In Praise of climate deniers (not)

Well not really praise as such but, bear with me, while I justify wandering into this absurdity. I know it's difficult to say nice things about MP Craig Kelly, who claimed that people would die because renewables were raising electricity prices. He was perhaps unaware that the World Health Organisation in 2008 calculated that coal particulate pollution caused one million deaths across the world. And Tony Abbott who, between mouthfuls of onion, told us that coal was good for humanity - which was in opposition to both the Pope and the British Royal family's position - the two institutes he holds dear to his heart. Those are just two of 34 confirmed deniers in the LNP, although the Institute of Public Affairs claims half of the LNP members are supporters of their position.

Well not really praise as such but, bear with me, while I justify wandering into this absurdity. I know it's difficult to say nice things about MP Craig Kelly, who claimed that people would die because renewables were raising electricity prices. He was perhaps unaware that the World Health Organisation in 2008 calculated that coal particulate pollution caused one million deaths across the world. And Tony Abbott who, between mouthfuls of onion, told us that coal was good for humanity - which was in opposition to both the Pope and the British Royal family's position - the two institutes he holds dear to his heart. Those are just two of 34 confirmed deniers in the LNP, although the Institute of Public Affairs claims half of the LNP members are supporters of their position.

Money and truth

That sounds like a lot of politicians on the wrong track (the US has 180 deniers in Congress!) and its certainly one of the reasons that action on climate change has stalled. But there are a total of 226 federal politicians in both houses, so what were the rest doing? Can 34 deniers be so powerful as to dominate an issue, or are these the nice guys who are actually honest enough to nail their colours to the mast and challenge their electorate to vote for them on the policies and their natural charm and charisma? And, as such, are they not more commendable than the other 192 so called “believers”, including Malcolm Turnbull, who promote or knowingly participate in the processes that are destroying the planets climate?

Which then prompts the question as to why on earth would we have a higher percentage of deniers in parliament than in the general public, and why are so many advocating or just accepting policies that harm the planet? Well, there is money, and lots of it, that comes from those who would like the government to continue with policies that benefit the donor at the expense of the environment. These donations are so important, and so potentially embarrassing, that the major parties have only been transparent with 10 to 20% of their disclosures. What we do know is that Fossil Fuel companies have declared donations of $968,343 to the ALP, Liberal and National parties in 2016-17, which was slightly down from the $1.03m donated in 2015-16 and $1.94m in 2014-15 (which was also a Federal election year).

https://theconversation.com/the-truth-about-political-donations-there-is-so-much-we-dont-know-91003

The usefulness of economics in political ideology

However even the most cynical politician, one who depends on this source of money for re election, would baulk at supporting some of the improprieties we have had thrust upon us by successive governments, unless there was some way to quell his/her distaste for their parties' actions. One way this can occur is via embracing a particular ideology - which by definition is a system of beliefs and ideals which forms the basis of economic or political theory and policy. As such, it's not all that different to its equivalent in religion – faith – as both tend to smother reasoning lest it lead to inconvenient conclusions.

Ideology plays a big part in how political parties and governments function, largely because aspiring politicians can't get endorsement without supporting the parties' theories and must then ‘tow the party line’ or risk dis-endorsement. But it does mean that a minority group can usurp control of a party, something that has occurred in all parties: The modern Liberal is nothing like the Menzies model which was high tax, (by today's standard) protectionist on trade, big on regulation, and ran with a budget surplus and low unemployment (2.2%). The Labor party was instinctively socialist until Paul Keating embraced Milton Frieberg's fantasies with the result that we have two mainstream parties of the right with the Liberal party pushed into the hard right effectively destroying the moderates (wets) and handing power to the ultra conservatives. Barry Jones the former ALP science minister described this as "political compaction," giving voters a choice between McDonald's and KFC.

And when it comes to ideology economics is a star performer. No matter what political camp, be it neo conservative, (hard right) neo liberal, (center right to center left), socialism or communism, economics rules, and does so without a soul, because its criteria for assessment is reduced down to a single figure called the Gross Domestic Product (GDP). Governments of the world assume that this one statistic can show whether things are getting better or worse despite the occasional hic-up like the Global Financial Crises. Yet as a measurement it was only adopted in the war years when production (of war material) was the key to winning the war. It did not measure human health, education, poverty, unemployment or environmental damage because the war took precedence over all the things that make up human well being. As a result today's governments will still prioritize policies or projects that will add to GDP, especially if it does so in the governments term of office. They can also virtually ignore those things that are not measured in financial terms and this includes damage to human health or the environment which are dismissed as being “externalities” of lesser importance than its contribution to “the economy” .

Nobel family rejected economics for inclusion in Nobel Prize

Economists (and to a lesser extent politicians) are so obsessed with this they have described GDP as one of the greatest inventions of the 20th century - and they have a point. Because now there is something definitive to give them credibility as policy makers and guardians of wisdom even though there is no correlation between GDP and wellbeing. To enhance this self appointed credibility and to justify all the absurdities they inflict upon us, economists usurped the prestige associated with the Nobel prize which as you may know was an initiative of Alfred Nobel back in 1901. The awards were issued for Chemistry, Physics, Literature, Medicine and Peace, there was no prize for economics mentioned in Alfred Nobel’s will. This didn’t materialise until 1968, when the Swedish Central Bank wanted to do something special for its 300th birthday. It made a donation to the Nobel Foundation to sponsor a prize and to make it more acceptable they called it a prize for ‘economic sciences’. Since the economics prize is announced at the same ceremony it is virtually indistinguishable from the others but the Nobel family estate didn’t approve so at the family’s insistence, the prize was given the name it has – the Sveriges Riksbank Prize given ‘in memory of’ Alfred Nobel, and not a true Nobel prize. Which is just as well since Nobel specified that his prizes should go to people who’s work has “conferred the greatest benefit on mankind”. That’s relatively easy to decide a winner in the traditional sciences, but the economic prize has often gone to people with completely opposing views. One recipient, Myron Scholes the 1997 winner, will forever be remembered by the failure of his hedge fund Long-Term Capital Management (LTCM) which collapsed in 1998 losing $US4.6 billion of investment.

Like any Nobel, the prize gives economists a stamp of approval in the mind of the general public, legitimising their entire philosophy. Of the 74 laureates so far, 28 are affiliated with the University of Chicago, the home of neoliberalism including Milton Friedman and Friedrick Hayek (architects of what become known as Reaganomics - deregulation, and the trickle down effect which double the US national debt) but even Hayek expressed doubt about the award saying:

“If I had been consulted whether to establish a Nobel Prize in economics, I should have decidedly advised against it. The Nobel Prize confers on an individual an authority which in economics no man ought to possess.”

Economic absurdities and political policies

This does not matter in science where the influence exercised by an individual is chiefly on his fellow experts - and they will soon cut him down to size if he exceeds his competence. But economist have influence over laymen: politicians, journalists, civil servants and the public, which gives them undeserved authority that is often used to override warnings from almost all other avenues, including scientific bodies. John Howard once remarked that “we could grow forever,” later admitting that we would need to rely on imported food to do so. Larry Summers, a former adviser to President Obama, stated, "The idea that we should put limits on growth because of some natural limit is a profound error, and one that, were it ever to prove influential, would have staggering social costs." It is a comment often repeated, despite being contrary to even basic mathematics, and was justified by referring to growth as being “sustainable”. When this was seen to be an oxymoron the wordsmiths produced an alternative, environmental problems can be “decoupled” - that is isolated - from growth, and even from population growth. There is no doubt that this form of economics, with its obsession with an ever expanding economy and dubious accounting, has been a great benefit for corporations like the fossil fuel industry. But it is also partially or wholly responsible for most of problems that now beset the world, including plastic pollution in oceans, air pollution in cities, the obesity pandemic, the collapse of coral reefs, and all the threats associated with catastrophic climate change. All so much different from a previous age, when President Kennedy was said to have had a plaque on his desk with the message, “The Buck Stops Here,” meaning that responsibility lies with those in power. Oddly enough the last time Australia had a prime minister who took responsibility for his mistakes was when Kevin Rudd admitted we could not meet his GHG reduction targets because of the population growth he had championed. And his Big Australia dream is still alive and well in the major political parties as well as the Greens.

Don Owers

I found what struck me personally as egregious growthist propaganda dressed up as an academic research article on The Conversation, yesterday:

I found what struck me personally as egregious growthist propaganda dressed up as an academic research article on The Conversation, yesterday:

You probably would have noticed the media attention given to the Australian economies historic 26 year reign of economic growth which has been claimed is breaking that held by the Netherlands. Apart from being incorrect, (The Netherlands’ real GDP declined by 0.3% in the June quarter of 2003, and by 0.01% in the September quarter of that year) that record should go to Japan. In fact, if Japanese GDP data were available on a quarterly basis earlier than 1960, it’s likely that this run of continuous economic growth would have been even longer, perhaps as long as 38 years, inferring from annual data available back to 1955. Not bad for a nation mocked for its decision to abandon population growth and actually reduce its population.

You probably would have noticed the media attention given to the Australian economies historic 26 year reign of economic growth which has been claimed is breaking that held by the Netherlands. Apart from being incorrect, (The Netherlands’ real GDP declined by 0.3% in the June quarter of 2003, and by 0.01% in the September quarter of that year) that record should go to Japan. In fact, if Japanese GDP data were available on a quarterly basis earlier than 1960, it’s likely that this run of continuous economic growth would have been even longer, perhaps as long as 38 years, inferring from annual data available back to 1955. Not bad for a nation mocked for its decision to abandon population growth and actually reduce its population. As the moderators summed up, Le Pen and Macron hold irreconcilably different points of view. This was a battle between a nationalist representing the French as a people and an ex-banker representing the global elite with all the support of banks, the mainstream media, the EU and the US-NATO bloc. Marine Le Pen is a highly skilled barrister, versed in criminal law, who was raised in anti-establishment politics, but one cannot help think of Joan of Arc trying to fight off the English here.

As the moderators summed up, Le Pen and Macron hold irreconcilably different points of view. This was a battle between a nationalist representing the French as a people and an ex-banker representing the global elite with all the support of banks, the mainstream media, the EU and the US-NATO bloc. Marine Le Pen is a highly skilled barrister, versed in criminal law, who was raised in anti-establishment politics, but one cannot help think of Joan of Arc trying to fight off the English here.

Article by Leith van Onselen. Dick Smith is a national treasure. Yesterday he used his own money to fund an ad in Australia’s major newspapers challenging Lucy Turnbull – the chief commissioner of the Greater Sydney Commission (GSC) – on mass immigration, and asking her what her eventual plans are for the population of Sydney – querying whether it could be 16 or even 100 million.

Article by Leith van Onselen. Dick Smith is a national treasure. Yesterday he used his own money to fund an ad in Australia’s major newspapers challenging Lucy Turnbull – the chief commissioner of the Greater Sydney Commission (GSC) – on mass immigration, and asking her what her eventual plans are for the population of Sydney – querying whether it could be 16 or even 100 million.

Dr. Andrew Leigh MP is a former Professor of economics at the ANU and is now the Labor member for Frazer. During his university career he was awarded the Economic Society of Australia's Young Economist Award which is given to honour that Australian economist under the age of forty who is deemed to have made a significant contribution to economic thought and knowledge. He has published over 50 journal articles in the disciplines of economics, public policy and law, and over 100 opinion pieces. His research findings have been discussed in, amongst others, the Australian, the Australian Financial Review, the Christian Monitor, the Economist, New York Times, the Sydney Morning Herald, Time and Washington Post. He has also written a number of books, perhaps the best of which is titled Battlers and Billionaires, which weaves together vivid anecdotes, interesting history and powerful statistics to tell the story of the growing inequality in this country. It is not as hard hitting as Thomas Piketty's book Capital which has a similar theme but a different conclusion, arguing that increased growth will not prevent the spiral into global inequality. Andrew's book on the other hand tells us that inequality can fuel (economic) growth, almost implying that the end justifies the means.

Dr. Andrew Leigh MP is a former Professor of economics at the ANU and is now the Labor member for Frazer. During his university career he was awarded the Economic Society of Australia's Young Economist Award which is given to honour that Australian economist under the age of forty who is deemed to have made a significant contribution to economic thought and knowledge. He has published over 50 journal articles in the disciplines of economics, public policy and law, and over 100 opinion pieces. His research findings have been discussed in, amongst others, the Australian, the Australian Financial Review, the Christian Monitor, the Economist, New York Times, the Sydney Morning Herald, Time and Washington Post. He has also written a number of books, perhaps the best of which is titled Battlers and Billionaires, which weaves together vivid anecdotes, interesting history and powerful statistics to tell the story of the growing inequality in this country. It is not as hard hitting as Thomas Piketty's book Capital which has a similar theme but a different conclusion, arguing that increased growth will not prevent the spiral into global inequality. Andrew's book on the other hand tells us that inequality can fuel (economic) growth, almost implying that the end justifies the means.

Australia may have the world’s highest debt to GDP ratio. We have the lowest ranking in the region (61st) for income security. Our social expenditure is behind Greece, Portugal, Spain and Italy's. The OECD has ranked Australia second last in government funding of public education.

Australia may have the world’s highest debt to GDP ratio. We have the lowest ranking in the region (61st) for income security. Our social expenditure is behind Greece, Portugal, Spain and Italy's. The OECD has ranked Australia second last in government funding of public education. The treasurer, Scott Morrison, has just informed us that we have had 25 years of economic growth and the economy is now growing at its fastest pace in four years, meaning we may well set a new record for the longest period of sustained growth.

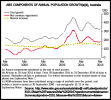

The treasurer, Scott Morrison, has just informed us that we have had 25 years of economic growth and the economy is now growing at its fastest pace in four years, meaning we may well set a new record for the longest period of sustained growth.  One of the most profound changes affecting the Australian economy and society over the past 12 years has been the massive lift in Australia’s net immigration, which surged from the mid-2000s and is running at roughly twice the pace of long-run norms (see next chart).

One of the most profound changes affecting the Australian economy and society over the past 12 years has been the massive lift in Australia’s net immigration, which surged from the mid-2000s and is running at roughly twice the pace of long-run norms (see next chart).

Dear Minister Dutton.

Dear Minister Dutton.

Did fossil fuel cause capitalism or did capitalism cause the creation of the technology to use fossil fuel for industrial processes? Did population start to grow in Britain before or after industrial capitalism? Why did the industrial revolution begin in Britain? Were there any precedents? Beginning before Roman Britain, this work of evolutionary sociology also looks at how Doggerland, sea-level changes accompanying ice-ages and global warming, forestation changes, malaria and plagues may have affected population movement, along with kinship rules, inheritance laws, and access to distant and denser communities through new modes of transport. Then, departing from Roman Britain, the book examines changes to the political system, fuels, technology and demography during the Reformation, the Restoration, the Dutch capitalist revolution, and the Trade Wars, to the eve of the French Revolution, which is the subject of the next volume. Hint: The cover on this book is like a treasure map and contains the major elements of the final theory.

Did fossil fuel cause capitalism or did capitalism cause the creation of the technology to use fossil fuel for industrial processes? Did population start to grow in Britain before or after industrial capitalism? Why did the industrial revolution begin in Britain? Were there any precedents? Beginning before Roman Britain, this work of evolutionary sociology also looks at how Doggerland, sea-level changes accompanying ice-ages and global warming, forestation changes, malaria and plagues may have affected population movement, along with kinship rules, inheritance laws, and access to distant and denser communities through new modes of transport. Then, departing from Roman Britain, the book examines changes to the political system, fuels, technology and demography during the Reformation, the Restoration, the Dutch capitalist revolution, and the Trade Wars, to the eve of the French Revolution, which is the subject of the next volume. Hint: The cover on this book is like a treasure map and contains the major elements of the final theory.  In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the impossible demand from the Greek voters that both austerity ends and that they remain in the euro as currently arranged. They also look at a parallel “future-tax” crypto currency as a possible answer to Greece’s problems. In the second half, Max interviews Liam Halligan, editor-at-large at BNE.eu and columnist at the Telegraph, about the latest on the unpayable debt crisis in Greece. Liam suggests a Grexit will happen but that Greece won’t be the first European nation to leave the euro.

In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the impossible demand from the Greek voters that both austerity ends and that they remain in the euro as currently arranged. They also look at a parallel “future-tax” crypto currency as a possible answer to Greece’s problems. In the second half, Max interviews Liam Halligan, editor-at-large at BNE.eu and columnist at the Telegraph, about the latest on the unpayable debt crisis in Greece. Liam suggests a Grexit will happen but that Greece won’t be the first European nation to leave the euro. Australian treasurer, Joe Hockey, stated in April 2014 that the age of entitlement had come to a close. [1] He was of course referring to entitlements that the faux-elite Liberal Party believe that people receive which they don't deserve. Medical health, education, financial assistance during unemployment and so forth. He wasn't referring to Negative Gearing or cash payouts for "Women of Calibre" to stay at home with their child.

Australian treasurer, Joe Hockey, stated in April 2014 that the age of entitlement had come to a close. [1] He was of course referring to entitlements that the faux-elite Liberal Party believe that people receive which they don't deserve. Medical health, education, financial assistance during unemployment and so forth. He wasn't referring to Negative Gearing or cash payouts for "Women of Calibre" to stay at home with their child.

Professor John Quiggin, of the University of Queensland criticised the Ernst and Young report on privatisation of the electricity industry.

Professor John Quiggin, of the University of Queensland criticised the Ernst and Young report on privatisation of the electricity industry. The Group of 20 (G20) is meeting in Brisbane this week to discuss the global economy. William Bourke says we should focus less on the GDP and instead look at real progress indicators like high employment, a diverse economic base and sustainable resource management.

The Group of 20 (G20) is meeting in Brisbane this week to discuss the global economy. William Bourke says we should focus less on the GDP and instead look at real progress indicators like high employment, a diverse economic base and sustainable resource management. This republished open letter calls for the teaching of economics to take the real world into account and become responsive to current needs, in the service of society, rather than promoting a single ideology. Republished from

This republished open letter calls for the teaching of economics to take the real world into account and become responsive to current needs, in the service of society, rather than promoting a single ideology. Republished from

Amid all the talk by politicians and media about the imminent horror budget with cuts to many important services, Treasurer Joe Hockey fails to see the source of more than enough money to cover all these ‘holes’, according to Sustainable Population Australia (SPA).

Amid all the talk by politicians and media about the imminent horror budget with cuts to many important services, Treasurer Joe Hockey fails to see the source of more than enough money to cover all these ‘holes’, according to Sustainable Population Australia (SPA).

"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills.

"The East West Link is a white elephant that risks undermining Melbourne's productive capacity and living standards. The tunnel is not a solution. It does not provide value for money. Generations of Victorians will be burdened by an $8 billion debt for a tunnel that will have long passed its use-by date. It is regrettable that this government is seeking to amend the Infrastructure Australia legislation to give the minister heightened discretion rather than going through the proper independent, transparent processes that Australians expect when it comes to large spending on infrastructure projects." - Kelvin Thomson, MP. Wills. (All emphases and headings have been inserted by Candobetter.net's editors.)

(All emphases and headings have been inserted by Candobetter.net's editors.)

(Original Source by John Kozy, Global Research, February 13, 2012:

(Original Source by John Kozy, Global Research, February 13, 2012:

Civil society groups across the Pacific criticise SOPAC and its development of a regional regulatory framework on deep sea mining (DSM). They argue that it facilitates and pre-empts DSM before Pacific Island communities have had the opportunity to debate whether this is a form of development they want.

Civil society groups across the Pacific criticise SOPAC and its development of a regional regulatory framework on deep sea mining (DSM). They argue that it facilitates and pre-empts DSM before Pacific Island communities have had the opportunity to debate whether this is a form of development they want. "Populate and reap rewards," was Monday's

"Populate and reap rewards," was Monday's

The economy of Australia is one of the largest capitalist economies in the world, with a GDP of US$1.57 trillion. We stand apart from the rest of the OECD with both population growth and economic growth rates roughly four times the OECD country average. Admittedly some of the other members of the OECD are going through hard economic times, but many of similar size to Australia (such as Sweden) have sound economies, high GDP per capita and far slower population and GDP growth rates.

The economy of Australia is one of the largest capitalist economies in the world, with a GDP of US$1.57 trillion. We stand apart from the rest of the OECD with both population growth and economic growth rates roughly four times the OECD country average. Admittedly some of the other members of the OECD are going through hard economic times, but many of similar size to Australia (such as Sweden) have sound economies, high GDP per capita and far slower population and GDP growth rates. There is no evidence supporting the argument that rapid population growth is a rational strategy for Australia. Quite the opposite.

There is no evidence supporting the argument that rapid population growth is a rational strategy for Australia. Quite the opposite.

Let’s ask why Greens, Liberals & Labor suppress the population issue: Stable Population Party - The party says it will reveal all in a front-page ad in the Sydney Morning Herald on Tuesday. The Stable Population Party points out that, despite a ‘massive thumbs down for big Australia’, [1] with 70 per cent hoping the population does not hit the 40 million mark projected by 2050, no major party will raise population as a campaign issue.

Let’s ask why Greens, Liberals & Labor suppress the population issue: Stable Population Party - The party says it will reveal all in a front-page ad in the Sydney Morning Herald on Tuesday. The Stable Population Party points out that, despite a ‘massive thumbs down for big Australia’, [1] with 70 per cent hoping the population does not hit the 40 million mark projected by 2050, no major party will raise population as a campaign issue.

Recent comments