See also: Community against East West Tunnel head to ALP conference this weekend of 17 May on the front page. - Ed

Unstated fuel costs of shale oil extraction undermine real gains

It is very important that all people understand that Shale Oil, like tar sands, demands far more energy (fuel) to extract than the old crude oil, as well as incurring appalling new democratic and environmental costs, notably to property rights and water conservation. The US and Australia have to be desperate to pursue this avenue, which has been banned in France (but US influenced forces in the EU are pushing to overthrow that ban). What you have is a situation where the US and other frackers are not giving out the increasing costs of oil recovery - in fuels, exploration, technology, and wars over hegemony in the Caspian and other regions. If they did, no-one would invest in shale-oil projects, or tollways. International energy agency reports are a public relations exercise on an issue too apparently specialised for most people to examine, but the principle is simple and it means that EastWest link business case is fundamentally flawed. Furthermore, so is the far more fundamental case for economic and population growth in Australia or elsewhere.

Hillbilly Economics unreliable in the 21st century

Anyone who watched the Beverly Hillbillies where the Clampett family danced around a gushing black oil geyser will know that crude oil used to be known as “Black Gold.” Unfortunately the days of crude oil gushing out of the earth are long gone. Now, much of what we assume is crude oil is no such thing. And that means that we also should not assume that frequent car use will continue indefinitely and that freeways and tollways are good investments or affordable.

Since the 1960s, and increasingly, crude oil has been supplemented by other fuels. Initially with lease condensates, lately with everything from vegetable oil to coal oil, shale oil and tarsands and grandma's old socks. This was predicted to happen by Walter Youngquist in Geodestinies and by many, many others from the early 1990s, but their message tends to date quickly due to it being very difficult to pinpoint the moment of 'oil peak' objectively.[1]

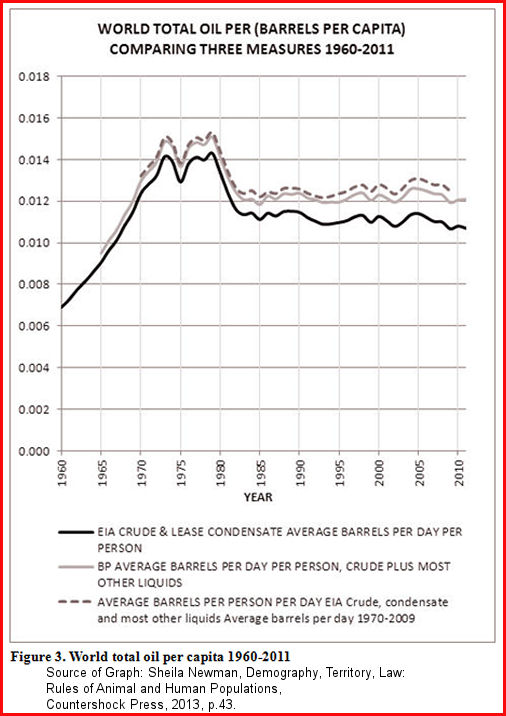

Real Trend: Every new drop of oil costs more than the last

The thing that most people - economists and even engineers - cannot get their heads around is that graphs of world oil production, which provide the figures for the one featured here, do not publish a fuel cost for fuel recovered report (or, in thermodynamic terms which you may have heard, Energy Return On Energy Invested (EROEI).) This is like stating your profits before doing your costs. [Here is an article I wrote specifically re shale oil in the US about correspondence on this with an EIA energy specialist spokesman here EIA should provide data on cost of North American shale gas exploitation to make balanced reports. This article contains his revealing response.]

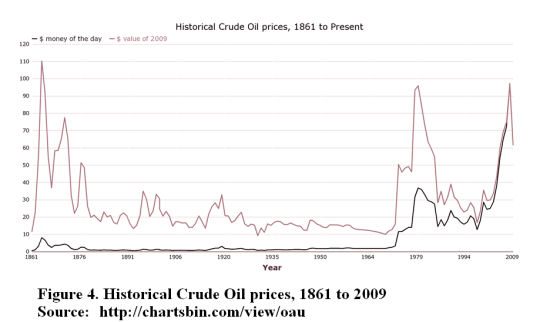

If the graphs did show costs, they would show that the number of equivalent barrels of oil used to get more oil has been climbing for ages and if you subtracted that increasing fuel expenditure you would show a decreasing fuel output. Part of the evidence for this lies in the changes to the definition of crude oil and petroleum, which show that world oil production statistics are made up of many new and costly oil sources. The attached graph is updated from Sheila Newman, Ed., The Final Energy Crisis, 2nd Ed, Pluto Books, UK, 2008 in Demography, Territory, Law, Rules of Animal and Human Populations, Countershock Press, 2013.

The attached graph, “World total oil per capita 1960-2011” shows the changes to the definition of crude oil and petroleum. I've also cut and pasted some paras from underneath. The source of this cited passage is Sheila Newman, Demography, Territory, Law, Rules of Animal and Human Populations, Countershock Press, 2013, p.43.

“Figure 3, ‘World total oil per capita 1960-2011’ suggests that, where once oil came from oil wells, now, to keep up with human population growth we supplement well-oil with all kinds of other stuff, whilst still presenting it as the same old stuff. If we still relied just on crude and lease condensates from oil fields, where trends are shown by the lowest and oldest line in the graph, we would be considerably poorer in total oil supply than we seem to be. Early definitions for total world oil (see EIA Crude and lease condensate from 1960-2011) only counted crude oil and lease condensate. Coinciding with the decline in easy oil availability as it became necessary to look harder and deeper for oil, the definition of oil started to include other sources obtained away from petroleum fields. The BP definition above counts crude oil, shale oil, oil sands and NGLs (the liquid content of natural gas where this is recovered separately). The EIA definition for Crude, condensate and most other liquids from 1970-2009 comprises natural gas plant liquids, and ‘other liquids’, defined as, “Biodiesel, ethanol, liquids produced from coal and oil shale, non-oil inputs to methyl tertiary butyl ether (MTBE), Orimulsion, and other hydrocarbons.” That’s a lot of new sources, all of them requiring more energy to extract than that required to harness the traditional ‘gusher’ close to the surface, now a rare phenomenon.

Highlighting the increasing cooption of non-crude oils and other processed and biological materials to ‘total oil’ makes the decline in crude and lease condensate more obvious, but the strange wavy plateau in the graph still gives the impression that we remain in control of our destinies. Some economists even believe [2] that we are still getting richer by producing more for less, that economic growth has become ‘dematerialised’ from fuels due to scientific efficiency. There was some truth to this shortly after the oil crash, but those gains are not as great as they are touted.

Another explanation is that, as prices for oil and other fossil fuels have risen, our efficiencies lie more in carefully choosing the kinds of fuels we use for different purposes, keeping oil only for the tasks that cannot be done well without it. For instance, where people once used oil to heat their homes, they now use coal-fired electricity or gas.[3]

We are told by politicians that flow energies like hydro, wave, solar and wind are contributing more and more to energy supply, but their contribution is small so far and can never match the vast reserves of fossil fuel that modern civilization is based on, because they cannot be stored in significant reserves and they tend to change on a daily basis and to be unpredictable. (That is not to say that these 'alternative' sources are not valuable. They just cannot support the vast populations and activities that fossil fuel supports. Most of these alternative sources are tried and true. Sun, water, tides and wind (along with beast) were solid bases for civilisation in Europe before coal and oil technologies. See Chapter 19: "France and Australia after oil" in S. Newman, Ed., The Final Energy Crisis, 2nd Edition, Pluto Press, 2008.)

The major alternative oil sources, however, that are really supplementing crude production are mostly pretty nasty, with a major symptom being clashes over democracy, even in the ‘developed’ world now. Farmers and communities are losing battles against corporations and their own governments over gas-fracking that threatens water supplies.[4] Farmers and climate change activists are outraged by coal-seam gas projects.

Mountaintops are being blown up to extract coal. [5] Tar-sand and shale-oil mining are last resorts that devastate land, use more fuel to extract, give less energy, and pollute atmosphere and water more than conventional sources. The world’s diminishing forests and their rare animal inhabitants are bulldozed to grow soybeans and other food crops to replace conventional crude and gas. Not really signs of increased ‘efficiency’.

Maybe this is really a bootstrap operation after all.

Although nuclear energy is important in electricity production in many countries, those countries got into nuclear at a time when there was plenty of capital. With some exceptions, like Iran (which encounters international political resistance) countries that do not already have it will have difficulty financing such massive new operations in global economies that keep faltering along with our crude oil supply. [6]

According to Figure 3, even with the addition of oil from these new, expensive, polluting and environmentally destructive sources, total global production of ‘oil’ is only just keeping up with population growth, if we take .012 barrels or so as the norm since 1982. Except – everyone doesn’t get their .012 barrels.

The cost of oil is increasingly unaffordable."

NOTES

[1] And, of course, earlier and famously by King Hubbert of “Hubbert’s Peak”.

[2] See Maddison, A., “Evidence submitted to Select Committee on Economic Affairs,” House of Lords, London, for the Inquiry into “Aspects of the Economics of Climate Change,” http://www.ggdc.net/Maddison/, 20 Feb 2005, p.2. “Past Relation between World Economic Growth and Energy Consumption: (3) Tables 4a and 4b compare the growth of world population and GDP with energy use (in terms of both fossil fuels and biomass) from 1820 to 2001. The energy intensity of GDP rose until 1900 (to 0.42 tons of oil equivalent per $1000) and fell in the course of the twentieth century (to 0.27 tons per $1000 in 2001). Per capita energy use at the world level rose about eightfold from 1820 to 2001.” My comment on this is that, although the economist Angus Maddison saw that GDP growth was decreasing, he nonetheless anticipated a long period of rapid growth through the 21st century, if not so rapid as in the last century. But he based this on his perception of trends of ‘dematerialization’ of the economy, which he inferred from trends in quantities of calories of oil-equivalent used, and failed to account for differences in the nature of fuels and their suitability for different uses.

[3] Cleveland, C.J., Kaufmann, R.K. & Stern, D.I., “Aggregation and the Role of Energy in the Economy,” Ecological Economics, vol.32, issue 2, pp 301-17, also at http://www.bu.edu/cees/people/faculty/cutler/articles/Aggregation_role_of_energy.pdf., cited in Sheila Newman, 2008. Ed., The Final Energy Crisis, Pluto Press, UK, pp13-14. “[The authors ]test the ‘dematerialisation’ explanation of conventional economists for claims that economic growth is proceeding well with reduced growth in global oil-production.

Looking at the causal relationship between energy use and GDP from 1947 to 1996, they find, instead, that people and business have not used less fuel, but that they have been more careful about the fuels they choose to do different tasks, choosing cheaper fuels to do low production work and more expensive ones for high returns. Cleveland et al’s main indicator of quality is financial price and it seems to be an indicator which performs well in this case. The authors find that the financial cost of fuels is an accurate reflexion of their versatility or adaptability to specific tasks more than is measuring the total calories they embody. (Neither was any relationship found between the quality of ‘transformity’ (Odum) and the versatility of fuels for human social needs in industrial societies over the period examined. The authors illustrate this with the example of coal: “Users value coal based on its heat content, sulphur content, cost of transportation and other factors that form the complex set of attributes that determine its usefulness relative to other fuels.”)

Logistical or engineering factors affect the return on calories. Humans have adapted their social systems and technology to the limitations of fuels and fuel supply. If a fuel must be transported a long way, it makes less sense to use gas, since the cost rises over distance. To keep expensive pipe diameters low, natural gas, for example, needs to be compressed or cooled to LNG for transport through insulated pipes. (This is also a major reason why using hydrogen as an electricity carrier is so awkward.) You would do better by using a solid (like coal) or a liquid (like petroleum) in this circumstance. Whereas petroleum was once more widely used in North America for domestic heating, because it has a higher calorie content than coal, it now tends to be used for more economically productive work. Coal-fired electricity became a heating option, but now the price of coal is rising due to demand and the cost of transporting it to sprawling populations. Cleveland et al found that the more expensive the fuel in dollar terms, the more carefully it was used. The authors also found that, even where fuel was cheap to start with, its cost would increase in line with the financial return it provided to the users, so that their financial measure showed reliability over time.”

[4] Newman, Sheila, 2011, April 11, “Fracking democracy,”http://candobetter.net/node/2348. Comments on this article document evolution of laws in France to totally ban gas-fracking as environmentally and socially untenable.

[5] McQuaid, John, 2009, January. Mining the Mountains. Smithsonian Magazine, http://www.smithsonianmag.com/science-nature/Mining-the-Mountain.html#ixzz275C3YDUt

“Explosives and giant machines are destroying Appalachian peaks to obtain coal. In a tiny West Virginia town, residents and the industry fight over a mountain's fate.” “Demand for mountaintop coal has been rising quickly, driven by high oil prices, energy-intensive lifestyles in the United States and elsewhere and hungry economies in China and India. The price of central Appalachian coal has nearly tripled since 2006 (the long-term effect on coal pricing of the latest global economic downturn isn't yet known). U.S. coal exports increased by 19 percent in 2007 and were expected to go up by 43 percent in 2008. Virginia-based Massey Energy, responsible for many of Appalachia's mountaintop projects, recently announced plans to sell more coal to China. As demand increases, so does mountaintop removal, the most efficient and most profitable form of coal mining. In West Virginia, mountaintop removal and other kinds of surface mining (including highwall mining, in which machines demolish mountainsides but leave peaks intact) accounted for about 42 percent of all coal extracted in 2007, up from 31 percent a decade earlier. ”

[6] For a discussion about costs of building nuclear power supply in Australia from scratch see Newman, Sheila, 2008. “France and Australia,” in Sheila Newman (Ed.) The Final Energy Crisis, 2nd edition, pp251-252.

Comments

Matthew Mitchell

Mon, 2014-05-19 13:07

Permalink

Coal Seam Gas - averting a 'civil' war' in the Northern Rivers

Add comment