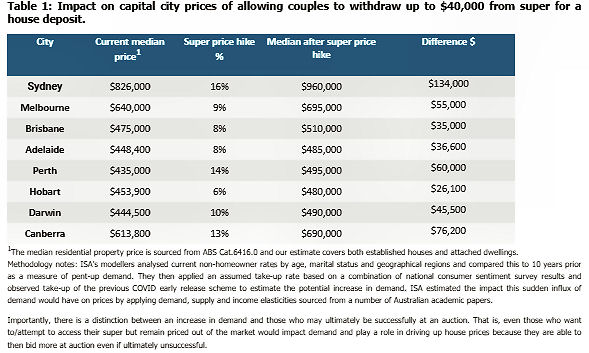

A fundamentally flawed proposal to bust open super for first home buyers housing deposits could hike the nation’s five major capital city median property prices by between 8-16%, preliminary analysis from Industry Super Australia shows.

A fundamentally flawed proposal to bust open super for first home buyers housing deposits could hike the nation’s five major capital city median property prices by between 8-16%, preliminary analysis from Industry Super Australia shows.

Allowing couples to take $40,000 from super would send property prices skyrocketing in all state capitals, but the impact would be most severe in Sydney, where the median property price could lift a staggering $134,000. (see table 1 below)

In most areas the price increases and extra property taxes would quickly surpass the amount of super a first home buyer could withdraw, so homebuyers would be paying more but at the expense of their super. In all cities but Hobart if a couple took out $40,000 from their super, nearly all would be lost through the price hikes the increased demand would fuel, in Sydney prices would spike by three times that amount.

The market would react quickly to the scheme becoming a reality, within a year the full price increases would likely be realised.

Many potential buyers would soon be locked out of the supercharged market, others would be lumped with far bigger mortgages – and would hit retirement with little savings and only the pension to rely on.

A big loser in this scheme, being pushed by a backbench MP, is the taxpayer, who would be forced to pay billions more into the aged pension, which could lead to higher taxes.

There is no free lunch in super and for every $1 taken out of super by someone in their 30s the taxpayer must pay up to $2.50 more in increased pension costs when they retire.

But the scheme is a real winner for the banks who would reap the windfall of the inflated mortgages.

Last week Superannuation Minister Jane Hume joined a chorus of economists, housing experts and a Retirement Income Review report author who have cautioned against raiding super for housing.

The findings of ISA’s preliminary analysis backs expert warnings that such a scheme would inflate prices and make affordability worse.

ISA will soon publish a detailed technical report on its findings, a briefing report on the proposal can be found here: https://www.industrysuper.com/media/super-bad-why-super-for-a-house-will-hurt-first-home-buyers/

Industry Super Australia Chief Executive Bernie Dean, commented as follows:

“This just confirms what experts have been saying for ages; that throwing super into the housing market would be like throwing petrol on a bonfire – it will jack up prices, inflate young people’s mortgages and add billions to the aged pension, which taxpayers will have to pay for. Politicians who own multiple investment properties and pocket 15% super might think price hikes are a ‘secondary’ consideration. They don’t care about locking young people into hugely inflated mortgages and a bleak future with hardly any savings to fall back on. We need sensible solutions – like boosting the supply of affordable housing which will bring prices down and get young people into a home without lumbering workers with higher taxes in the future. We welcomed the minister pouring cold water on this idea very publicly last week and would encourage the Treasurer and the PM to back her up and show that the government is not beholden to extreme elements within its ranks.”

Comments

quark

Sun, 2021-02-28 09:11

Permalink

Taxpayer funded housing inflation?

Add comment