How does the world reach limits? This is a question that few dare to examine. My analysis suggests that these limits will come in a very different way than most have expected–through financial stress that ultimately relates to rising unit energy costs, plus the need to use increasing amounts of energy for additional purposes:

- To extract oil and other minerals from locations where extraction is very difficult, such as in shale formations, or very deep under the sea;

- To mitigate water shortages and pollution issues, using processes such as desalination and long distance transport of food; and

- To attempt to reduce future fossil fuel use, by building devices such as solar panels and electric cars that increase fossil fuel energy use now in the hope of reducing energy use later.

We have long known that the world is likely to eventually reach limits. In 1972, the book The Limits to Growth by Donella Meadows and others modeled the likely impact of growing population, limited resources, and rising pollution in a finite world. They considered a number of scenarios under a range of different assumptions. These models strongly suggested the world economy would begin to hit limits in the first half of the 21st century and would eventually collapse.

The indications of the 1972 analysis were considered nonsense by most. Clearly, the world would work its way around limits of the type suggested. The world would find additional resources in short supply. It would become more efficient at using resources and would tackle the problem of rising pollution. The free market would handle any problems that might arise.

The Limits to Growth analysis modeled the world economy in terms of flows; it did not try to model the financial system. In recent years, I have been looking at the situation and have discovered that as we hit limits in a finite world, the financial system is the most vulnerable part because of the system because it ties everything else together. Debt in particular is vulnerable because the time-shifting aspect of debt “works” much better in a rapidly growing economy than in an economy that is barely growing or shrinking.

The problem that now looks like it has the potential to push the world into financial collapse is something no one would have thought of—high oil pricesclip_image002 that take a slice out of the economy, without anything to show in return. Consumers find that their own salaries do not rise as oil prices rise. They find that they need to cut back on discretionary spending if they are to have adequate funds to pay for necessities produced using oil. Food is one such necessity; oil is used to run farm equipment, make herbicides and pesticides, and transport finished food products. The result of a cutback in discretionary spending is recession or near recession, and less job availability. Governments find themselves in financial distress from trying to mitigate the recession-like impacts without adequate tax revenue.

One of our big problems now is a lack of cheap substitutes for oil. Highly touted renewable energy sources such as wind and solar PV are not cheap. They also do not substitute directly for oil, and they increase near-term fossil fuel consumption. Ethanol can act as an “oil extender,” but it is not cheap. Battery powered cars are also not cheap.

The issue of rising oil prices is really a two-sided issue. The least expensive sources of oil tend to be extracted first. Thus, the cost of producing oil tends to rise over time. As a result, oil producers tend to require ever-rising oil prices to cover their costs. It is the interaction of these two forces that leads to the likelihood of financial collapse in the near term:

- Need for ever-rising oil prices by oil producers.

- The adverse impact of high-energy prices on consumers.

If a cheap substitute for oil had already come along in adequate quantity, there would be no problem. The issue is that no suitable substitute has been found, and financial problems are here already. In fact, collapse may very well come from oil prices not rising high enough to satisfy the needs of those extracting the oil, because of worldwide recession.

The Role of Inexpensive Energy

The fact that few stop to realize is that energy of the right type is absolutely essential for making goods and services of all kinds. Even if the services are simply typing numbers into a computer, we need energy of precisely the right kind for several different purposes:

- To make the computer and transport it to the current location.

- To build the building where the worker works.

- To light the building where the worker works.

- To heat or cool the building where the worker works.

- To transport the worker to the location where he works.

- To produce the foods that the worker eats.

- To produce the clothing that the worker wears.

Furthermore, the energy used needs to be inexpensive, for many reasons—so that the worker’s salary goes farther; so that the goods or services created are competitive in a world market; and so that governments can gain adequate tax revenue from taxing energy products. We don’t think of fossil fuel energy products as being a significant source of tax revenue, but they very often are, especially for exporters (Rodgers map of oil “government take” percentages).

Some of the energy listed above is paid for by the employer; some is paid for by the employee. This difference is irrelevant, since all are equally essential. Some energy is omitted from the above list, but is still very important. Energy to build roads, electric transmission lines, schools, and health care centers is essential if the current system is to be maintained. If energy prices rise, taxes and fees to pay for basic services such as these will likely need to rise.

How “Growth” Began

For most primates, such as chimpanzees and gorillas, the number of the species fluctuates up and down within a range. Total population isn’t very high. If human population followed that of other large primates, there wouldn’t be more than a few million humans worldwide. They would likely live in one geographical area.

How did humans venture out of this mold? In my view, a likely way that humans were able to improve their dominance over other animals and plants was through the controlled use of fire, a skill they learned over one million years ago (Luke 2012). Controlled use of fire could be used for many purposes, including cooking food, providing heat in cool weather, and scaring away wild animals.

The earliest use of fire was in some sense very inexpensive. Dry sticks and leaves were close at hand. If humans used a technique such as twirling one stick against another with the right technique and the right kind of wood, such a fire could be made in less than a minute (Hough 1890). Once humans had discovered how to make fire, they could use it to leverage their meager muscular strength.

The benefits of the controlled use of fire are perhaps not as obvious to us as they would have been to the early users. When it became possible to cook food, a much wider variety of potential foodstuffs could be eaten. The nutrition from food was also better. There is even some evidence that cooking food allowed the human body to evolve in the direction of smaller chewing and digestive apparatus and a bigger brain (Wrangham 2009). A bigger brain would allow humans to outsmart their prey. (Dilworth 2010)

Cooking food allowed humans to spend much less time chewing food than previously—only one-tenth as much time according to one study (4.7% of daily activity vs. 48% of daily activity) (Organ et al. 2011). The reduction in chewing time left more time other activities, such as making tools and clothing.

Humans gradually increased their control over many additional energy sources. Training dogs to help in hunting came very early. Humans learned to make sailboats using wind energy. They learned to domesticate plants and animals, so that they could provide more food energy in the location where it was needed. Domesticated animals could also be used to pull loads.

Humans learned to use wind mills and water mills made from wood, and eventually learned to use coal, petroleum (also called oil), natural gas, and uranium. The availability of fossil fuels vastly increased our ability to make substances that require heating, including metals, glass, and concrete. Prior to this time, wood had been used as an energy source, leading to widespread deforestation.

With the availability of metals, glass, and concrete in quantity, it became possible to develop modern hydroelectric power plants and transmission lines to transmit this electricity. It also became possible to build railroads, steam-powered ships, better plows, and many other useful devices.

Population rose dramatically after fossil fuels were added, enabling better food production and transportation. This started about 1800.

All of these activities led to a very long history of what we today might call economic growth. Prior to the availability of fossil fuels, the majority of this growth was in population, rather than a major change in living standards. (The population was still very low compared to today.) In later years, increased energy use was still associated with increased population, but it was also associated with an increase in creature comforts—bigger homes, better transportation, heating and cooling of homes, and greater availability of services like education, medicine, and financial servicesclip_image002[1].

How Cheap Energy and Technology Combine to Lead to Economic Growth

Without external energy, all we have is the energy from our own bodies. We can perhaps leverage this energy a bit by picking up a stick and using it to hit something, or by picking up a rock and throwing it. In total, this leveraging of our own energy doesn’t get us very far—many animals do the same thing. Such tools provide some leverage, but they are not quite enough.

The next step up in leverage comes if we can find some sort of external energy to use to supplement our own energy when making goods and services. One example might be heat from a fire built with sticks used for baking bread; another example might be energy from an animal pulling a cart. This additional energy can’t take too much of (1) our human energy, (2) resources from the ground, or (3) financial capital, or we will have little to invest what we really want—technology that gives us the many goods we use, and services such as education, health care, and recreation.

The use of inexpensive energy led to a positive feedback loop: the value of the goods and service produced was sufficient to produce a profit when all costs were considered, thanks to the inexpensive cost of the energy used. This profit allowed additional investment, and contributed to further energy development and further growth. This profit also often led to rising salaries. The additional cheap energy use combined with greater technology produced the impression that humans were becoming more “productive.”

For a very long time, we were able to ramp up the amount of energy we used, worldwide. There were many civilizations that collapsed along the way, but in total, for all civilizations in the world combined, energy consumption, population, and goods and services produced tended to rise over time.

In the 1970s, we had our first experience with oil limits. US oil production started dropping in 1971. The drop in oil production set us up as easy prey for an oil embargo in 1973-1974, and oil prices spiked. We got around this problem, and more high price problems in the late 1970s by

- Starting work on new inexpensive oil production in the North Sea, Alaska, and Mexico.

- Adopting more fuel-efficient cars, already available in Japan.

- Switching from oil to nuclear or coal for electricity production.

- Cutting back on oil intensive activities, such as building new roads and doing heavy manufacturing in the United States.

The economy eventually more or less recovered, but men’s wages stagnated, and women found a need to join the workforce to maintain the standards of living of their families. Oil prices dropped back, but not quite a far as to prior level. The lack of energy intensive industries (powered by cheap oil) likely contributed to the stagnation of wages for men.

Recently, since about 2004, we have again been encountering high oil prices. Unfortunately, the easy options to fix them are mostly gone. We have run out of cheap energy options—tight oil from shale formations isn’t cheap. Wages again are stagnating, even worse than before. The positive feedback loop based on low energy prices that we had been experiencing when oil prices were low isn’t working nearly as well, and economic growth rates are falling.

The technical name for the problem we are running into with oil is diminishing marginal returns. This represents a situation where more and more inputs are used in extraction, but these additional inputs add very little more in the way of the desired output, which is oil. Oil companies find that an investment of a given amount, say $1,000 dollars, yields a much smaller amount of oil than it used to in the past—often less than a fourth as much. There are often more up-front expenses in drilling the wells, and less certainty about the length of time that oil can be extracted from a new well.

Oil that requires high up-front investment needs a high price to justify its extraction. When consumers pay the high oil price, the amount they have for discretionary goods drops. The feedback loop starts working the wrong direction—in the direction of more layoffs, and lower wages for those working. Companies, including oil companies, have a harder time making a profit. They find outsourcing labor costs to lower-cost parts of the world more attractive.

Can this Growth Continue Indefinitely?

Even apart from the oil price problem, there are other reasons to think that growth cannot continue indefinitely in a finite world. For one thing, we are already running short of fresh water in many parts of the world, including China, India and the Middle East. Topsoil is eroding, and is being depleted of minerals. In addition, if population continues to rise, we will need a way to feed all of these people—either more arable land, or a way of producing more food per acre.

Pollution is another issue. One type is acidification of oceans; another leads to dead zones in oceans. Mercury pollution is a widespread problem. Fresh water that is available is often very polluted. Excess carbon dioxide in the atmosphere leads to concerns about climate change.

There is also an issue with humans crowding out other species. In the past, there have been five widespread die-offs of species, called “Mass Extinctions.” Humans seem now to be causing a Sixth Mass Extinction. Paleontologist Niles Eldredge describes the Sixth Mass Extinction as follows:

- Phase One began when first humans began to disperse to different parts of the world about 100,000 years ago. [We were still hunter-gatherers at that point, but we killed off large species for food as we went.]

- Phase Two began about 10,000 years ago, when humans turned to agriculture.

According to Eldredge, once we turned to agriculture, we stopped living within local ecosystems. We converted land to produce only one or two crops, and classified all unwanted species as “weeds”. Now with fossil fuels, we are bringing our attack on other species to a new higher level. For example, there is greater clearing of land for agriculture, overfishing, and too much forest use by humans (Eldredge 2005).

In many ways, the pattern of human population growth and growth of use of resources by humans are like a cancer. Growth has to stop for one reason or other—smothering other species, depletion of resources, or pollution.

Many Competing Wrong Diagnoses of our Current Problem

The problem we are running into now is not an easy one to figure out because the problem crosses many disciplines. Is it a financial problem? Or a climate change problem? Or an oil depletion problem? It is hard to find individuals with knowledge across a range of fields.

There is also a strong bias against really understanding the problem, if the answer appears to be in the “very bad to truly awful” range. Politicians want a problem that is easily solvable. So do sustainability folks, and peak oil folks, and people writing academic papers. Those selling newspapers want answers that will please their advertisers. Academic book publishers want books that won’t scare potential buyers.

Another issue is that nature works on a flow basis. All we have in a given year in terms of resources is what we pull out in that year. If we use more resources for one thing–extracting oil, or making solar panels, it leaves less for other purposes. Consumers also work mostly from the income from their current paychecks. Even if we come up with what looks like wonderful solutions, in terms of an investment now for payback later, nature and consumers aren’t very co-operative in producing them.

Consumers need ever-more debt, to make the solutions sort of work. If one necessary resource–cheap oil–is in short supply, nature dictates that other resource uses shrink, to work within available balances. So there is more pressure toward collapse.

Virtually no one understands our complex problem. As a result, we end up with all kinds of stories about how we can fix our problem, none of which make sense:

“Humans don’t need fossil fuels; we can just walk away.” – But how do we feed 7 billion people? How long would our forests last before they are used for fuel?

“More wind and solar PV” – But these use fossil fuels now, and don’t fix oil prices.

“Climate change is our only problem.”—Climate change needs to be considered in conjunction with other limits, many of which are hitting very soon. Maybe there is good news about climate, but it likely will be more than offset by bad news from limits not considered in the model.

This article was originally published on 04.11.2013 on Gail Tverberg's blog, Our Finite World:

http://ourfiniteworld.com/2013/10/23/rising-energy-costs-lead-to-recession-eventually-collapse/#more-38555

About Gail Tverberg

Gail Tverberg is an actuary interested in finite world issues - oil depletion, natural gas depletion, water shortages, and climate change. The financial system is also likely to be affected. Gail writes on these issues at Our Finite World.

I have just learned, regretfully, of the death of Jay Hanson. My first report was that it occurred in a diving accident. Subsequently it has been clarified that he fell ill after diving, and died that night. Jay Hanson lived in Hawaii. He was the founder of multiple energy resources or peak oil lists from the 1990s, starting with the incredibly popular Dieoff website and DieOff list which looked at peak oil, population numbers, and scarcity. An intermediate list was Killer Ape-Peak Oil. The last list of which we are aware was [America2Point0] which Hanson closed 'until further notice' on 20 December 2016. Hanson was teetotal for many years and studied evolutionary psychology. He believed that humans would be ultimately unable to deal with resource scarcity or human induced climate change because they could not cope with major environmental and evolutionary problems involving themselves.

I have just learned, regretfully, of the death of Jay Hanson. My first report was that it occurred in a diving accident. Subsequently it has been clarified that he fell ill after diving, and died that night. Jay Hanson lived in Hawaii. He was the founder of multiple energy resources or peak oil lists from the 1990s, starting with the incredibly popular Dieoff website and DieOff list which looked at peak oil, population numbers, and scarcity. An intermediate list was Killer Ape-Peak Oil. The last list of which we are aware was [America2Point0] which Hanson closed 'until further notice' on 20 December 2016. Hanson was teetotal for many years and studied evolutionary psychology. He believed that humans would be ultimately unable to deal with resource scarcity or human induced climate change because they could not cope with major environmental and evolutionary problems involving themselves.

This program from Press tv Iran is interesting and useful in bringing us up to date. Iranians know a thing or two about oil production and the oil market. The issues of peak demand and peak production are very hard to estimate and no-one here pretends to have the answers, but a number of factors are canvassed, including US President Trump. As usual, however, in such programs, population growth and economic growth are skirted around. Similarly, increasing efficiency among OECD countries is taken as a given, and increasing consumption among 'developing' countries is also taken as a given. The elephant in the room is, of course, when does peak demand meet peak production.

This program from Press tv Iran is interesting and useful in bringing us up to date. Iranians know a thing or two about oil production and the oil market. The issues of peak demand and peak production are very hard to estimate and no-one here pretends to have the answers, but a number of factors are canvassed, including US President Trump. As usual, however, in such programs, population growth and economic growth are skirted around. Similarly, increasing efficiency among OECD countries is taken as a given, and increasing consumption among 'developing' countries is also taken as a given. The elephant in the room is, of course, when does peak demand meet peak production.

Mark Jones wrote “Battle of the Titans” when he was dying of cancer in 2005. This project animated his last days and he believed that what he had to say was of utmost importance. Many readers will find it prophetic, except in so far as he overlooks the role of Russia as an oil supplier. He does not overlook China, however, and America’s willingness to use all its remaining fuel to retain global hegemony. Here I have extracted passages which fit quite well together and give a somewhat clairvoyant view – from 2005 – of today’s frantic posturing, propagandizing and stirring up trouble in Ukraine, by the United States and Europe as they perhaps tried to influence China to side with them through their power-play in the Ukraine, then, helplessly watched Putin sign the massive gas supply contract with China.

Mark Jones wrote “Battle of the Titans” when he was dying of cancer in 2005. This project animated his last days and he believed that what he had to say was of utmost importance. Many readers will find it prophetic, except in so far as he overlooks the role of Russia as an oil supplier. He does not overlook China, however, and America’s willingness to use all its remaining fuel to retain global hegemony. Here I have extracted passages which fit quite well together and give a somewhat clairvoyant view – from 2005 – of today’s frantic posturing, propagandizing and stirring up trouble in Ukraine, by the United States and Europe as they perhaps tried to influence China to side with them through their power-play in the Ukraine, then, helplessly watched Putin sign the massive gas supply contract with China.

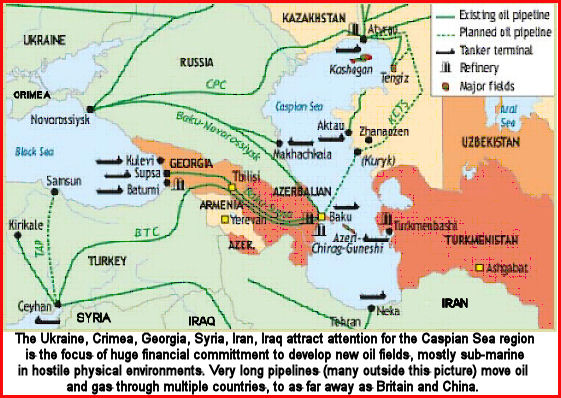

If you thought that the affairs of the Ukraine and Crimea were too abstract for you, maybe this will make you more curious. Natalya Poklonskaya is or was a government prosecutor in the Ukraine Crimea. She has been made into an anime character in a video. She made strong statements about upholding the rule of law and is now on the illegitimate coup-installed Ukraine government's wanted list. The Ukraine government came to power as a result of a US/NATO orchestrated coup in the resource depletion wars of the 21st century. Russia is defending its oil and gas pipelines in the region. Russia had the very first and the longest petroleum product pipeline in the world in the late 19th century and British, US and European governments and commercial interests have been plotting to get more control there ever since. The region is criss-crossed with oil and gas pipelines going in many directions from Baku to as far as Germany and China. Natalya Poklonskaya rightly wants her message to be heard and dismisses this video, however it may be the way to get her message better appreciated worldwide, so we are promoting it. And we include in this article a video with Poklonskaya's real speech, with English sub-titles.

If you thought that the affairs of the Ukraine and Crimea were too abstract for you, maybe this will make you more curious. Natalya Poklonskaya is or was a government prosecutor in the Ukraine Crimea. She has been made into an anime character in a video. She made strong statements about upholding the rule of law and is now on the illegitimate coup-installed Ukraine government's wanted list. The Ukraine government came to power as a result of a US/NATO orchestrated coup in the resource depletion wars of the 21st century. Russia is defending its oil and gas pipelines in the region. Russia had the very first and the longest petroleum product pipeline in the world in the late 19th century and British, US and European governments and commercial interests have been plotting to get more control there ever since. The region is criss-crossed with oil and gas pipelines going in many directions from Baku to as far as Germany and China. Natalya Poklonskaya rightly wants her message to be heard and dismisses this video, however it may be the way to get her message better appreciated worldwide, so we are promoting it. And we include in this article a video with Poklonskaya's real speech, with English sub-titles. "The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills.

"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills. (All emphases and headings have been inserted by Candobetter.net's editors.)

(All emphases and headings have been inserted by Candobetter.net's editors.) Has capitalism, corporatisation and globalisation corrupted big international aid organisations. Is there some way we can boost the grass-roots activists and reinforce whatever is still working within troubled countries like Syria. And what are we doing there, anyway? AMRIS interview inside.

Has capitalism, corporatisation and globalisation corrupted big international aid organisations. Is there some way we can boost the grass-roots activists and reinforce whatever is still working within troubled countries like Syria. And what are we doing there, anyway? AMRIS interview inside.

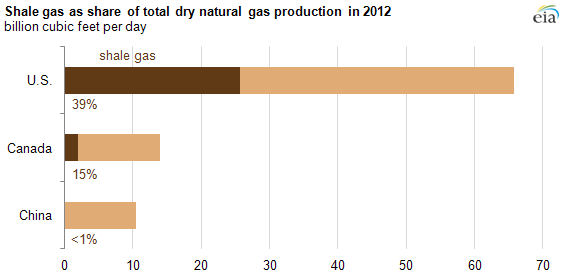

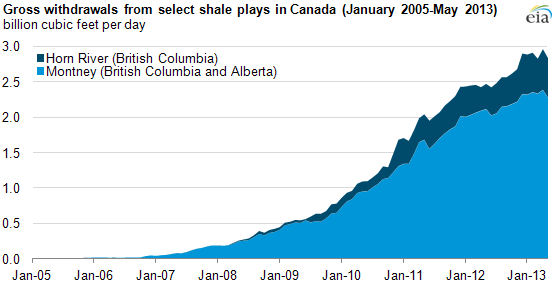

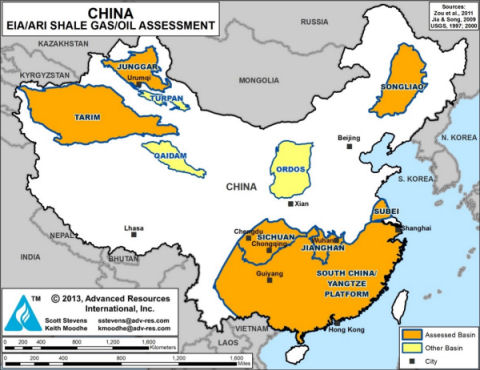

In a press release entitled, "North America leads the world in production of shale gas," the US Energy Information Administration (EIA) boasts long and loud that US gas quantities extracted by fracking shale beds vastly exceed production in Canada and China. Energy resources analysts, however, are critical that the EIA never releases balanced accounts on petroleum and gas production which would reveal the growing costs of extraction.

In a press release entitled, "North America leads the world in production of shale gas," the US Energy Information Administration (EIA) boasts long and loud that US gas quantities extracted by fracking shale beds vastly exceed production in Canada and China. Energy resources analysts, however, are critical that the EIA never releases balanced accounts on petroleum and gas production which would reveal the growing costs of extraction.

The Alliance against fracking in South Africa, AfriForum and Treasure the Karoo Action Group (TKAG), has said that shale gas exploration cannot proceed, following a statement by Trade and Industry Minister, Rob Davies, that Government could authorise shale gas exploration before next year's elections. See also other candobetter articles on fracking here:

The Alliance against fracking in South Africa, AfriForum and Treasure the Karoo Action Group (TKAG), has said that shale gas exploration cannot proceed, following a statement by Trade and Industry Minister, Rob Davies, that Government could authorise shale gas exploration before next year's elections. See also other candobetter articles on fracking here:

Former career mining professional Simon Michaux gives a public lecture in Adelaide describing the onset of 'peak mining' and its various implications for natural resource management. A significant and comprehensive update to the field. Governments will be watching this one and trying to ignore it.

Former career mining professional Simon Michaux gives a public lecture in Adelaide describing the onset of 'peak mining' and its various implications for natural resource management. A significant and comprehensive update to the field. Governments will be watching this one and trying to ignore it. Bill Gross, Nouriel Roubini, Laurence Kotlikoff, Steve Keen, Michel Chossudovsky, the Wall Street Journal and many others say that our entire economy is a Ponzi scheme.

Bill Gross, Nouriel Roubini, Laurence Kotlikoff, Steve Keen, Michel Chossudovsky, the Wall Street Journal and many others say that our entire economy is a Ponzi scheme. Former Reagan budget director David Stockton just agreed:

Former Reagan budget director David Stockton just agreed: Another sign of overpopulation and resource competition: We publish a press release from a commercial anti-pirate operation which offers naval escort services across the Gulf of Aden, the Arabian Sea and the Indian Ocean, where easy collection of oil is no longer guaranteed. "In West Africa in the area known as the Gulf of Guinea, where there is no UK, EUNAVFOR or US Naval presence (nor is there planned to be), maritime crime is escalating and is spiralling to such levels that the UN Security Council has recognised it as a specific threat to international security (Resolutions 2018 [2011] and 2039 [2012]). It is estimated that the state of Nigeria is losing $1bn of crude oil through theft every month."

Another sign of overpopulation and resource competition: We publish a press release from a commercial anti-pirate operation which offers naval escort services across the Gulf of Aden, the Arabian Sea and the Indian Ocean, where easy collection of oil is no longer guaranteed. "In West Africa in the area known as the Gulf of Guinea, where there is no UK, EUNAVFOR or US Naval presence (nor is there planned to be), maritime crime is escalating and is spiralling to such levels that the UN Security Council has recognised it as a specific threat to international security (Resolutions 2018 [2011] and 2039 [2012]). It is estimated that the state of Nigeria is losing $1bn of crude oil through theft every month."

Amazingly or perhaps, true to type, Australia is experiencing extreme shortages of domestic natural gas supplies. World-wide there is a gas-rush. It also looks like oil is already not keeping up with demand as countries scramble for new more energy costly, polluting and environmentally destructive forms of energy, like tarsands, fracked gas, and sugarcane ethanol. The media is failing to paper over the cracks: Australia looks like a cartoon demonstration of entropy with energy dispersing, the environment overheating, overpopulation and political disorder. And there is nowhere for Australians to escape.

Amazingly or perhaps, true to type, Australia is experiencing extreme shortages of domestic natural gas supplies. World-wide there is a gas-rush. It also looks like oil is already not keeping up with demand as countries scramble for new more energy costly, polluting and environmentally destructive forms of energy, like tarsands, fracked gas, and sugarcane ethanol. The media is failing to paper over the cracks: Australia looks like a cartoon demonstration of entropy with energy dispersing, the environment overheating, overpopulation and political disorder. And there is nowhere for Australians to escape.

On November 6, 2012 it was reported that the Victorian government was cooling on the idea of another port for Hastings and instead its planners were casting their collective beady eye in the direction of Werribee. ("

On November 6, 2012 it was reported that the Victorian government was cooling on the idea of another port for Hastings and instead its planners were casting their collective beady eye in the direction of Werribee. ("

In the US Presidential race, both roads lead to financial collapse, resource depletion, war, irreversible climate change, species extinction, chaos, despair and hopelessness.

In the US Presidential race, both roads lead to financial collapse, resource depletion, war, irreversible climate change, species extinction, chaos, despair and hopelessness.

The Australian Bureau of Statistics reports the highest population growth rate since 2009. An 18 per cent increase in annual net overseas migration to 197,200 is responsible for the rise. Australia is entering a period of uncertainty for which we will be better prepared if we do not have to support ever more people - native born or immigrants. -- Sustainable Population Australia (SPA)

The Australian Bureau of Statistics reports the highest population growth rate since 2009. An 18 per cent increase in annual net overseas migration to 197,200 is responsible for the rise. Australia is entering a period of uncertainty for which we will be better prepared if we do not have to support ever more people - native born or immigrants. -- Sustainable Population Australia (SPA)

Report on Richard Heinberg's tour of Australia, Melbourne talk: We should remember that the economy is a subset of the environment and that 'not sustainable' does not mean 'insufficiently eco-groovy'. Heinberg pointed to Australia's growing reliance on petroleum and its decreasing production and suggested that the policy of growing our population needs a profound rethink. Some strange and interesting responses from the audience. And a standing ovation for Australian MP Kelvin Thomson, who was chairing Heinberg's session. Not to mention Jenny Warfe - a terrific new Vice President for SPA Victoria and Tasmanian Branch.

Report on Richard Heinberg's tour of Australia, Melbourne talk: We should remember that the economy is a subset of the environment and that 'not sustainable' does not mean 'insufficiently eco-groovy'. Heinberg pointed to Australia's growing reliance on petroleum and its decreasing production and suggested that the policy of growing our population needs a profound rethink. Some strange and interesting responses from the audience. And a standing ovation for Australian MP Kelvin Thomson, who was chairing Heinberg's session. Not to mention Jenny Warfe - a terrific new Vice President for SPA Victoria and Tasmanian Branch. As for the Gold Coast; those hundreds of skyscrapers lining the beach are completely vulnerable to permanent deluge. Their location is a testimony to shortsightedness and opportunistic investment overseen by negligent councils and state governments.

As for the Gold Coast; those hundreds of skyscrapers lining the beach are completely vulnerable to permanent deluge. Their location is a testimony to shortsightedness and opportunistic investment overseen by negligent councils and state governments. Kelvin Thomson MP will be chairing Richard Heinberg's talk about his book, The End of Growth 7.30pm. on Saturday 22 September 2012 at The Wheeler Centre, 176 Little Lonsdale Street. Heinberg is a well-known peak oil blogger and writer who delivers an entertaining and stimulating message on the serious subject of resource depletion which Australian governments and development and financial planners at all levels simply cannot cope with. At a time when Australia continues to back military intervention in the oil-rich Middle East, Richard's talk is especially topical. As well as that, it is the reality we all must deal with. So go along and then take the message back to your state and federal political representative and your growth-obsessed local council.

Kelvin Thomson MP will be chairing Richard Heinberg's talk about his book, The End of Growth 7.30pm. on Saturday 22 September 2012 at The Wheeler Centre, 176 Little Lonsdale Street. Heinberg is a well-known peak oil blogger and writer who delivers an entertaining and stimulating message on the serious subject of resource depletion which Australian governments and development and financial planners at all levels simply cannot cope with. At a time when Australia continues to back military intervention in the oil-rich Middle East, Richard's talk is especially topical. As well as that, it is the reality we all must deal with. So go along and then take the message back to your state and federal political representative and your growth-obsessed local council.

Bill McKibben has recently unveiled some new "terrifying math" about global warming. But there are other numbers that terrify me more. My mother used to tell me to stop worrying, because it is not the things we worry about that usually get us, but the things we don't see coming. I think she was right.

Bill McKibben has recently unveiled some new "terrifying math" about global warming. But there are other numbers that terrify me more. My mother used to tell me to stop worrying, because it is not the things we worry about that usually get us, but the things we don't see coming. I think she was right.  Bill McKibben recently wrote about the “terrifying math” of global warming:

Bill McKibben recently wrote about the “terrifying math” of global warming:

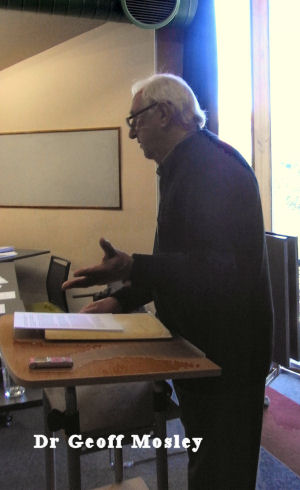

"Wind turbines are a compulsory backdrop for Julia Gillard when she is talking about the carbon tax but how often have you seen an image of her farewelling one of the huge coal laden boats at a Queensland port or staring into a giant open cut coal mine in the Hunter Valley? You could say that wind turbines help to mask the truth that there is a continuing growth in the usage of fossil fuels and in energy use generally." The decline in real environmental politics: despite the rising dangers of economic and population growth, an increasingly sidelined mainstream conservation movement finds false comfort in endless damage control and symbolic activity. The WW2 generation lived the community gardens, food and petrol rationing that are now goals of oil depletion awareness groups today. We were much more sustainable then. The way forward in a steady state economy would include equality and sustainability. Dr Mosley also drew a useful distinction between 'equality' and 'equal opportunity'.

"Wind turbines are a compulsory backdrop for Julia Gillard when she is talking about the carbon tax but how often have you seen an image of her farewelling one of the huge coal laden boats at a Queensland port or staring into a giant open cut coal mine in the Hunter Valley? You could say that wind turbines help to mask the truth that there is a continuing growth in the usage of fossil fuels and in energy use generally." The decline in real environmental politics: despite the rising dangers of economic and population growth, an increasingly sidelined mainstream conservation movement finds false comfort in endless damage control and symbolic activity. The WW2 generation lived the community gardens, food and petrol rationing that are now goals of oil depletion awareness groups today. We were much more sustainable then. The way forward in a steady state economy would include equality and sustainability. Dr Mosley also drew a useful distinction between 'equality' and 'equal opportunity'.

Humanity has struggled to survive through the millennia in terms of balancing population size with food supply. The same is true now, but population numbers have been soaring for over a century. The limiting factor has been hidden, but this factor -- oil and natural gas, or petroleum -- is close to or beyond its peak extraction. Without ample, free-flowing petroleum, it will not be possible to support a population of several billion for long.

Humanity has struggled to survive through the millennia in terms of balancing population size with food supply. The same is true now, but population numbers have been soaring for over a century. The limiting factor has been hidden, but this factor -- oil and natural gas, or petroleum -- is close to or beyond its peak extraction. Without ample, free-flowing petroleum, it will not be possible to support a population of several billion for long.

I live in a community of right-brained people with innumerate minds full of New Age mush, devoid of logic and antagonistic to science. The shibboleths of 'compassion' and 'caring and sharing' prevail over dispassionate analysis. The medieval mentality of Tibetan Bhuddism combines with the prescriptions of soft-green environmentalism to produce a brew of 'thinking' that is toxic to comprehension. It is a community where people will pay $50 for a psychic reading or a quack medical therapy but balk at paying the same amount of money to fix a leaking kitchen sink or a subscription to Science Daily. I wrote this almost 5 years ago, and despite the development of our much acclaimed "Community Garden" and a local "transition" initiative, I can think of no good reason to make more than one amendment----even we do grow a backbone and a "hard edge"---a local 'fortress' would not indefinitely endure. We are hopelessly dependent on the outside world in ways that we have not yet contemplated. Our deficiencies will only become apparent, I think, when our "Long" emergency becomes a permanent one.

I live in a community of right-brained people with innumerate minds full of New Age mush, devoid of logic and antagonistic to science. The shibboleths of 'compassion' and 'caring and sharing' prevail over dispassionate analysis. The medieval mentality of Tibetan Bhuddism combines with the prescriptions of soft-green environmentalism to produce a brew of 'thinking' that is toxic to comprehension. It is a community where people will pay $50 for a psychic reading or a quack medical therapy but balk at paying the same amount of money to fix a leaking kitchen sink or a subscription to Science Daily. I wrote this almost 5 years ago, and despite the development of our much acclaimed "Community Garden" and a local "transition" initiative, I can think of no good reason to make more than one amendment----even we do grow a backbone and a "hard edge"---a local 'fortress' would not indefinitely endure. We are hopelessly dependent on the outside world in ways that we have not yet contemplated. Our deficiencies will only become apparent, I think, when our "Long" emergency becomes a permanent one.

Robert Bowman writes about the need to restore the Constitutional rights of American citizens, enhance their national security through a return to Constitutional foreign and military policies, and rebuild their economy by providing financial security to American families. None of these things can be accomplished so long as the giant multinational corporations, the banks and financial service companies, the insurance industry, the fossil fuel conglomerates, the weapons manufacturers, and the billionaires are running the US government. Therefore the first priority of American patriots, he says, has to be separating big money and political power.

Robert Bowman writes about the need to restore the Constitutional rights of American citizens, enhance their national security through a return to Constitutional foreign and military policies, and rebuild their economy by providing financial security to American families. None of these things can be accomplished so long as the giant multinational corporations, the banks and financial service companies, the insurance industry, the fossil fuel conglomerates, the weapons manufacturers, and the billionaires are running the US government. Therefore the first priority of American patriots, he says, has to be separating big money and political power.

On the brink of new year it is tempting to think about our financial situation in the months to come

On the brink of new year it is tempting to think about our financial situation in the months to come

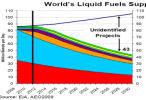

The supply of the world's most essential energy source is going off a cliff. Not in the distant future, but within two years. Production of all liquid fuels, including oil, will drop within 20 years to half what it is today. And the difference needs to be made up with "unidentified projects" – in other words, we face a potential ‘rank shortage’. According to this graph, we stand on the edge of a precipice, with no prior warning from either the industry or governments, which ostensibly protect the public interest.

The supply of the world's most essential energy source is going off a cliff. Not in the distant future, but within two years. Production of all liquid fuels, including oil, will drop within 20 years to half what it is today. And the difference needs to be made up with "unidentified projects" – in other words, we face a potential ‘rank shortage’. According to this graph, we stand on the edge of a precipice, with no prior warning from either the industry or governments, which ostensibly protect the public interest.

Recent comments