2003 the average AUDUSD exchange rate has been around 0.85. From late 2010 to early 2013 the exchange rate was above parity (ie > 1.0). This is when Ford and GM started talking about closing down Australian operations.

Let's consider the same imported car when the exchange rate is 1:1. (10,000 x 1.05 Duty)/1.0 = AUD10,500. To bring it up to AUD17,500 the import duty would have needed to be raised to 75%. (10,000 x 1.75 Duty)/1.0 = AUD17,500.

Wouldn't this have been a reasonable strategy? How could any fair and reasonable assessment conclude that because the car industry could not immediately reduce its factory gate prices by 43% (ie 1 - 10,000/17,500) in response to radical exchange rate fluctuations, it should not be protected by a tariff whose benchmark had been established at an exchange rate of 0.6 with a rate of 5%? Surely a floating Australian dollar must be combined with floating tariffs?

The collective intelligence of the entire parliament of Labor and Liberal politicians was unable to identify or address such problems associated with Paul Keating's deregulation. Therefore, as the AUD rose from 2003 onwards for reasons directly linked to the actions of innumerate (??) politicians, Australia's manufacturing industry has been dealt a severe blow. No jobs for our children in manufacturing?

What drove the Australian dollar higher? Clearly a contributor to this was a booming mining sector (selling rocks for US dollars and bringing the money home in Australian dollars) combined with extreme population growth driving demand for goods & services and inflows of capital as people arrived; particularly while the rest of the world floundered under the burden of the GFC. Australia's Government chose a surge in mass migration to drive demand and interest rates higher as the rest of the world lowered interest rates.

So we have Government; and by that I mean Government supported by all the major political parties, that is orchestrating the following:

- An unregulated exchange rate for the Australian Dollar

- General lowering of tariff levels

- No link between tariffs and the unregulated exchange rate

- "Liberal" FIRB decisions on foreign ownership of Australian assets that differ radically from those of other countries, and trading partners, in the region

- Manipulating demand using the mass migration tool to create an inherent conflict of interest between driving GDP growth with population growth, managing interest rates, managing global competitiveness and managing house prices.

To hell with the future. Let's drive a cheap BMW after selling a house or two to reap the "Chinese Bonus"??

Was this inevitable? Ask any innumerate politician for an answer and they may not even understand the question. Isn't patriotism, wherever feasible, about retaining the means of production? Or as Karl Marx said; "The production of too many useful things results in too many useless people."

Recent comments