How much further can developer-debts drag us down?

Role of debt in a fool's paradise

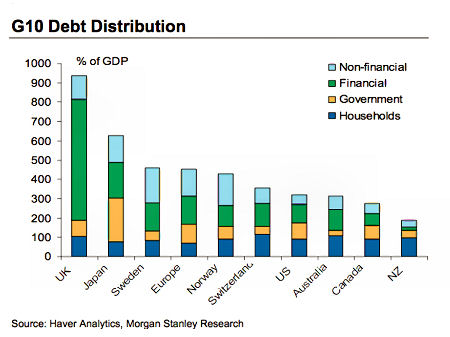

The world graph shows Australian private debt to be proportionately higher than that in the US, Financial sector debt to be significant and Govt debt to be relatively small. Why then is so-called excessive Government debt ALL we ever hear about from the media and the growls emanating from the political bear-pit? Are they just stupid or are they trying to hide or completely deny something?

Also of morbid interest is that the UK is an economic meltdown waiting to happen. Financial debt is running at 1000% of GDP. How can that astronomical amount possibly be bailed out when it implodes? Greece and Spain are flecks of dust compared to that one.

These give a snapshot of the extremity of the national and global debt situation. Very evidently it is the biggest elephant in the global lounge-room at the moment and will only get stinkier and more broadly destructive the longer that its overwhelming presence is ignored.

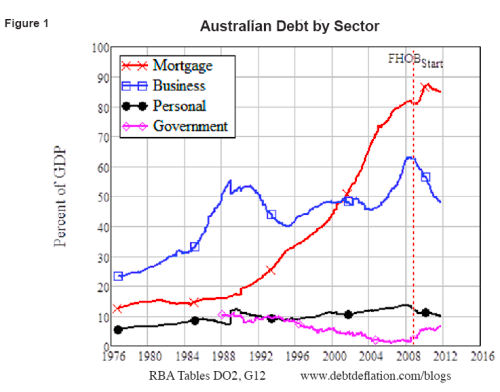

Australian debt related to housing

Australian debt related to housing represents a huge part of the costs of doing business and of living. The opposition has a lot to say about the cost of a carbon tax, but that cost would be imperceptible if governments and the growth lobby stopped pushing up land and housing costs by importing whole towns worth of people into this country.

We are looking at long-term loss of spending capacity

There is a pressing need for governance to recognise the game-changing transition that is now irreversibly underway so that the best outcomes can be drawn within the very unfamiliar and difficult economic rules of this new game. We have now moved from a long build-up period of enormous credit spending and debt accumulation into a long period of debt de-leveraging and consequent loss of spending capacity. The loss will hit Individuals and thus the retail economy, and hit all levels of government and thus the entire public spending program. Public debt and Government financial capacity will be hit even harder if governments continue to bail-out wealthy financial institutions for their speculative losses.

Unfortunately a number of reasons make such bail-outs likely to occur, and particularly so if the ordinary person remains unaware of the nature of this big structural change that is underway. Its impacts will reach deeply across our entire socio-economic framework. It effectively destroys the growth model that has been employed since World War Two.

Local councillors need to educate themselves beyond State ideological feed

Local Councillors need to become aware of this so that they can pull back from a futile reliance upon property development and associated tourism to drive Shire economy. I know most do not have the mental faculty or will to do so, however some might if the material is presented in the right way. This need is especially urgent in the context of the impending construction a new Strategic Town Plan.

Greg Wood is a leader in the fight to stop inappropriate development at Rainbow Beach Queensland in a World Heritage area.http://www.inskip.org/index.html

Recent comments