ISDS and the TPP: Trading our National Sovereignty

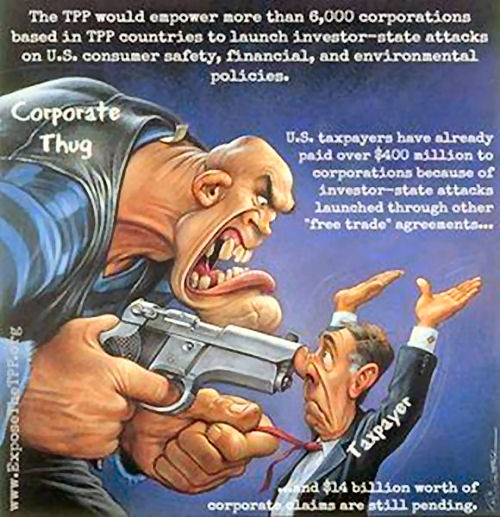

This article was originally published at bloggerme.com.au Since Tony Abbott was elected, Australia has progressed with two trade agreements that place Australia at risk of Investor-State Dispute Systems (ISDS) — one already signed with Korea (which definitely includes ISDS) and another close to agreement with Japan (which may include an ISDS). ISDS creates a parallel legal system that allows foreign investors to sue Australian taxpayers if Australia passes laws that reduce the value of their investments or their profits.

This article was originally published at bloggerme.com.au Since Tony Abbott was elected, Australia has progressed with two trade agreements that place Australia at risk of Investor-State Dispute Systems (ISDS) — one already signed with Korea (which definitely includes ISDS) and another close to agreement with Japan (which may include an ISDS). ISDS creates a parallel legal system that allows foreign investors to sue Australian taxpayers if Australia passes laws that reduce the value of their investments or their profits.

ISDS is so controversial (dangerous) that popular resistance against it is holding up the Transatlantic Trade and Investment Partnership agreement between America and the E.U. Indonesia has just announced that it is terminating over 60 bi-lateral trade agreements due to its concerns about ISDS clauses in those agreements.

In Australia, Greens Senator Peter Whish-Wilson has introduced the Trade and Foreign Investment (Protecting the Public Interest) Act 2014 into the Senate. The Bill aims to protect Australian laws by banning ISDS provisions which enable foreign investors to sue governments (ours or others).

The Department of Foreign Affairs and Trade (DFAT) argues that the latest ISDS agreements are "improved" versions that protect Australia's interests and that new ISDS agreements will replace. Others argue that old ones will still be in place, so the new ones can not offer any improvement.These statements were made at the recent DFAT stakeholder meeting for the TPP held in Melbourne on March 26. See the article TPP a high quality trade agreement - for multinationals, on the Independent Australia site for more information on this meeting and the TPP process in general.

There is an inquiry by the Senate Foreign Affairs, Defence and Trade Committee into the Bill and AFTINET has been asked to supply some points and references for people and organisations who want to make submissions.

Submission to the Senate Foreign Affairs, Defence and Trade Committee into the ISDS Bill close on 11 April 2014. The Reporting Date for the Report of the Inquiry: 16 June 2014, so public hearings will probably be held in May.

Below are 6 points (produced by AFTINET, with references) explaining why the government’s “safeguards “in the Korea FTA won’t work, and the latest information about Indonesia, Germany and France opposing ISDS in trade agreements.

1. ISDS has developed expanded legal rights for investors which are not found in national legal systems

ISDS enables foreign investors to sue governments for compensation in an international tribunal if they can claim that a domestic law or policy “harms” their investment. ISDS has expanded beyond its original intention, which was to pay monetary compensation to foreign investors in the event of the actual expropriation or taking of their property by host governments. There has been an expansion of legal concepts like “indirect expropriation” and “fair and equitable treatment” beyond the scope of their meaning in national legal systems, to enable investors to lodge claims against domestic law or policy on the grounds that it reduces the value of their investment.

(United Nations Committee on Trade and Development, (UNCTAD), 2000, p. 11)

2. Increasing numbers of ISDS cases against health and environmental legislation

There are increasing numbers of cases in which foreign investors are suing governments for hundreds of millions of dollars over health, environment and other public interest legislation. Recent examples include:

- the Philip Morris Tobacco Company suing Australia and Uruguay over regulation of tobacco packaging for public health reasons

- the Eli Lilly pharmaceutical company suing the Canadian national government over a court decision to refuse a medicine patent

- the US Lone Pine mining company suing the Québec provincial government of Canada over environmental regulation of shale gas mining

- the Swedish energy company, Vattenfall, suing the German government over its decision to phase out nuclear energy.

(Gaukrodger and Gordon OECD, 2014, p. 7, Public Citizen Table of Cases, 2014).

3. Costs to government and taxpayers

Both the costs of running cases(OECD estimates an average of $8 million per case, with some cases costing up to $30 million) and the compensation awarded to foreign investors, (often hundreds of millions and in some cases billions of dollars) can discourage governments from proceeding with legitimate domestic legislation. The highest compensation award so far is $1.8 billion against the government of Ecuador. This is damaging for any government, but particularly damaging for developing countries, and can have a freezing effect on legitimate domestic legislation.

(Gaukrodger and Gordon, OECD, 2012, p. 19, UNCTAD, 2013a, p. 3)

4. Lack of legal protections found in domestic legal systems

The disputes are heard by international investment tribunals, operating in under different sets of rules, but all of which lack the safeguards of national legal systems in the following ways.

- The proceedings are not made public unless both parties agree and even the results of proceedings can remain secret, unlike national legal systems, where proceedings and results are public

- The arbitrators can also be practising advocates, and so lack the independence of judges in national legal systems

- There is no system of precedents, and no appeal system, so decisions lack consistency

- Third-party funding of cases, described by the OECD as “a new industry composed of institutional investors who invest in litigation by providing finance in return for a stake in a legal claim” has encouraged a growing industry of investment law firms which actively solicit business and encourage large claims.

(UNCTAD, 2013b, p. 1, Gaukrodger and Gordon, OECD, 2014, p. 36)

5. Recent “safeguards” in ISDS clauses to protect health, environment and other public interest legislation have not been effective

There are claims that recent changes to the wording of ISDS clauses in trade and investment agreements like the Korea-Australia Free Trade Agreement (KAFTA) are “safeguards” which will prevent foreign investors from suing governments over health, environment or other public interest legislation.

But the first “safeguard” sentence in the KAFTA reads: "except in rare circumstances non-discriminatory regulatory actions by a party that are designed and applied to protect legitimate public welfare objectives, such as public health, safety and the environment, do not constitute indirect expropriations" (KAFTA chapter 11, annex 2B). Many legal experts have pointed out that the phrase "except in rare circumstances" leaves a very big loophole, which recent cases have used to advantage. The second “safeguard” is a more limited definition of "fair and equitable treatment" for foreign investors (KAFTA chapter 11, clause 11.5.2 and Annex 2A). However tribunals have ignored these limitations and applied the previous higher standard. A third “safeguard” is a reference to the general protections for “human, animal or plant life” in article XX of the WTO General agreement on Tariffs and Trade (KAFTA Article 22.1). This article has only been successful in one out of 35 cases in the WTO which have attempted to use it to safeguard health and environmental legislation.

These same “safeguards” in recent trade agreements like the Central American Free Trade Agreement and the Peru-US Free Trade Agreement have not prevented foreign investors from launching cases against environmental legislation. For example:

- the Government of El Salvador has been sued by Pacific Rim Mining Corporation under the Central American Free Trade agreement, over a ban on mining to protect the nation’s limited groundwater resources

- the US-based Renco Group is using ISDS in the Peru-US free Trade Agreement to contest a local court decision that it was responsible for pollution from its lead mine. Both cases are ongoing and may take several years.

(see case studies in Public Citizen, 2010, 2013, 2014)

6. Increasing numbers of governments are withdrawing from ISDS

Increasing numbers of governments are reviewing and terminating their involvement in ISDS. These include members of the European Union like France and Germany, Brazil, Argentina and eight other countries in Latin America, India and South Africa. Indonesia has recently announced it will terminate all 67 of bilateral investment treaties.

(Gaukrodger and Gordon, OECD, 2012, p.7, European Parliamentary Research Service, 2014. p.2, Bland and Donnan, 2014)

References

Ben Bland and Shawn Donnan, (2014) “Indonesia to terminate more than 60 bilateral investment treaties” Financial Times, March 27 http://www.ft.com/intl/cms/s/0/3755c1b2-b4e2-11e3-af92-00144feabdc0.html?ftcamp=published_links/rss/asiapacific/feed//product&siteedition=uk#axzz2x5CRbtpN

Donnan, S., and Wagstyl, S., (2014) “Transatlantic trade talks hit German snag” Financial Times, March 14 found at http://www.ft.com/cms/s/0/cc5c4860-ab9d-11e3-90af-00144feab7de.html#axzz2xCOjUOBt

European Parliamentary Research Service, (2014) “Investor-State Dispute Settlement (ISDS): state of play and prospects for reform” European Parliamentary Research Briefing, Brussels. January. www.europarl.europa.eu/.../LDM_BRI(2014)130710_REV2_EN.pdf

?David Gaukrodger and Catherine Gordon, (2012), “Investor-state dispute settlement: a scoping paper for the investment policy community”, OECD Working Papers on International Investment, no. 2012/3, OECD Investment Division, Paris, December. www.oecd.org/daf/inv/investment-policy/WP-2012_3.pdf

Public Citizen, (2010) CAFTA Investor Rights Undermining Democracy and the Environment: Pacific Rim Mining Case, Washington found at http://www.citizen.org/documents/Pacific_Rim_Backgrounder1.pdf

Public Citizen, (2013) Only One of 35 Attempts to Use the GATT Article XX/GATS Article XIV “General Exception” Has Ever Succeeded https://www.citizen.org/documents/general-exception.pdf

Public Citizen, (2014) Table of Foreign Investor-State Cases and Claims under NAFTA, August, Washington, found at http://www.citizen.org/documents/investor-state-chart.pdf

United Nations Committee on Trade and Development, (UNCTAD) (2000) "Taking of property", Issues in International Investment Agreements, UNCTAD, Geneva.

United Nations Committee on Trade and Development, (UNCTAD) (2013a) Recent Developments in Investor-State Dispute Settlement, IIA Issues Note, UNCTAD, May, found at http://unctad.org/en/PublicationsLibrary/webdiaepcb2013d3_en.pdf

United Nations Committee on Trade and Development, (UNCTAD) (2013b) Reform of investor state dispute settlement: in search of a roadmap, IIA Issues Note, UNCTAD, June, found at http://unctad.org/en/PublicationsLibrary/webdiaepcb2013d4_en.pdf

Recent comments