Role of debt in a fool's paradise

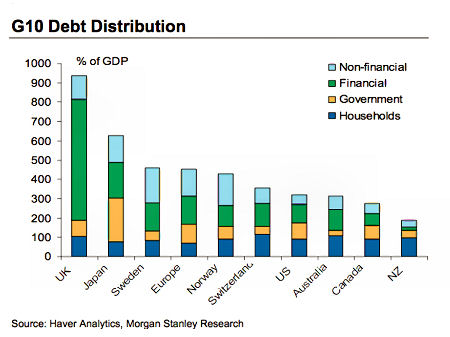

The world graph shows Australian private debt to be proportionately higher than that in the US, Financial sector debt to be significant and Govt debt to be relatively small. Why then is so-called excessive Government debt ALL we ever hear about from the media and the growls emanating from the political bear-pit? Are they just stupid or are they trying to hide or completely deny something?

Also of morbid interest is that the UK is an economic meltdown waiting to happen. Financial debt is running at 1000% of GDP. How can that astronomical amount possibly be bailed out when it implodes? Greece and Spain are flecks of dust compared to that one.

These give a snapshot of the extremity of the national and global debt situation. Very evidently it is the biggest elephant in the global lounge-room at the moment and will only get stinkier and more broadly destructive the longer that its overwhelming presence is ignored.

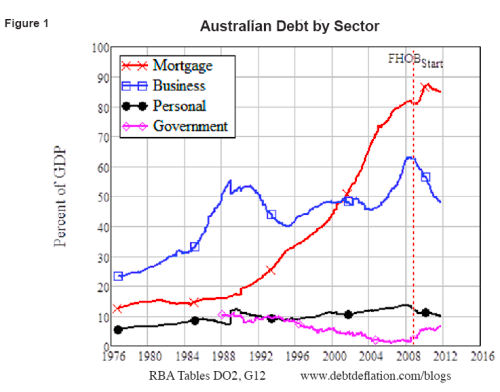

Australian debt related to housing

Australian debt related to housing represents a huge part of the costs of doing business and of living. The opposition has a lot to say about the cost of a carbon tax, but that cost would be imperceptible if governments and the growth lobby stopped pushing up land and housing costs by importing whole towns worth of people into this country.

We are looking at long-term loss of spending capacity

There is a pressing need for governance to recognise the game-changing transition that is now irreversibly underway so that the best outcomes can be drawn within the very unfamiliar and difficult economic rules of this new game. We have now moved from a long build-up period of enormous credit spending and debt accumulation into a long period of debt de-leveraging and consequent loss of spending capacity. The loss will hit Individuals and thus the retail economy, and hit all levels of government and thus the entire public spending program. Public debt and Government financial capacity will be hit even harder if governments continue to bail-out wealthy financial institutions for their speculative losses.

Unfortunately a number of reasons make such bail-outs likely to occur, and particularly so if the ordinary person remains unaware of the nature of this big structural change that is underway. Its impacts will reach deeply across our entire socio-economic framework. It effectively destroys the growth model that has been employed since World War Two.

Local councillors need to educate themselves beyond State ideological feed

Local Councillors need to become aware of this so that they can pull back from a futile reliance upon property development and associated tourism to drive Shire economy. I know most do not have the mental faculty or will to do so, however some might if the material is presented in the right way. This need is especially urgent in the context of the impending construction a new Strategic Town Plan.

Greg Wood is a leader in the fight to stop inappropriate development at Rainbow Beach Queensland in a World Heritage area.http://www.inskip.org/index.html

Comments

Geoffrey Taylor

Fri, 2012-06-15 01:35

Permalink

Greedy few gain from reduction of our overall wealth

Where is Australia not able to produce wealth because of a shortage of

workers (apart from the mining 'industry' which does nothing more than

remove from the ground our finite non-renewable legacy of fossil fuels and

metals which rightly belongs to this and all future generations)?

What little of the Australian economy produces real wealth that can

actually be traded for real imported wealth--agriculture and our minuscule

manufacturing industry--has already more than sufficient human resources within

this country.

Adding to our population at best can only increases the number of

people amongst whom this continent's finite quantity of wealth must be shared

thereby making each of us on average, poorer.

On top of that increasing the population adds to dis-economies of scale caused

principally by abysmally planned urban expansion, most likely done for the

benefit of the motor industry, and tollway builders amongst others, as well as

land developers. As a consequence many people live far from their workplaces,

education, shopping and entertainment and recreation facilities and other

amenities and are forced to drive long distances each day with resultant

gridlock during peak hours.

Greg (not verified)

Fri, 2012-06-15 15:26

Permalink

The hidden apex

Anonymous (not verified)

Tue, 2012-06-19 02:32

Permalink

Developers against Australians

Panel rejects height limits for Southbank skyscrapers of June 18, 2012 by Simon Johanson in The Age (http://www.theage.com.au/business/panel-rejects-height-limits-for-

southbank-skyscrapers-20120617-20i2p.html)

Southbank, Melbourne, is 50% owned by foreigners living in places like Hong Kong, KL, Singapore and Jakarta because that is where the developers run big selling sessions. So the Australians who buy and live in these apartments are very angry because the Melbourne City Council want to bring in good rules about heights and separations but this so called expert Panel will not agree and want the sky to be the limit and as close as you like – well it is called discretionary, which as we know is meaningless.

Where, for instance, the people and the council want 20 metres between buildings, recently the Minister approved a building only 10 metres from its neighbour. Pretty tough on both sides of the divide – high in the sky and all you look out at is into someone else's living room.

Disgusting!

KeepMelbourneMa... (not verified)

Tue, 2012-06-19 08:38

Permalink

"Planning" is synonymous with growth and deregulation

There's no Planning as such in Melbourne any more. It's become synonymous for growth, and liberalizing building and construction standards. The fox is in charge of the chickens - those with vested interests in growth and the property market are setting the rules, and standards on height, and the extension of our urban growth boundary. It's all downhill, and Victoria's economy is at a standstill from all the financial demands of growth.

These high rises cast long shadows, are imposing, windy tunnels and are not family friendly. How can children live in them? The residents ultimately will be forced to add to urban sprawl if they decide to have families.

These towers are about warehousing people as consumers, as economic units, to add to our customer base and GDP, not about planning human-centric living standards for Melbourne.

The carbon tax will exacerbate the high costs of power, water is becoming a luxury item, Councils keep increasing rates to keep abreast with their services, rubbish disposal costs a premium, traffic congestion drives the need for more freeways, and jobs are going offshore.

The obvious end result is that Melbourne ends up family-hostile, with more and more homelessness and crime, and closer to a divided community of haves and have-nots - like a third world city.

Add comment