council rates

Ratepayers Victoria: Rate-capping: The Truth is out there!

Mulgrave 14 Nov 2015: Free Reengineering Local Government Seminar - Ratepayers Vic Inc & Eastern Ratepayers Inc event

Venue: Mulgrave Country Club, Saturday 14 November, 9.30am to 4pm. Join us and other ratepayer leaders to discuss about common core issues and how the LG Act and other associated laws, and the roles of ratepayer groups can be changed to fix today’s broken LG system for the better. The seminar will include free light lunch and feature inspirational speakers.

Venue: Mulgrave Country Club, Saturday 14 November, 9.30am to 4pm. Join us and other ratepayer leaders to discuss about common core issues and how the LG Act and other associated laws, and the roles of ratepayer groups can be changed to fix today’s broken LG system for the better. The seminar will include free light lunch and feature inspirational speakers.

RVI Public Seminar : Reengineering Local Government

A Ratepayers Victoria Inc event in partnership with Eastern Ratepayers Inc

TIME: 9:30 am registration, seminar from 10 am to 4 pm

VENUE: Mulgrave Country Club, Corner of Wellington and Jells Road, Mulgrave 3150.

Objectives

- Identify the key deficiencies in LG system

- Fixing today’s broken system via LG Act reforms

- Recognising a peak body for ratepayers in Victoria

- Contribute info for RVI submission to the LG Act Review program

Contact: The event is free. For catering purposes, early booking is required by 1 Nov 2015 – please contact either:

- Jack Davis – [email protected]; mobile 0412 238 974, or

- Frank Sullivan – [email protected]; mobile 0438 555 805

Join us and other ratepayer leaders to discuss about common core issues and how the LG Act and other associated laws, and the roles of ratepayer groups can be changed to fix today’s broken LG system for the better.

The seminar will include free light lunch and feature inspirational speakers including:

Keynote Speakers:

Minister for Local Government , Hon Natalie Hutchins

Assoc Professor of International Business, Sharif As-Saber

Guest Presenters:

Joe Lenzo, Ratepayer advocate leader from Mornington Peninsula Shire

Carl Cowie, CEO of Mornington Peninsula Shire

Rafal Kapton, Councilor of Casey

Matthew Gordon, Board Director of Oursay, a digital community engagement platform.

Frank Deutsch, Councilor of Ararat

These guest speakers will share their insights, such as what is wrong with Local Government today, a case study of best practice CEO leadership and council operations transformation; workplace bullying and conduct reforms; using technology as strategic tools for change; community engagement reforms, etc.

RVI President Jack Davis will open the seminar. Seminar attendees will engage in Q&A with the Minister; participate in working lunch breakout group activities to identify key issues in local government and share ideas for reforming the LG Act and formally recognizing a funded ratepayer peak body in the sector.

Because of time management, questions for Q&A will have to submitted to either Jack Davies or Frank Sullivan by 12 Nov 2015 and the submitted questions will be chosen on a first come first serve basis. On-call questions are not allowed on the day of seminar. For those who missed their questions chosen can individually contact and converse with the Minister, through her email [email protected].

This seminar ‘s focus is to understand the coming reform directions and identify future ratepayers’ roles and driven opportunities for change in a new local government world where “Every council is responsive to, and reflective of, their local community” is evidently effective.

Rate Capping: The Perfect Storm for Change

Ratepayers Victoria Incorporated (RVI) is pleased to know that the legacy culling and bludgeoning of ratepayers to pay excessive council rate increases is about to end. In Victoria, rates have increased to about 80% over the last ten years, almost double NSW's 42%. "On the 14 November, RVI is hosting a ratepayer seminar (themed Reengineering Local Government) in Mulgrave, Monash. During this seminar, RVI will reveal its reform strategy, potential partners and aim to recruit project teams. For the very first time, ratepayers can stop being the silenced and frustrated stakeholder. They can and will become the new high value adding and agile solution partners in the new and reformed local government system. Change has started. There is no way back now." Jack Davis, President.

Ratepayers Victoria Incorporated (RVI) is pleased to know that the legacy culling and bludgeoning of ratepayers to pay excessive council rate increases is about to end. In Victoria, rates have increased to about 80% over the last ten years, almost double NSW's 42%. "On the 14 November, RVI is hosting a ratepayer seminar (themed Reengineering Local Government) in Mulgrave, Monash. During this seminar, RVI will reveal its reform strategy, potential partners and aim to recruit project teams. For the very first time, ratepayers can stop being the silenced and frustrated stakeholder. They can and will become the new high value adding and agile solution partners in the new and reformed local government system. Change has started. There is no way back now." Jack Davis, President.

CPI capped rates and improved efficiencies are not the only benefits arising from the Fair Go Rates policy:

• Ratepayers will have greater say and influence in their council's affairs, notably setting future rate directions and underlying budget expenditure priorities, and support for justifying capped rate variations.

• The arising chain effects will also bring about higher propensity of councils to increase their collaboration, accountability and transparency (CAT) performance, which can translate into increasing good governance in councils' annual and strategic budget planning and utilisation.

• More importantly, these CAT capabilities will also help to build sustainable TRUST between councils and ratepayers, a first time milestone-breaker in local government history.

It is natural that councils and their peak bodies are nervous of the perfect storm of change coming to disrupt their status quo. However, they do not have to be alone in their rate capping journey. They can choose to engage and partner with ratepayers to help them make rate capping work and embrace continuous learning and quality improvements.

Great change involves greater challenges. There will be mistakes made, but so what. Mistakes create lessons learnt that are necessary for enabling continuous improvements, which together with effective community collaboration, are critical success factors.

RVI is forging ahead its reform plan to build grass-root capacity to help fix the currently broken local government system. With committed support from the Local Government Minister, Local Government Victoria, Essential Services Commission and now the ratepayer community, what more can councils ask for? They are in the most favourable and well supported positions to make rate capping work. In a very viable future scenario, ratepayers and councils can become agile partners in ensuring the peace, order and good governance in every Victorian municipal district. The big question is will councils and their peak bodies come to the party?

On the 14 November, RVI is hosting a ratepayer seminar (themed Reengineering Local Government) in Mulgrave, Monash. During this seminar, RVI will reveal its reform strategy, potential partners and aim to recruit project teams. For the very first time, ratepayers can stop being the silenced and frustrated stakeholder. They can and will become the new high value adding and agile solution partners in the new and reformed local government system. Change has started. There is no way back now.

Jack Davis

President

Source: Ratepayers Victoria Inc (RVI) Media Release - 21 Oct 2015

Rates and Taxes: Time to push back against council rates

The article below is about cost-shifting to local councils to cope with increasing demand for infrastructure and services. This is of course a reflection of population pressure. The councils once could limit the amount of new homes and development but their capacity to do this has been greatly eroded by state government. The state governments have also left councils with little option but to borrow and to gouge residents with higher rates to cater to ever increasing costs of population growth. Just as there seem to be no limits to population growth in Victoria, there are no limits to local rates in Victoria. The article below is an extract from Cardinia Ratepayers and Residents Assn Inc Newsletter.

The article below is about cost-shifting to local councils to cope with increasing demand for infrastructure and services. This is of course a reflection of population pressure. The councils once could limit the amount of new homes and development but their capacity to do this has been greatly eroded by state government. The state governments have also left councils with little option but to borrow and to gouge residents with higher rates to cater to ever increasing costs of population growth. Just as there seem to be no limits to population growth in Victoria, there are no limits to local rates in Victoria. The article below is an extract from Cardinia Ratepayers and Residents Assn Inc Newsletter.

There is a limit to tax charged under government legislation. There is no limit to Council rates that are charged at whatever level a Council decides upon in a financial period of up to four years. Federal taxes are calculated on income, sale of goods and service, stamp duty etc. Council rates are based on fluctuating property values and calculated on estimated necessary expenditure, not affordable expenditure. Somehow taxes have become merged with rates due to cost shifting from government onto local councils. Until ratepayers understand they are actually paying extra tax via council rates, requests for rates relief will fall on deaf ears because councils are delivering services and infrastructure beyond their financial capacity in order to comply with government policies of continuing growth and expansion.

There is a limit to tax charged under government legislation. There is no limit to Council rates that are charged at whatever level a Council decides upon in a financial period of up to four years. Federal taxes are calculated on income, sale of goods and service, stamp duty etc. Council rates are based on fluctuating property values and calculated on estimated necessary expenditure, not affordable expenditure. Somehow taxes have become merged with rates due to cost shifting from government onto local councils. Until ratepayers understand they are actually paying extra tax via council rates, requests for rates relief will fall on deaf ears because councils are delivering services and infrastructure beyond their financial capacity in order to comply with government policies of continuing growth and expansion.

The notion of “local government“ has been officially and politically perpetuated to legitimise the cost shifting carried out at state and federal level .

Government grants and financial handouts blur the reality of this situation. Ratepayers must look carefully at what they expect in return for taxes paid to government and what they receive in return for annually increasing rates paid to the local council. Rates and Taxes.

There is a limit to tax charged under government legislation. There is no limit to Council rates that are charged at whatever level a Council decides upon in a financial period of up to four years. Federal taxes are calculated on income, sale of goods and service, stamp duty etc. Council rates are based on fluctuating property values and calculated on estimated necessary expenditure, not affordable expenditure. Somehow taxes have become merged with rates due to cost shifting from government onto local councils. Until ratepayers understand they are actually paying extra tax via council rates, requests for rates relief will fall on deaf ears because councils are delivering services and infrastructure beyond their financial capacity in order to comply with government policies of continuing growth and expansion.

The notion of “local government“ has been officially and politically perpetuated to legitimise the cost shifting carried out at state and federal level .

Government grants and financial handouts blur the reality of this situation. Ratepayers must look carefully at what they expect in return for taxes paid to government and what they receive in return for annually increasing rates paid to the local council.

Original article at http://www.crra.org.au/news13/news1314.pdf

Are Council Rates legal? State Gov removing residents' rights - Ratepayers Vic.

Ratepayers have fewer and fewer rights in Victoria but it may be that they can refuse to pay their rates unless they are satisfied.

Ratepayers have fewer and fewer rights in Victoria but it may be that they can refuse to pay their rates unless they are satisfied.

State Government removing right to know/approve new buildings next door

(As Reported on 3aw 15/3/12)

The State Government have submitted to parliament a law that council’s no longer have to advise abutting owners of a planning permit application or that the applicant must place a notice on the site.

This means that you will not be aware what is proposed next door nor will you have the option to object because the Planning application will have already been granted.

This is not in the best interest of Ratepayers or for local community, think about what this will mean.

If a councilor or a council officer or builder wants to have a planning application approved you will not know about the application, until the builders arrive.

Council Rates are they legal?

There has been much debate on this issue.

Victorian Ratepayers Inc.(RPV) from the facts presented to our organisation it would appear that Council’s have no legal right to collect rates, consider the following facts.

There is a core issue for us all in Australia, and that is whether municipal councils have the power/authority to charge "rates". Please consider

- In 1904, the High Court of Australia determined that municipal "rates" are a tax.

- In 1988, the people of Australia voted in a referendum in relation to municipal councils being recognised in the Commonwealth Constitution as a third tier of government.

The vote was NO!!!

- In 2009, [Pape V Commissioner of Taxation] the High Court said that "responsible government" involved three fundamental principles.

- 1/ The passing of legislation to collect tax (as public money for public purposes),

- 2/ Money collected must go into a Consolidated Revenue Fund, and

- 3/ The Parliament MUST make Bills for approval of the spending of those funds .. to become Acts.

- Consider whether municipal councils are able to be held as "responsible government" from this fundamental legal standard!

Now, if councils are not lawfully authorised as a third tier of government in several States for several reasons. The tax they collect is not done with lawful authority.

The standard set for responsible government by the Rule of Law applying to this country is upheld by the High Court, and we need to ensure this occurs in-so-far-as "rates" are concerned.

Your views on this matter are invited .

Emails To jack_d[AT]iinet.net.au Email Jack

MORE INFORMATION

Source of article material: Ratepayers Victoria Inc., "March News letter 2012"

Email ; ratepayersvictoria@ gmail.com Phone 03 9570 6227

Postal Address 8/1248 North Road Oakleigh South 3167

Website: http://www.ratepayersvictoria.com.au

Is the Peninsula's 2011-12 Rates & Charges Rise Victoria's Worst?

Mornington Peninsula Ratepayer's and Residents' Association says that Mornington Peninsula shire has earned the disgraceful reputation of being the worst financial performing council in Victoria in 2011-12, that its liveability statement is spin, and that they can't understand why the Council ignored the call by many in the community to advertise for a CEO who can control rate increases.

Mornington Peninsula Ratepayer's and Residents' Association says that Mornington Peninsula shire has earned the disgraceful reputation of being the worst financial performing council in Victoria in 2011-12, that its liveability statement is spin, and that they can't understand why the Council ignored the call by many in the community to advertise for a CEO who can control rate increases.

The Mornington Peninsula Shire Mayor, Cr Graham Pittock's spin says the shire budget is a “liveability budget” because rates will only increase 6.8%. However we are confused by his logic.

The fact is that this year the budget shows that ratepayers will be contributing an additional $10.269 million or 9.85% in rates and charges to the shire's “bucket of cash”. This is before the bucket overflows with an additional $1.41 million increase in charges for tip fees.

The Municipal Association of Victoria's list of rates and charges for Victoria's 79 councils shows that only West Wimmera, Murrindindi and Baw Baw have increased rates and charges per assessed property more than the Mornington Peninsula.

West Wimmera and Baw Baw were affected by the recent floods. Murrindindi includes the townships of Marysville and Kinglake and is rebuilding after the 2009 bushfires when 95 people in the shire perished.

The Peninsula escaped relatively lightly compared to these shires and has no excuse to raise the rates to the same extent.

In addition, an examination of the financial statements for the 79 councils in Victoria shows that the shire has the second highest level of borrowings and that the Mornington Peninsula (apart from the major cities of Melbourne and Geelong) has the second highest level of total current financial liabilities of the other councils.

The Ratepayer's Association says that this earns the shire the disgraceful reputation of being the worst financial performing council in Victoria in 201112, that the liveability statement is just further spin, and they can't understand why the Council ignored the call by many in the community to advertise for a CEO who can control rate increases.

Source:

MORNINGTON PENINSULA RATEPAYERS' AND RESIDENTS' ASSOCIATION INC

PO Box 4087 Rosebud Vic 3939 Email:[email protected] Tel:0413457092

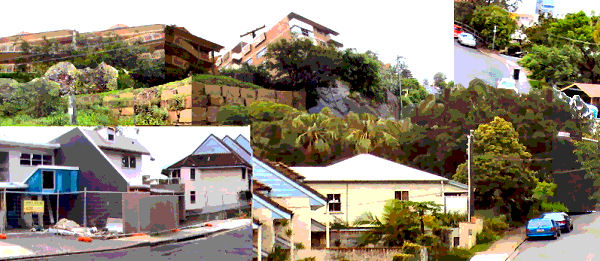

Council rates system destroys urban rainforest and community in Brisbane

The Australian land tax system creates hot treeless slums. In Queensland, for instance, the Brisbane City Council charges landowners according to the assessed market value of their land. If the Council land-zoning changes to allow medium or high density housing on land previously zoned only for detached homes, then the commercial value of that land goes up as each block will then be able to hold several dwellings instead of one. Although living conditions then become cramped and the quality of life for residents of higher density declines in comparison with that of residents of detached single dwellings, the total financial value of the medium density dwellings inevitably exceeds that of a single residence on the same land.

The Australian land tax system creates hot treeless slums. In Queensland, for instance, the Brisbane City Council charges landowners according to the assessed market value of their land. If the Council land-zoning changes to allow medium or high density housing on land previously zoned only for detached homes, then the commercial value of that land goes up as each block will then be able to hold several dwellings instead of one. Although living conditions then become cramped and the quality of life for residents of higher density declines in comparison with that of residents of detached single dwellings, the total financial value of the medium density dwellings inevitably exceeds that of a single residence on the same land.

Rich aspire now to what working class had 40 years ago

The houses and gardens in this gentrified, expensive area of Brisbane, very close to the CBD, used to belong to working class families, who grew vegetables in their back yards and whose children played in the rainforest in the valley between the houses. Those were the 'bad' old days. Nowadays, of course, ordinary people cannot hope to purchase in this area, and many will never own a home, let alone a home with a garden and a rainforest out back, 20 minutes walk from the Brisbane GPO.

Greed or necessity

But apparently even the current residents of this last green valley in inner Brisbane are going to lose the rainforest out back too, because the opportunity to make a quid by developing every square inch causes neighbours to cave in to greed, or necessity, one by one. As the land values go up, so do rates. And down come the trees...

Holding out

One man has held out now since the late sixties to the three blocks of land adjacent to a fourth with the house where he raised his children, simply because, as an architect, he can see that the forest is of more intrinsic value than the cash-value of the land. He can no longer afford to pay the rates, however, and so is faced with the option of going into debt to build on the property or going into debt to keep the property for nature.

Land-taxes and overpopulation doom nature and raise costs

Has government-engineered population growth in Brisbane made every square inch of this area too expensive to leave unpaved or is there some way out?

In June 2010, it was "reported" on ninesn.com that Brisbane home owners were to be slugged with a 5.04% increase in their council rates (based upon the the fact that the increase would drive up the rates on average by $80 (presumably per year)).

This hike shows how ordinary Brisbane home-owners and mortgagees are being made to pay the price of the mismanagement of our economy by governments at the Federal state and local, particularly due the encouragement of population growth by those governments.

Land-tax system creates slums

The Brisbane City Council charges landowners according to the assessed market value of their land. If the Council land-zoning changes to allow medium or high density housing on land previously zoned only for detached homes, then the commercial value of that land goes up as each block will then be able to hold several dwellings instead of one. Although living conditions then become cramped and the quality of life for residents of higher density declines in comparison with that of residents of detached single dwellings, the total financial value of the medium density dwellings inevitably exceeds that of a single residence on the same land.

People don't like what is happening

In spite of the profits that can be made, many residents choose to forego such profits and continue to live in single detached dwellings. They may do so in order to preserve the suburban lifestyle to which they have become accustomed and to avoid the disruption to their own lives entailed in selling their own residence and moving further away from the centre of the city, work and amenities in order to find a house similar to the one they have sold.

What can be lost

The google-earth map (at least five years old, judging by the current landscape features not shown) of the suburb near the centre of Brisbane (alluded to at the beginning of this article) shows what else can be lost by the rezoning of inner city suburbs. In this photo is a precious patch of suburban rainforest, a thing of utmost rarity in Brisbane, which is currently being gnawed away by subdivision. As mentioned in the introduction, in the past, much of the rainforest at the back of these homes was an effective commons in which local children played. The rainforest also continues to perform a number of valuable ecological services, and to provide shelter and food for wildlife. Without this patch of forest, and other fragments, Brisbane would be a far less pleasant place to live.

Removal of trees causes flooding

Rain, which falls on suburban rainforest, is retained in the soils, bushes and trees. Rain which which falls on rooftops, driveways, concrete footpaths, roadways and mowed lawns, is quickly driven by gravity into lower parts of the city. Towns in which vegetated land has been replaced with housing - particularly high-density housing - are more prone to flooding. A very striking example is the town of Toowoomba, 140 km to the west of Brisbane. over decades, vegetated land on the higher ground surrounding Toowoomba's centre has been cleared and covered with housing. Now all but the lightest of showers cause the centre of Toowoomba to become flooded.

Removal of trees causes climate warming

Those sought-after timber Brisbaner houses with their ornate wooden trimmings and lattice-work verandahs now stand where vast forests once stood. People often don't realise that the wood for those houses came from the forests they replaced. As more and more of Brisbane has been changed from living green into a concrete jungle, it's local climate has become hotter and less pleasant. The vegetation in the photo almost certainly keeps the locals cooler and Brisbane as a whole more healthy. Forested suburban settings are immensely desirable and raise the value of the housing nearby as well as benefiting the wider environment.

Environmentally responsible penalised

Yet landowners who try to preserve vegetation, including rainforest, on their land have been penalised, rather than being rewarded for the service their decision provide to Brisbane. The City Council forces them to pay rates on assessed land values that those environmentally sensitive landholders could only possibly gain from if they were to choose to destroy the vegetation on their land with subdivision and to profit

from medium density housing construction.

The google-earth map photo is about five years old. A considerable amount of urban rainforest has been lost in that time as a result of medium density housing construction. Vegetation known to have been lost has been indicated by red lines on the map. In addition, the rainforest has been encroached upon by extensions of housing, often to construct sub-units down the valley.

If some residents are willing to profit from the destruction of their natural environment, at least those who won't should not be penalised for doing so. Rather than hitting environmentally generous landowners with rate increases, the City Council should discount their rates (and do so retrospectively) for the environmental services they have protected on their land which have benefited the other residents of Brisbane and the native possums, flying foxes, and many beautiful birds, which depend on such fragments of rainforest.

Hobson's choice?

I know personally that the landowner with the three forested unbuilt blocks now sees little choice but to sell his land because the rates are so high. If he reluctantly goes ahead and the remnant rainforest is destroyed it will be more than a loss of natural beauty for Brisbane residents. Almost certainly the loss of the ecological services will make Brisbane a hotter and uglier. It will certainly not improve it. Those who can afford to will most likely draw on more electrical power to make their homes cool at least on the inside.

I know personally that the landowner with the three forested unbuilt blocks now sees little choice but to sell his land because the rates are so high. If he reluctantly goes ahead and the remnant rainforest is destroyed it will be more than a loss of natural beauty for Brisbane residents. Almost certainly the loss of the ecological services will make Brisbane a hotter and uglier. It will certainly not improve it. Those who can afford to will most likely draw on more electrical power to make their homes cool at least on the inside.

NIMBYs needed now

The poorer classes who once lived unpretentiously but well in this very suburb with far more space than people now do, will swelter in miserable high-density subdivisions and in the treeless outer suburbs. Many will certainly not be able to afford the option of air-conditioning because, as human population has increased and the trees have been destroyed, the heat has increased and so has the cost of housing and of power.

This kind of thing is happening all over Australia.

Brisbane and Australia need more NIMBYs.

Appendix: the decline of amphibians in urban Australia

(This brief appendix has been extracted from nimby's comment Frogs on the decline too of 6 Jan 11.)

Dr Andrew Hamer, based at the University of Melbourne, stressing that reptile and frog habitats need be conserved in residential areas by keeping them as natural as possible, even if they are only small areas. "Our research suggests that many reptile and frog species have been negatively affected by urbanization,” says Dr Hamer. With

higher density living

!--a-->, more concrete drains rather than rivers and creeks, and less back yards and green wedges, our amphibians and reptile have little chance of being protected.

Democracy lost in Victorian Rates Scandal - the costs of overpopulation

Population growth costs you and me: "In the last 10 years rates have risen by over 100% which is more than almost every other consumer commodity. This includes hospital and medical services, health services, education, food, alcohol, tobacco, petrol, gas and electricity, restaurants meals, take away fast food, domestic and international holidays, clothing and footwear, household appliances, and motor vehicles." (Alan Nelsen, Coordinator McCrae Action Group and Secretary Mornington Peninsula Ratepayers' & Residents' Assoc Inc.)

Population growth costs you and me: "In the last 10 years rates have risen by over 100% which is more than almost every other consumer commodity. This includes hospital and medical services, health services, education, food, alcohol, tobacco, petrol, gas and electricity, restaurants meals, take away fast food, domestic and international holidays, clothing and footwear, household appliances, and motor vehicles." (Alan Nelsen, Coordinator McCrae Action Group and Secretary Mornington Peninsula Ratepayers' & Residents' Assoc Inc.)

The appalling increase in the Mornington Peninsula Shire's Rates over 10 years is about average for all councils.

There appears to be no price watch or system of discipline by government to keep councils honest so it seems councils increase rates by an amount which they think they can "get away with" rather than focusing on efficiency and keeping rates down.

Comments and suggestions about how we might get some action on a parliamentary review of council rate increases would be appreciated.

Victorian rates climbed 100% last decade

Victorian councils have lost touch with reality. In the last 10 years rates have risen by over 100% which is more than almost every other consumer commodity. This includes hospital and medical services, health services, education, food, alcohol, tobacco, petrol, gas and electricity, restaurants meals, take away fast food, domestic and international holidays, clothing and footwear, household appliances, and motor vehicles.

When banks, petrol companies and supermarkets raise their prices there are howls of protest from the public and politicians, government inquiries and price watches. However over the last decade councils have left the price increases of these providers in their wake, and yet not a murmur.

Victoria worst state for rates

Victorian rates have increased by 30% more than any other state, three times the increase in CPI, and by more than double the increases in wages. Rates just simply cannot continue to rise as they have previously.

In NSW rates are pegged

An urgent parliamentary inquiry needs to be held into the reasons for the outrageous rate increases and how they can be restrained in the future. Perhaps the government should follow the New South Wales government's example which pegs rates. The rise over the past five years is 50% less than in Victoria.

This article was created from edited material by Dr Alan Nelsen, Coordinator McCrae Action Group and Secretary Mornington Peninsula Ratepayers' & Residents' Assoc Inc. Contact him at alanne[AT]ihug.com.au

Recent comments