Today I helped a registered nurse to scan documents to submit in a job application. While we were doing this, she mentioned to me with great concern that she had heard that the government is talking about making people work until they are 70 years old and make them take out loans on their homes in order to fund their retirement. "I'm only 46," she said, "but I didn't work when my children were young and I never had the money to save for a home. So I'm supposed to keep on working until I'm 70. I'm too tired now to work full-time because, even though standards are slipping, working conditions are getting tougher and tougher and management more and more unreasonable." The latest productivity report on An Aging Australia supplies policies to undermine the political strength of older people who would otherwise be able to represent the rest of the community and defend the wealth and security basis of the younger generations. Blaming older people for economic decline that has its real seeds in resource decline sets the scene for generational splitting. However, the real targets are actually today's young people and their children.

Today I helped a registered nurse to scan documents to submit in a job application. While we were doing this, she mentioned to me with great concern that she had heard that the government is talking about making people work until they are 70 years old and make them take out loans on their homes in order to fund their retirement. "I'm only 46," she said, "but I didn't work when my children were young and I never had the money to save for a home. So I'm supposed to keep on working until I'm 70. I'm too tired now to work full-time because, even though standards are slipping, working conditions are getting tougher and tougher and management more and more unreasonable." The latest productivity report on An Aging Australia supplies policies to undermine the political strength of older people who would otherwise be able to represent the rest of the community and defend the wealth and security basis of the younger generations. Blaming older people for economic decline that has its real seeds in resource decline sets the scene for generational splitting. However, the real targets are actually today's young people and their children.You would think that in an Australia where the Productivity Commission (see below) is banging on about how health care for an aging population is going to be a huge slice of our economic pie that my friend would be sitting pretty. Not so.

Setting the tone for scary policies: "An Aging Australia" Productivity Commission Report

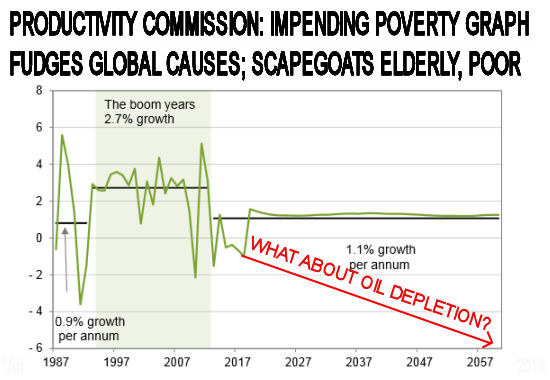

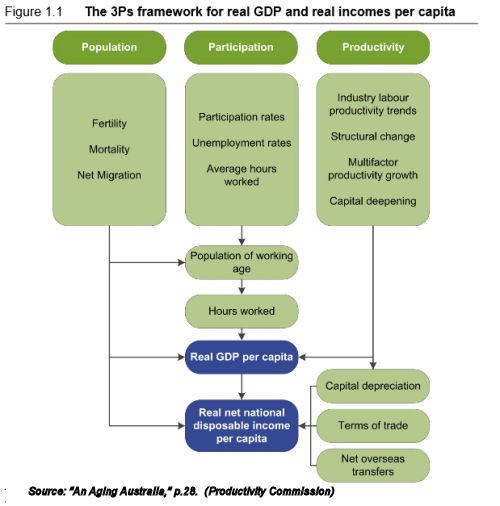

The news about people working until they are 70 years old and being made to sell their houses back to the bank comes from another rather Orwellian report by the Australian Productivity Commission. The Commission seems to want to blame a lot of its suggestions here on the aging population and the costs of health care. (The reference is An Aging Australia, available at this URL: http://www.pc.gov.au/__data/assets/pdf_file/0005/129749/ageing-australia.pdf).  The report has a narrow economic basis whereby GDP = Numbers of Workers X Productivity X Terms of trade. There is no overt consideration of resource depletion, although you can tell it is lurking namelessly. The report presents as an excuse for more population growth, even though it predicts an indefinite (possibly endless) period of economic poverty, when people will have to borrow on their homes to live and work until they drop for declining returns, which it relates vaguely to the end of the mining boom.

The report has a narrow economic basis whereby GDP = Numbers of Workers X Productivity X Terms of trade. There is no overt consideration of resource depletion, although you can tell it is lurking namelessly. The report presents as an excuse for more population growth, even though it predicts an indefinite (possibly endless) period of economic poverty, when people will have to borrow on their homes to live and work until they drop for declining returns, which it relates vaguely to the end of the mining boom.

"Terms of trade is projected to decline so that, with the additional impacts of contracting growth rates of labour supply and labour productivity, disposable income is projected to grow at a much slower rate compared with the boom period from 1993 to 2012 (figure 7). The bottom line is that the combined cocktail of falling labour supply per capita, a declining terms of trade and poorer productivity growth rates mean that Australians can expect that the growth in disposable income per capita will fall to less than half that of the boom years. A period of truly diminished outcomes is likely to be at hand, unless luck or appropriate policy initiatives intervene. "

Demographic Fairy-tales

In a section entitled "Demography: Net overseas migration", the Report comes clean on what is driving high population growth in Australia: Successive recent governments have pushed very high immigration.

"Unlike either fertility or mortality, [Net Overseas Migration - NOM] is more readily controllable by the Australian Government (DIAC 2013). Most particularly, the Government can set quotas on its migration program [...]."

The report also admits that our extremely high mass immigration is a wild card, although it uses less colourful language:

"Were such levels of [Net Overseas Migration - NOM] to persist over the next 50 years, it would imply a considerably more populous Australia than most population projections."

The section concludes with a sublimely irresponsible comment about why our population might not spiral out of control but somehow stop after 2017 or something like that:

"Typically, advanced countries experience population growth slowdowns as their population numbers rise, and some reversion of Australian population growth rates to the average OECD rate might ultimately be expected," it concludes, blithely.

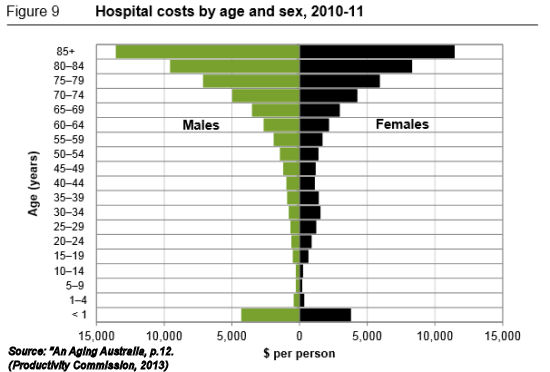

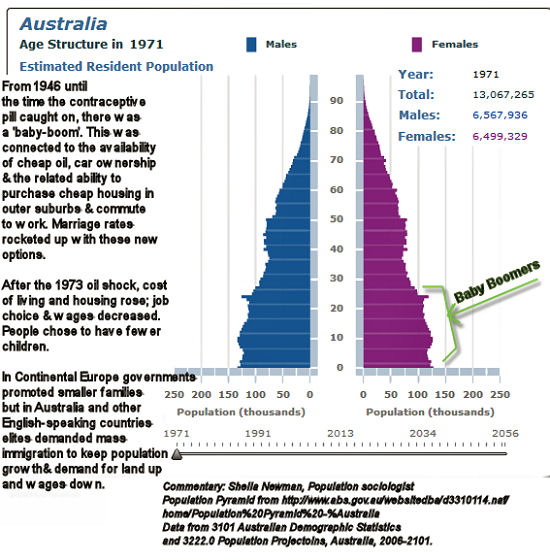

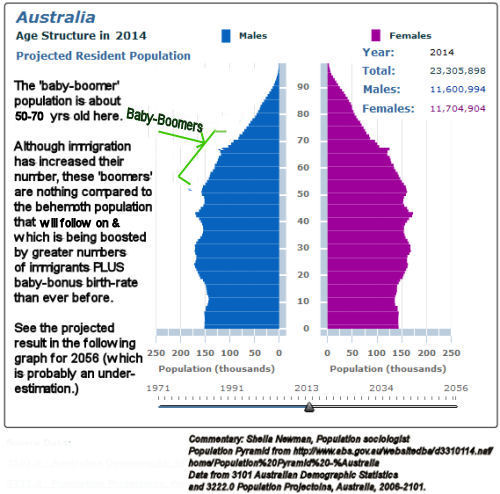

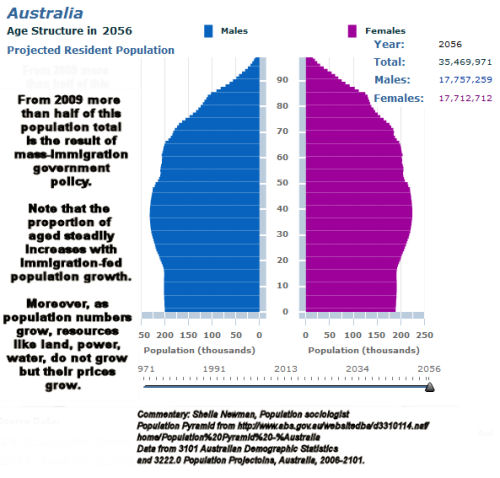

My comment The Report's faith in Australia experiencing a population growth slowdown to the 'average OECD rate' is dangerously ridiculous in the light of Australia's high immigration. It is presumably relying on 'demographic transition' ideology, which is (a) unreliable and (b) does not take high immigration into account. Australia's population growth was slowing naturally but this natural trend has been completely distorted by State and Federally led mass immigration.[1] See footnote for full quoted passage.[2]  There are some very slanted presentations of the medical costs of aging, notably in a diagram, "Hospital Costs by Age and Sex 2010-2011," which shows a kind of upside-down pyramid with costly old people at its wide top and low cost young people near the narrow base. This gives an apparent cost-weight per elderly person. The casual observer could easily infer from the graph that there were more people over 65 and 85 plus than all the other age-groups in 2011. In fact, due mostly to mass immigration, these numbers will actually be continually bloated, year after year, instead of dying back naturally as the baby-boomers leave their mortal coil.

There are some very slanted presentations of the medical costs of aging, notably in a diagram, "Hospital Costs by Age and Sex 2010-2011," which shows a kind of upside-down pyramid with costly old people at its wide top and low cost young people near the narrow base. This gives an apparent cost-weight per elderly person. The casual observer could easily infer from the graph that there were more people over 65 and 85 plus than all the other age-groups in 2011. In fact, due mostly to mass immigration, these numbers will actually be continually bloated, year after year, instead of dying back naturally as the baby-boomers leave their mortal coil.  Mass immigration, discontinued in Western Continental Europe after the first oil shock in 1973, meant that population numbers will decline naturally there as oil declines. In Australian and other Anglophone countries, however, there will be no such gentle and natural decline if artificial population boosting through high immigration is allowed to continue.

Mass immigration, discontinued in Western Continental Europe after the first oil shock in 1973, meant that population numbers will decline naturally there as oil declines. In Australian and other Anglophone countries, however, there will be no such gentle and natural decline if artificial population boosting through high immigration is allowed to continue.  The report justifies its presentation of 'trends' in the following statement:

The report justifies its presentation of 'trends' in the following statement:

"The apparent neat precision of any particular number is not meant to convey that this shall inevitably be the result, when over a 50 year period a wide variety of unknown factors will arise. But the existence of unknown factors is no basis for not considering the trends, which are the important aspect of this analysis. The trends are unmistakable in most cases."

The problem is that those 'trends' in population, and their proposed solutions in erosion of housing equity and retirement benefits will be taken for gospel by the mass media and parliament. They will be portrayed as inevitable and used to further the corporate agenda, which is to control more and more of Australia's remaining wealth, and allow the majority of citizens less and less control over their material and political circumstances. The very narrow context of this kind of economic report prevents it from recommending citizen empowerment or admitting to resource depletion or inviting comparison with more democratic societies and reconsideration of our legal system. Can the report researchers and writers be criticised for this? Not really; they are working within the same paradigm as the nurses I described at the beginning of this article. It would be career suicide for them to suggest that we are going in the wrong direction with overpopulation and overconsumption. The Report fails to take into account some enormously influential trends in climate change, overpopulation, oil depletion, loss of democracy (e.g. laws against 'terrorism'), numbers of wars with increasing impact. It doesn't consider that during the industrial revolution where its life-expectancy charts begin, life expectancy went down to less than half of the ordinary biblical span of three score and ten before it went up again 'due to modern medicine'. And that now diabetes and other nutritional diseases related to our so-called advanced lifestyles and medicine are reducing life expectancy, not increasing it. It does acknowledge a failure to factor those disease risks in, but still merrily uses its projections:

The problem is that those 'trends' in population, and their proposed solutions in erosion of housing equity and retirement benefits will be taken for gospel by the mass media and parliament. They will be portrayed as inevitable and used to further the corporate agenda, which is to control more and more of Australia's remaining wealth, and allow the majority of citizens less and less control over their material and political circumstances. The very narrow context of this kind of economic report prevents it from recommending citizen empowerment or admitting to resource depletion or inviting comparison with more democratic societies and reconsideration of our legal system. Can the report researchers and writers be criticised for this? Not really; they are working within the same paradigm as the nurses I described at the beginning of this article. It would be career suicide for them to suggest that we are going in the wrong direction with overpopulation and overconsumption. The Report fails to take into account some enormously influential trends in climate change, overpopulation, oil depletion, loss of democracy (e.g. laws against 'terrorism'), numbers of wars with increasing impact. It doesn't consider that during the industrial revolution where its life-expectancy charts begin, life expectancy went down to less than half of the ordinary biblical span of three score and ten before it went up again 'due to modern medicine'. And that now diabetes and other nutritional diseases related to our so-called advanced lifestyles and medicine are reducing life expectancy, not increasing it. It does acknowledge a failure to factor those disease risks in, but still merrily uses its projections:

"As the ABS notes, this approach also ignores the possibility of major adverse events, such as major pandemics or wars, though historically these have sometimes been important. Some of these events would be difficult to estimate given their rarity in historical data, and at best, could be treated separately as low probability, high impact events with assumed statistical distributions. For example, the European Actuarial Consultative Group (2006) assesses that there is a high risk of a major global pandemic over a decade, but that events with significant excess population mortality are unlikely. Others doubt that it is possible to make ‘any scientifically based prediction about the emergence of future pandemics ’ (Taubenberger and Morens 2009). Given this, it is more reasonable to take account of other significant risks — such as the possible adverse impacts on longevity of lifestyle factors (growing obesity) and antibiotic resistant bacteria, which would have a gradual effect and could be modelled as a lower - life expectancy scenario in mortality projections. "

In fact, the Report shows what struck me as a wicked sense of humour at times, as if it recognises its own absurdity. On prevention of obesity and other diseases like AIDS, it seems to suggest that dying young might be more economical in the long run:

Second, and more subtly, gauging the effectiveness and efficiency of preventative measures on a disease - by - disease basis can miss the reality that people live to die another day (Bonneux et al. 1998). Dollars saved on avoiding (or minimising the costs) of one disease opens the possibility of people experiencing another costly disease. Ideally, assessments of particular interventions should adopt a longitudinal approach that takes into account the timing and costs of disease and quality of life under the counterfactual that no preventative action is taken.

Housing equity, poverty and power

The Productivity Commission Report "canvasses "policy approaches currently over - the - horizon, but nevertheless relevant to a deeper consideration of the challenges of an ageing Australia (including the role of non - fungible housing equity as a financing method and the link between labour force participation and the Age Pension eligibility age)." Comment:This report supplies policies to undermine the political strength of older people who would otherwise be able to represent the rest of the community and defend the wealth and security basis of the younger generations. Blaming older people for economic decline that has its real seeds in resource decline sets the scene for generational splitting. The power elites (in the form of banks and corporate government) can then find ways to seize remaining assets and resources in the community for their own enrichment. Young people should realise that this report actually targets their generation - see the huge bulge in the 2014 population pyramid of people below the age of 60. These are the post-baby-boomers. It is their old age that is targeted here. Without land and housing they have no means to grow food, no secure shelter, no security to pass on to their families. The Productivity Commission, with its very narrow parameters of examination, is effectively providing future governments with excuses to make laws to beggar the population. And the Commission is cynically aware of this, implying that young people are stupidly myopic and won't realise that it is their futures that are being targeted, because they cannot imagine being old:

"Despite the possibility of such responses [i.e. protests against giving up their homes], governments can use anti-avoidance measures to reduce the risks of such behaviours at older ages (as it does already with gifting provisions). And responses by the young to possible asset tests when they are old are likely to be relatively weak, reflecting discounting of the future , myopia and the fact that caps would apply to any government - backed equity withdrawal."

Don't you love the term government-backed 'equity withdrawal'? A great new term for the State stealing from its citizens. On Housing equity: Aim: Put land outside the reach of banks. To avoid being patsies to these predator policies, Australians need to create new community ownerships with special laws of inheritance for their children, to help relocalise power and organisation in line with families and clans. These are the only secure bases for people in hard times. The British legal model promotes the opposite. If Australia changed its system to Roman Law (the kind used throughout continental Europe) children would be guaranteed to inherit from their parents; shelter and income would be deemed civil rights at law. Another model that amounts to the same thing is the New Zealand Maori land-rights model, which guarantees every Maori descendent land which cannot be sold. Banks should not be able to take shelter and food-gardens from owners or their inheritors. Governments should not be able to legislate water prices out of reach of suburban food producers. Planners should not be able to authorise buildings which block sunlight from gardens and solar panels. People should all have rights to viable land. This is what is missing from this report, which assumes that we will all work for other people and rely on diminishing rations when we can no longer compete with young workers. The Report trots out the low inflation assertion with which many Australians would disagree:

"The average Australian has nevertheless fared well in the last two decades in terms of net national disposable income per capita, low inflation and low unemployment."

In fact, inflation indicators fail to take into account the very high cost of land for housing, which drives up all other costs. Wages must be high enough for workers to pay the highest accommodation costs in the world and business must pay similar costs for premises, plus wages. Shrinking disposable income has appeared to stretch because of cheap imports from low-wage and low land-cost countries, like China. People have only been able to afford trinkets, however. Whilst rents and mortgages rose, dependence on wages and debt grew. With mass immigration and watering-down of industrial protection, wages and conditions are deteriorating and the cost of finite resources, shelter, food, water and power are inflating. Conclusion: These trends are the result of government engineering the population to please corporate fancy. If Australians do not start to band together against their corporatised governments these nightmares will come to pass.

Commission Press Release: Key Points of An ageing Australia: preparing for the future

Productivity Commission, 22 November, 2013 [3] "The report examines the effects of ageing on economic output (underpinned by changes in population, participation and productivity) and the resulting implications for government budgets were current policy settings to be maintained. Key points: Australia's population will both grow strongly and become older. Such slow but profound shifts in the nature of a society do not elicit the same scrutiny as immediate policy issues. The preferable time to contemplate the implications is while these near inevitable trends are still in their infancy. Population ageing is largely a positive outcome, primarily reflecting improved life expectancy. A female (male) born in 2012 will on average live for an estimated 94.4 (91.6) years. However, population growth and ageing will affect labour supply, economic output, infrastructure requirements and governments' budgets. Australia's population is projected to rise to around 38 million by 2060, or around 15 million more than the population in 2012. Sydney and Melbourne can be expected to grow by around 3 million each over this period. The population aged 75 or more years is expected to rise by 4 million from 2012 to 2060, increasing from about 6.4 to 14.4 per cent of the population. In 2012, there was roughly one person aged 100 years old or more to every 100 babies. By 2060, it is projected there will be around 25 such centenarians. Total private and public investment requirements over this 50 year period are estimated to be more than 5 times the cumulative investment made over the last half century, which reveals the importance of an efficient investment environment. Labour participation rates are expected to fall from around 65 to 60 per cent from 2012 to 2060, and overall labour supply per capita to contract by 5 per cent. Average labour productivity growth is projected to be around 1.5 per cent per annum from 2012-13, well below the high productivity period from 1988-89 to 2003-04. Real disposable income per capita is expected to grow at 1.1 per cent per annum compared with the average 2.7 per cent annual growth over the last 20 years. Collectively, it is projected that Australian governments will face additional pressures on their budgets equivalent to around 6 per cent of national GDP by 2060, principally reflecting the growth of expenditure on health, aged care and the Age Pension. Major impending economic and social changes can create the impetus for new reform approaches not currently on the policy horizon. For example: The design of the Age Pension and broader retirement income system might be linked to life expectancy after completion of the current transition to 67 years in 2023. Using some of the annual growth in the housing equity of older Australians could help ensure higher quality options for aged care services and lower fiscal costs. Wide ranging health care reforms could improve productivity in the sector that is the largest contributor to fiscal pressures. Even modest improvements in this area would reduce fiscal pressures significantly."

NOTES

26/11/2013: Correction to Stupid mistake about baby-boomers' ages corrected on population-pyramid-2014.jpg. I had them as tweny years older than they are. Apologies. Thanks Jill Quirk of SPA Victoria for pointing this out. [1] For the latest on demographic theories and which ones hold water, see Sheila Newman, Demography, Territory and Law: The Rules of Animal and Human Populations, Countershock Press, 2013, Chapter 2, "Modern Fertility, Mortality and Development Myths." [2] An Aging Australia, (Productivity Commission), pp.37-38: "DEMOGRAPHY While the technical definition and estimation of net overseas migration (NOM) is complex, it is a measure of long - term arrivals less long - term departures. NOM has been a critical factor behind Australia’s population growth and will continue to be so (PC 2011 d ). Unlike either fertility or mortality, NOM is more readily controllable by the Australian Government (DIAC 2013). Most particularly, the Government can set quotas on its migration program — which comprises three categories of migrant (humanitarian, skilled and family re-union). That said, the Australian Government does not have full control over NOM as any number of Australians (and New Zealanders) can arrive or depart. Moreover, the number of temporary entrants, such as long - term visitors and working holiday makers, is effectively uncapped. Their numbers are largely driven by other factors, such as economic conditions. However, since temporary entrants ultimately leave, they do not contribute to long - run population growth. Currently, NOM is around 230000 per year, which is well above the longer - term average. From 1948 to 2003, NOM was around 90 000 per year, with no upwards trend. In contrast, in the period 2003 – 2012, the average NOM was around 200000 and the trend growth was around 10000 per year (figure 2.2). DIAC (2013)forecasts that current high levels of NOM will persist at least until 2017, but that its growth rate will decline. It projects NOM of around 250000 in 2017. Were such levels of NOM to persist over the next 50 years, it would imply a considerably more populous Australia than most population projections. It is difficult to establish whether a level of NOM around 200000 – 250000 is likely to persist. In part, the high recent levels may reflect strong relative economic and income growth in Australia c ompared to other countries, which make Australia an attractive destination. Given that the terms of trade are now declining, it is possible that NOM will fall somewhat from its current level. The contribution of high relative fertility rates and migration means that Australia’s population is growing at a rate well above most OECD countries. Over the period from 1999 to 2010, Australia had the 4th highest population growth rate among OECD countries, with higher growth rates than some less developed economies, such as Mexico and Turkey (OECD 2013). The average growth rate for Australia (1.47 per cent growth per annum) was more than four times that for the 27 European Union countries (0.35 per cent per annum) and more than twice that of the OECD overall (0.68 per cent per annum). The persistence of NOM of 250000 persons per year would underpin continued high growth rates of this order. Typically, advanced countries experience population growth slowdowns as their population numbers rise, and some reversion of Australian population growth rates to the average OECD rate might ultimately be expected. " [3] This is a press release from the Productivity Commission about its report.

Comments

Anonymous (not verified)

Sat, 2013-11-23 10:35

Permalink

What's the real purpose of our economy?

quark

Sun, 2013-11-24 17:08

Permalink

Economy needs to deliver to us and future generations

Deb T. (not verified)

Sat, 2013-11-23 11:00

Permalink

Our government just wants us dead

anon (not verified)

Sun, 2016-05-29 22:02

Permalink

The simplistic illogic of neoliberalism belies its insincerity

Add comment