Oil Superspike and Forecasting Fatigue

If we take a flashback view on “official forecasts” from one year ago – in June 2007 – the unreality of those Cheap Oil Hopes jump from the page. While the OECD’s IEA is mutating quite fast into a Peak Oil friendly organization, able to admit that future oil supplies will not meet likely or probable demand, the US EIA and other diehards, ironically including the OPEC Secretariat and its far out underestimates of world oil demand growth, have not yet made that cultural revolution.

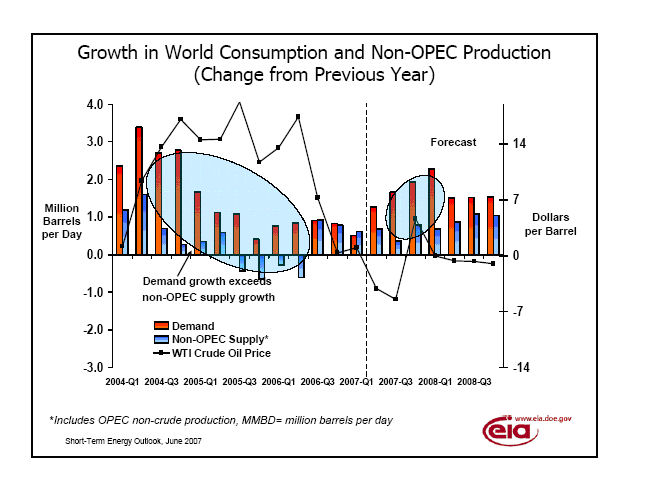

The chart below, from the US EIA’s June 2007 forecast, which for natural gas set a truly unreal forecast or wish-list 2008 average price, Henry Hub, of about 7.40 USD/mln BTU, is typical of how far out of line from reality some of the ‘official forecasting’ fraternity has got. For 2007-2008, the US EIA in June 2007 was hoping, very hard, the upward price spiral for oil was going to be trimmed back, to highly moderate, almost zero growth of average prices.

From Q3 2007 the graph of crude oil price change from previous year goes straight up – in the real world – not close to zero, as the US EIA hoped and wanted for 2008 and for 2009. For obvious reasons, the US EIA’s faith-based forecasters expected “nonOPEC supply” to ramp up, because OPEC was set to stay recalcitrant about unleashing its massive-mythic pent-up supply capacities. The US EIA placed its bet on new hopefuls like Angola and Azerbaijan + Kazakhstan, and tarsand grubbing Canada, and perhaps even hoped Russia, too, would ramp-up exports in a quest to grab petrodollars. Or maybe they would do this to please the outgoing G W Bush administration? Or because NOPEC producers have a special urge to exhaust their resource pile at record speed, drive down the oil price and national revenues, ending up as Price Takers peddling their cheap and tacky Sunset Commodity like they did for 15 years through 1985-2000. Dream on !

We all know that ‘supply side economics’ is the only economic policy music since at least 20 years, but supply siders also have one demand-side idea on oil. This is ‘price elastic’ demand shrinkage due to oil demanding consumers, habituated to cheap oil, waking up to unreal and exotic prices and suddenly using less. Certainly since 2005, as oil prices have racked their way up, the consumer-nation energy agencies led by the OECD’s IEA and the US EIA have manfully done what they could to talk down demand – on paper.

It might have been high last year but Boy ! Have we got news for you next year ! The slump in demand forecast for last year didn’t happen, as the world’s regular Teflon Herd consumer kept on gulping their gasoline, gasoil, cooking kerosene, aviation kerosene and other fuels, but this year everything is different. Rivaling each other in unreal forward demand estimates, and joined also by OPEC’s Secretariat for whatever dark or hidden motive, by the investment banks and by almost all analysts, the forecasting crowd today claims world oil demand in 2008 is “unlikely” to grow more than 1.1 mln b/d to 1.3 mln b/d.

Maybe these ‘experts’ don’t know the world automotive industry is in full-flood, with a likely 2008 output around 70 million cars, 27 million motorcycles and scooters, 8 million heavy vehicles including trucks, buses, tractors, harvesters and construction site vehicles, and 2 million other road and off-road vehicles. To be sure, 4WD monsters with 350 HP engines trundling round shopping mall car parks are no longer in vogue, in the US or Europe, but cars arent going out of fashion. The first thing buyers do with a new car is fill the tank, and the same for buyers of ‘Capemax’ cargo ships using up to 10 tons of oil per hour, or buyers of Airbus, Boeing and business jet planes and the bulldozers needed to build new airports for them to land on their oil-based tires.

Real world demand growth in 2008 is likely closer to 1.6 or maybe 1.7 mln b/d than 1.2 mln b/d, immediately swallowing June’s largesse from King Abdullah, to grace the world’s consumers with another 0.3 mln b/d (or was that 0.2 mln b/d ?). The headline number for world oil demand as a year average daily number, is likewise and constantly underestimated. One big reason for this is ignoring the rate of loss-to-production and losses through all downstream steps in the well-to-wheel chain. These add by my estimates to a year average near 1.4 mln b/d and are increasing at least 2 times faster than production growth (around 4% annual increase of losses for 2% production growth). By late this Summer, the peak annual bulge of demand can lift global demand beyond 90 mln b/d. Will production meet this ?

WORLD OIL DEMAND 2005 - 2008

NOTES:

1.Daily demand in Million barrels/day (Mbd) on “all liquids” base, including NGLs, refinery gains, other condensates, tarsand and syncrude oil, GTL (gas to oil), CTL (coal to oil) and the biofuels

2. Total demand includes all loss-in-production, loss in transport, storage and loss in break of bulk operations, estimated at 1.4 Mbd.

Net final demand for 2008, for example, is a day average of 89.5 – 1.4 = 88.1 Mbd.

3. First annual peak, 2007, was depressed due to exceptionally warm winter conditions in northern hemisphere.

200-dollar oil by Christmas ?

Since late April 2008, gathering numbers of analysts have come around to the simple logic I noted many times previously. From Jan 2007 to Jan 2008 oil prices swung from a month-low of 49.50 USD/bbl in 2007 to a month high above 100 USD/bbl in 2008. Doing that doubling operation one more time generates a Jan 2009 target of 200 USD/bbl. After Jeff Rubin of CITIC, we had GS analysts led by Arjun Murti, in a 5 May report titled “Has the Oil Super-Spike Endgame Begun ?” which concluded 200-dollar oil is not impossible. The few European analysts following Patrick Artuis of Natixis Bank, who more than 2 years ago forecast that 200-dollar or 300-dollar oil was far from science fiction by around mid-2009, come to the same ballpark estimates as Murti’s report.

Maybe we need to spike-up to 200 USD/bbl to achieve finance sector and global economic meltdown, but maybe also we don’t. Prices above 130 USD/bbl are going to do impressive things for US monthly oil trade deficits, on its 13 or 13.5 mln barrels/day of crude and products imports. India imports the same percent of its total consumption, about 65%, even if this only adds to a modest 2.2 mln b/d, but paying for cooking kerosene in a country where 300 million persons – exactly the same number as USA’s total population – live on about 1 dollar 50 cents-per-day means very big subsidies. If not, the rubber band breaks and India’s vanishing forests disappear even faster as firewood, and social tensions will burn in a country with a Muslim minority big enough to make it the third-biggest Muslim nation in the world, if it was a separate entity. Oil subsidies in India, loudly decried as market distortion by OECD finance ministers worried about gasoline prices for their consumer horde car fleets, and worrying fall-out in the airline industry, have spiraled to about 3% of India’s GNP. China’s impressive foreign exchange cashpile, like the US trade deficit but in exact reverse – China is a creditor nation – will surely start shrinking as 130 dollar-oil eats into it, but nowhere near so fast as shrinkage of Japan’s ‘traditional’ monthly trade surplus, already down 33% on one year previous. As economic growth slows, quite fast in India and also in China, quite fast in several European countries, very fast in some Latin American countries, inflation rises – usually described as ‘only due to oil’, but now surely helped by oil.

The club of big economies and countries with 20%+ annual inflation has now reached more than 20, and is growing. Inflation is not uniquely due to oil prices but helped by energy cost push, specially at over 100 USD/bbl, and when added to falling economic growth is the signal we have the rubber band of “seamless global growth” stretched near its limits. The detonator for a global economic explosion, triggering a crash landing for growth and inflation at 10% pa right across the OECD, and many times that outside the OECD, is easy to project. When sudden and repeated interest rate rises are brought to close proximity with existing high inflation the global economy can replicate 1979-1980. This was the last time oil prices in 2008 dollars were anything like today’s, probably around 95 to 110 USD/bbl when corrected for inflation. The real difference was that interest rates, at the time, were sky high, at over 10%pa in all OECD countries when the second Oil Shock hit.

Stress and Storm Signals

To be sure the situation is grave. June’s G-8 finance ministers meeting in Osaka, at which the Russian and Canadian ministers were perhaps not sincerely sure they wanted cheap oil, due to oil’s miracle effect on their budget balances, foreign exchange reserves and value of their national moneys, was held under special crisis conditions. The ministers posed for the family photo without neckties – a new Japanese custom for office-based salarymen who, without ties, can take temperatures at least 10°C higher than nekutai colleagues hooked on air conditioning. As everybody, or at least finance ministers believe, airconditioning is a big oil user in advanced economies burning 140 million-year-old fossil residues to change the world’s climate. We can ask: at 200-dollars for the barrel will the ministers pose naked ?

World finance and business leaders have to date in mid-June not come around to telling us what oil price is needed to make the band snap, which in fact is the real and interesting question. There are several parameters in the mix deciding when and how this happens, all of them daily-commented by finance and business players, analysts, and by consumers in the street, whether driving their car or buying food or anything else.

One way global economic explosion can happen is when or if the USD versus EUR, or Dollar/Euro struggle gets vicious. Today even Ben Bernanke wants a strong dollar, to curb both imported and domestic inflation, and is fast losing interest in bailing out subprime-addicted investment and other banks, asset reinsurers, and other Wall Street wailers for billion dollar Federal Reserve handouts. The Euro Central Bank’s Monsieur Trichet created the Euro in a pure atavistic dream of “saving Europe from inflation”, forever of course. This hasn’t worked. The outrageously overvalued Euro does not protect against inflation – it might even favor or generate it by its own heavy presence. No country feels the money is its own, and everybody feels they were cheated by the fiat exchange rate they had to accept, to get Euros.

As in Argentina, Venezuela, Russia or the GCC countries, real world inflation has really slipped out of Al-Din’s petro lamp in Europe, trashing ECB and official, as well as “consensus” CPI figures produced by consensus forecasters anxious to please the ECB. Europeans no longer believe inflation is low because, after all, flat screen TVs always cost less and “the Euro is strong”.

The USD/EUR pivot is exactly 1.50 USD for 1 Euro; when the Euro gets there it can fall and fast, with no floor, like it rose against the US dollar with no ceiling – which is par for a fiat money The Trichet gang will not take this lying down and will crank up interest rates. So will Bernanke. Pretty soon the US goes into real economy recession, like the Eurozone was already “but nobody knew” because 1.5%pa economic growth is normal for Europe’s obsolete, oil-intense and energy-intense “postindustrial” countries living like the USA with unreal dreams of economic power.

In the Europe of June 2008, retail gasoline and diesel prices around 9 to 10 US dollars per US gallon are already generating daily protests by the biggest energy-using and wasting industries and professions, from fishing and trucking through farming to taxis and ambulances. With a Euro buying only 1.18 USD, the famous “target rate” the ECB itself set, back in 1998 at the Euro’s launch, this shifts up to 11 dollars-a-gallon or more. How long do consumers take that ?

The Oil Price Trigger

The important point is this: current global oil supply/demand conditions can bring 2009 Super-Spike prices to the present anytime we get a geopolitical shock to layer on the shifting mix of factors making the rubber band very fragile. Even without this, completely spooking average analysts and business-as-usual deciders, pure physical shortage might tilt oil prices into Super-spike realms by mid-2009. Constantly underestimating demand, and overestimating new supply is a sure way to experience bad surprises.

We can say that if 130-dollar oil is a really bad dream for the real world economy, 200-dollar oil will be even more traumatic. With the USA’s oil trade deficit running at maybe 2 billion dollars-a-day, the Obama gang will need a lot more than friendly winks and gifts from Wall Street backers – and will have to radically cut US oil import demand. Exactly the same applies to European leaders painfully trying to fool European consumers they need a European passport and army, not affordable food, lodging and energy. In other words, the pussyfooting with bolt-on gadget “soft energy solutions” as our heartfelt contribution to fighting climate change will need to give way to simple and straight oil-saving and energy-saving. This will be the equivalent of what Jimmy Carter called a cultural revolution – and like his administration showed, these don’t happen without crisis.

Copyright Andrew McKillop, 2008

Andrew Mckillop

Also published at http://www.energypulse.net/centers/article/article_display.cfm?a_id=1798

Comments

Yuki Otoko

Thu, 2008-11-13 14:01

Permalink

Why are we at US$60 a barrel now?

Sheila Newman

Thu, 2008-11-13 14:12

Permalink

My 2c worth on the cost of oil

bill T (not verified)

Sun, 2008-12-28 16:53

Permalink

oil @ $200

As a trader for an investment firm I can say this.

Greed made the price go up as with food prices in 07-08.

Some other traders & hedge fund managers feel this way. We need to get speculators out of this area. I can buy lots of oil options and never take title to it. Hell, I know guys who were getting $1 in hard assets and getting $5 in credit, that buys lots of oil options.

As a trader I should not have the right to buy oil or a food based contract unless i am willing to take delivery of it at some point.

Add comment