"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills.

(All emphases and headings have been inserted by Candobetter.net's editors.)

(All emphases and headings have been inserted by Candobetter.net's editors.)

Unpopular, unwanted, unwise

The Liberal government's biggest piece of land transport infrastructure is the proposed freeway through Royal Park in Melbourne, which it calls the East West Link. In fact, it does not link the east and west at all. Nor does it have the support of most Victorians, who know perfectly well that if it proceeds it will come with a massive opportunity cost and put paid to their hopes for a rail line to Doncaster, a rail line to Melbourne Airport, rail to Mernda or public transport to Monash University. In particular, it does not have the support of local residents, who are appalled by its impact on Royal Park, the Moonee Ponds Creek and the Melbourne Zoo. I commend Julianne Bell, the tireless secretary of Protectors of Public Lands Victoria and committee member of Royal Park Protection Group, and all the community groups who are working incredibly hard to stop this project happening: David Muir and theKensington Association, Kaye Oddie and the Friends of Moonee Ponds Creek, the Carlton Association and many others.

Costly, profligate, secretive, ill-informed

For a Liberal government that grandstands about fiscal rectitude, this $8 billion project is being put forward without passing any serious cost-benefit analysis. The government claims that the benefits of the $6 billion to $8 billion freeway outweigh the cost but refuses to provide details, claiming that this would compromise commercial negotiations.

Misunderstands Glaeser's Triumph of the City theory

The government's business case relies totally on the assumption of what economists call an 'agglomeration effect', in which population and economic clusters in cities lead to efficiencies and add to business productivity. The Linking Melbourne Authority, which provides information on road infrastructure projects conducted on behalf of the Victorian government, has referred to a book by the American writer, Edward L Glaeser, called Triumph of the City. Its main thesis is the agglomeration benefits that create cities. But the Linking Melbourne Authority does not appear to have read the book, because the book does not argue that freeways are the path to these benefits, in fact it argues quite the opposite. Mr Glaeser argues that 'driving creates negative externalities that hamper urban economies'. He warns against highway building, calling it 'antiurban'.

I quote:

“For decades we have tried to solve the problem of too many cars on too few lanes by building more roads, but each new highway or bridge then attracts more traffic.”

The Age commentator, Kenneth Davidson, has accurately pointed out in relation to the Royal Park freeway:

“It will cripple the state's fiscal position for many years through massive payments to the public-private partnership consortium that will finance it. The financial burden on the Victorian taxpayer will be so big that it will ''crowd out'' the state's core responsibilities for funding schools, hospitals, rail transport and even other roads for at least a generation.”

Contorted and ridiculous economic estimates

An email recently obtained through FOI illustrates that the Victorian government's own economic consultant, Chris Tehan of Evans & Peck, told the government that the business case had dramatically overestimated the wider economic benefits to get an artificial figure of a $1.40 return. According to The Age:

“… the methodology ‘has not been used in any of [the Transport Department's] other public transport projects or program modelling to date’”.

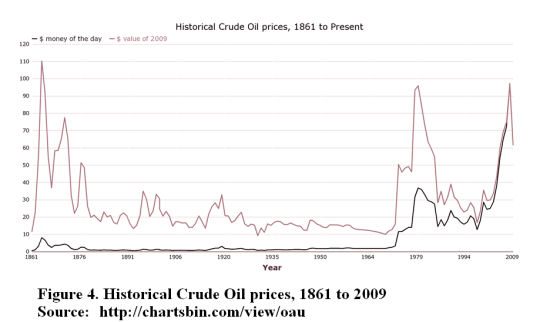

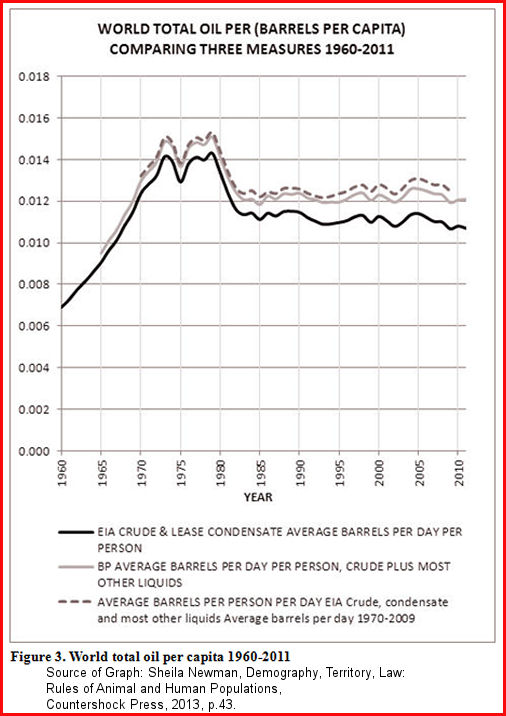

The financial case for the east-west link hinges on a prediction that toll road use will jump over the next 30 years because of rising wealth and shrinking petrol and CBD parking price rises.

The business case for the link makes the controversial assumption that: firstly, a driver's willingness to use toll roads will increase by 1.4 per cent per annum due to rising incomes; secondly, the rate of increase in the cost of running a car will fall from the current two per cent per annum in real terms to half a per cent per annum by 2041; and, thirdly, that the rate of increase in the cost of inner-city parking, which is currently increasing at four per cent per annum in real terms, will fall to 0.5 per cent by 2041.

Victorian government caught out manufacturing and manipulating benefits

The Victorian government has been caught out manipulating modelling to produce a favourable result.

As the minister at the table well knows, this is the Land Transport Infrastructure Amendment Bill 2014. The East West Link is this government's prime piece of proposed land transport infrastructure, and I am detailing to the House why I am opposed to this piece of land transport infrastructure.

Increasingly dodgy business case models being passed by Victorian Government

The former Infrastructure Australia head, Michael Deegan, told a Senate committee that the government's unpublished business case provided an alternative estimate showing a benefit-cost ratio of just 0.8. Under this scenario, the project would return just 80 cents for every one dollar spent, suggesting an economic loss if the stock-standard analysis preferred by Infrastructure Australia is used.

According to The Age, in a submission to a federal infrastructure inquiry, Infrastructure Australia outed Victoria for failing to submit a robust business case for the East West Link, singling out:

“….the controversial $6 billion to $8 billion road as a key example of why the public are cynical about ‘big ticket’ infrastructure announcements.”

Infrastructure Australia's 11-member council, which includes the transport experts, Sir Rod Eddington, and the federal Treasury secretary, Martin Parkinson, is understood to broadly recommend only those projects with benefit-cost ratios of more than 1.5. And Michael Deegan warns that big-spending promises are being made without proper scrutiny. The Age quotes him as saying:

“This is a particular problem during election periods where commitments are often made although robust business cases have not been prepared, let alone independently reviewed.”

Fed Gov changes afoot to ring-fence projects from independent scrutiny

The Age continues, saying that Infrastructure Australia:

““… is particularly concerned about changes proposed by the Deputy Prime Minister, Warren Truss, which will give the federal government discretion to ring-fence some projects from independent scrutiny.”"

Mr Deegan warned that any such change would ‘exacerbate’ the problem of projects being presented to Infrastructure Australia ''with limited or questionable business cases.”

The freeway through Royal Park is a classic example of economic 'mutton dressed up as lamb'.

The article continues:

“Prime Minister Tony Abbott, who is opposed to Commonwealth funding for public transport projects, has pledged $1.5 billion for the east-west project, with the rest coming from the state government, which will collect toll revenue, and the private sector.”

Costly 'solution' doomed to fail on its own terms 12 years after construction

According to the traffic expert, Stephen Pelosi, the traffic on the East-West Link in the morning peak is expected to have slowed to 20 to 30 kilometres per hour by 2031 as worsening congestion pushes the road close to capacity just 12 years after it is due to open. The East West Link is forecast to carry 80,000 vehicles a day on opening in 2019, increasing to between 100,000 and 120,000 a day by 2031 according to his modelling. He is quoted in The Age:

''If it's reaching 120,000 we're at a position where we're reaching capacity,'' Mr Pelosi said. ''Unless you intervene in some manner and manage the toll rate to influence demand, you get a situation where you're near capacity."

“

It is not much use to commuters.

457 Visas mean no guarantee Australian workers will get jobs from EastWest link

When the Prime Minister is challenged about all the manufacturing jobs that are being lost in Melbourne with the impending closure of Ford, Holden and Toyota, and the job cuts at Qantas, he says, 'It will be alright, we are going to build the EastWest Link'. But will those construction jobs actually go to Australian workers – to Victorian workers, to Melbourne workers? In fact there are no guarantees – there are no guarantees! – that Australian workers will get the jobs created on the project from design through to actual construction work. This is because government policies at the federal and state level favour foreign companies and foreign workers over Australian workers and companies.

At the end of September 2013 there were 13,440 temporary foreign workers on 457 visas in the Australian construction industry, an increase of five per cent in just 12 months. At the end of January 2014 a total of 110,000 457 visa workers were in Australia, four per cent more than at the end of January 2013. The nature of the construction industry is such that any number of these 457 visa workers could be deployed to work on the Royal Park freeway, from engineering to trades like carpentry and other blue-collar jobs. The slowdown in resource sector construction means that many firms employing 457 construction workers are desperately looking for infrastructure projects to fill the gap in their orders.

Government reducing worker protection and encouraging 457 workers

On top of that, the Liberal government has shown that its agenda is to reduce protections for Australian workers and young people in the 457 visa program in the name of deregulation and removing what it calls 'unnecessary red tape'.

Let us consider exactly what the Liberal government considers unnecessary red tape. First, it has removed or watered down the key protections for Australian workers that Labor introduced in its June 2013 legislation, the Migration Amendment (Temporary Sponsored Visas) Act 2013, specifically, the labour market testing provisions. In November last year the coalition issued regulations under that legislation which make it much easier for employers to hire temporary foreign workers on 457 visas even when qualified Australian workers are readily available and willing to do the work. The figures from the Department of Immigration and Border Protection say that, for 65 per cent of all of the 457 visa nominations.

I am not the one who made the claim that the East West Link is a solution for the unemployed manufacturing workers in Melbourne; it was the Prime Minister who made that claim. I am pointing out why that claim is flawed.

Figures from the Department of Immigration and Border Protection indicate that, for 65 per cent of all 457 visa nominations, they have exempted employers from any legal obligation to labour market test – that is, to even look for Australian workers, let alone show that none were available, before 457 visas could be approved for temporary foreign workers. The Construction, Forestry, Mining and Energy Union, the CFMEU, pointed out in a recent submission to the Productivity Commission that, even in the minority of cases where 457 labour market testing is required, the protections for Australian workers looking for jobs on projects like the East West Tunnel are 'virtually non-existent'. They state:

“Employers have no obligation even to advertise jobs for which they nominate foreign nationals for 457 visas – ‘other recruitment efforts’ (unspecified) will suffice, according to FAQs on the Department’s website.

Job ads can be put on Facebook or buried on obscure company websites, for only a few minutes, then taken down. There is no minimum advertising time …”

The CFMEU propose there be a 28-day advertising period, and I agree with them. They also state:

“The so-called ‘job ads’ can be ‘placed’ any time in the last 12 months. This means employers can use job ads placed in February 2013 to justify their bid for 457 visa workers in February 2014 – regardless of the number of Australian workers who become available or unemployed in that time.”

Employers have no obligation to keep any records of the number of Australian applicants, the number who got jobs and those who didn’t, and the reasons why the Australian candidates missed out while temporary foreign workers did not.

Employers simply have to ‘declare’ this information to the Immigration Department and that’s the end of it. They have no obligation to prove they made good faith efforts to employ Australians first or keep records of any job interviews.

The government regards requirements like this as red tape holding back employers. I say that, without such requirements, a project like the East West Link, if it proceeds, will not employ many Victorian workers at all.

The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects.

Thursday 20th March 2014

The Hon Kelvin Thomson MP

Federal Labor Member for Wills

"The advantage that oil distillates have is that the energy density (energy content/unit volume) of oil distillates is much greater than electric batteries and that advantage still exists. To reduce that disadvantage, auto makers now put as many battery cells in series as they can. Modern electric vehicles have the whole bottom of the vehicle covered with electric battery cells. Many electric vehicles now have a rated range of +300 miles.

"The advantage that oil distillates have is that the energy density (energy content/unit volume) of oil distillates is much greater than electric batteries and that advantage still exists. To reduce that disadvantage, auto makers now put as many battery cells in series as they can. Modern electric vehicles have the whole bottom of the vehicle covered with electric battery cells. Many electric vehicles now have a rated range of +300 miles.

"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills.

"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills. (All emphases and headings have been inserted by Candobetter.net's editors.)

(All emphases and headings have been inserted by Candobetter.net's editors.)

Anglo-capitalism is a system born of dispossession and one which has industrialised cruelty to humans and animals on a massive, constantly worsening scale. (See

Anglo-capitalism is a system born of dispossession and one which has industrialised cruelty to humans and animals on a massive, constantly worsening scale. (See

Recent comments