"Pensioners reject forced reverse mortgages" - Pensioners & Superannuants Assoc (CPSA)

Monday, 27 April 2015

Monday, 27 April 2015

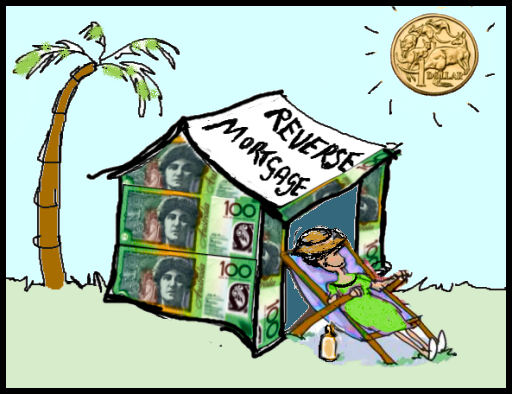

“The suggestion by the Centre for Independent Studies[1] that the family home should be included in the pension asset test and be reverse mortgaged for an income stream would cost pensioners dearly,” said Manager, Research and Advocacy, Amelia Christie.

“Forcing pensioners to take out reverse mortgages in order to put food on the table is both heartless and poor policy – the only winners would be the banks.

“Government backed reverse mortgages have been investigated in the past for aged care and wholly rejected by Treasury because they effectively make the Federal Government the country’s largest bank.

“Government backed reverse mortgages have been investigated in the past for aged care and wholly rejected by Treasury because they effectively make the Federal Government the country’s largest bank.

Tackle housing affordability, not home owners and their children

“Inbuilt into the pension system is the assumption that people own their own homes. The rate of pension is not enough to be able to live easily in the private rental market, an increasing reality for many pensioners. The report is correct in stating that non-homeowners are worse off than those who have been able to purchase a home. The solution to this, however, is not to penalise homeowners but rather to tackle housing affordability and increase Rent Assistance.

“CPSA calls on the Government to stay true to its word to not include the family home in the pension asset test[2] ,” said Ms Christie.

It should also be noted that it is extremely difficult to change plans after a reverse mortgage, for instance, if you want to move or if you need to go into aged care.

Source of quotes was: http://www.cpsa.org.au/income/income-media-releases/1268-pensioners-reject-forced-reverse-mortgages

Recent comments