In her Quarterly Essay piece, "Great Expectations," Laura Tingle loads a gun with a big bullet that she never shoots - which I thought any writer knew was a no-no. She says that "constant mass migration" " more than anything else" pushed the Australian economy and the population through waves of rapid change. The whole time I was reading her essay I was waiting for the gun to go off and for Detective Tingle to say two obvious things ... ...

In her Quarterly Essay piece, "Great Expectations," Laura Tingle loads a gun with a big bullet that she never shoots - which I thought any writer knew was a no-no. She says that "constant mass migration" " more than anything else" pushed the Australian economy and the population through waves of rapid change. The whole time I was reading her essay I was waiting for the gun to go off and for Detective Tingle to say two obvious things ... ...

This is a review of Australian Financial Review's Chief Economics editor, Laura Tingle's sweeping condemnation but interesting analysis of Australians' perceived expectations of democracy, which should not go unanswered. Having googled and found no critical responses, I wrote my own.[Ed: On 8 Aug 2012, Notes 8 and 9 ammended to eliminate confusion re Khemlani loan minutes.]

Review of Laura Tingle, "Great Expectations" in Quarterly Essay, Issue 46, June 2012.

Tingle says 'Entitlement'; you say 'Rights'

Laura Tingle's thesis (if you can call it that) is that Australian governments not only fail to deliver, but that they don't have the power to deliver what the public expects anymore.

According to her, this situation came about in the following way: Australian government began by administering a dependent population in a patronising way. Australians became passive recipients of government benefits - to the extent, Tingle believes, that convicts seemed almost more inclined to die of starvation than to try to feed themselves by farming. Moreover, after the gold rush, Australian men got the vote and could run for parliament whether or not they had property and the quality of politicians declined compared to that when only people with property could vote. In these circumstances, politicians with poor manners came to dominate parliament and Australians therefore lost respect for their politicians.

With deregulation and privatisation (under Hawke and Keating), governments dissolved the very institutions that gave them power. Because of Hawke and Keating's actions Australian governments now have so little power that they are unable to satisfy the promises they make at election time to the electorate.

Both Howard and Rudd attempted to counter this institutional impotence with handouts to individuals. Howard pretended that he was into small government and Rudd revelled in big government. Howard lost government because the electorate rejected Workchoices. Rudd was removed by his own party because he was unable to live up to the expectations he had himself created.

The party replaced Rudd with Julia Gillard but she has problems because she now heads a minority government. Australians don't like minority governments, says Laura Tingle, repeating the mantra from Fairfax and Murdoch newspapers, which are more into telling people how they feel about Gillard and minority government than finding out what Australians really think about Gillard. Tingle concludes that the social contract needs to be renegotiated: Australians need to decide what they want from government and government needs to decide what it can still actually do in an "open economy".

The essay is badly structured because it raises issues then never returns to them, reading like something edited at the last moment to remove some paragraphs that were originally included, thus reducing the sense of the argument. It is long and filled with assertions that strike me as dubious, based on somewhat cherry-picked arguments. I can only take on a few and have chosen some of those which I consider most flawed by ideology. In some cases a class bias is so blatant that one looks for the punchline, but, it seems, Ms Tingle does not mean to show a funny side in her views.

The idea that politicians post gold rush were of poor quality

For the idea that the politicians post gold rush were of poor quality Tingle provides no justification except that they were ordinary people of presumed lesser education than those furnished by a system that required people to own property in order to run for election or to vote. Tingle nonetheless has noted in the same text that Governor Arthur Phillip made children's education mandatory and free in the Australian colonies, and therefore that ordinary Australians were better educated than ordinary British.[1]. The well-educated property owning politicians took refuge in the NSW Upper House, according to Tingle. (It seems to me that the same thing happened in Britain, where there was no gold rush, but business replaced landed gentry and peerage as coal and iron overshadowed agricultural production in the industrial revolution.)

On pages 19-20, in order to show that Australians were, from the get-go, dependent 'entitled' people, Tingle quotes Hirst (without mentioning that he is known by some as a slavery revisionist) [2] in Colonial Society and its Enemies who wrote that convicts during the first settlement were content to use up rations as food was running out and showed no interest in producing food for themselves.

From the diary of a man who was actually there, Watkin Tench, as edited by Tim Flannery,[3] you would learn, however, that people could not grow food properly in the first two years because they had been shipped out without sufficient tools and did not have farming skills. And Laura Tingle should know (considering she is an economic journalist) that growing food was extremely difficult in Australia without mechanisation and fertilisers. As for a reputed passivity among convicts, the regime of the first settlement was a terrifying one where, as well as frequent floggings and solitary confinements someone was executed, often for stealing food, every other day.[4]

Tingle often uses the word 'paternalistic' to describe Australian government from the earliest days of settlement, but a better word would be authoritarian. By using the word 'paternalistic' however, which has a somewhat benevolent undertone, she also manages to characterise Australians as childlike and passive. With Hirst's help, convicts emerge as wimps who tugged at Daddy Governor's apron strings, thus copping a few well-deserved slaps. This caricature sets the tone for this digest of Australian government powers and citizens' rights.

"Entitlement" and "Rights"

'Entitlement' is a new slur-word to denigrate democracy and Tingle often uses it instead of the term 'rights', and when she uses 'rights' she puts them down:

Tingle: "Men would commonly march on government buildings demanding work when things were difficult, and politicians would oblige." (p.26)

"Many of the laws that determined how we lived, our rights, even our rail gauges, had been passed. A strong expectation that governments would ultimately look after us and provide us with work had firmly taken root, along with our cynicism about politicians." p.27.

"We fought relatively little for rights, since so many came from our British inheritance." (p.25)

There are many similar examples.[5]

Although Tingle mentions that the French Revolution took place simultaneously with the establishment of the first settlement in Australia, her knowledge of its impact seems negligible. She talks vaguely of human rights and accuses Australia of not being interested or involved in these because, she implies, Australian rights came almost seamlessly bestowed by the bureaucracy. She gives no examples of the Australian rights to which she alludes (unless she means the ability of freed convicts to buy land and to be paid for work), but she also seems to be unaware that these rights and many more are enshrined at law in the bulk of European polities through Napoleon's civil code and its imitations, all of which followed on from the first part of the French Revolution. Various rulers during the long period of revolution tried to convince the French people that they were pretentious and suffering from 'entitlement' and wars were fought by Britain with other royal houses and the church to stop them getting democracy, but today the French have real rights and so no upstart can accuse them of empty attitude or 'entitlement'.

Australia has no such citizens' rights enshrined at law. Perhaps once, when we had state banks, state assets (like Telecom) and state housing and government unemployment services, and universal pension rights, we could speak of rights provided by institutions, however. As such institutions have been privatised and deregulated by Hawke, Keating and Howard, we have of course lost those implied and institutionalised rights, just as the governments have lost the power to provide them. What is left is the right to vote (for governments with no means to power) and the right to rent land for housing from the banks via extortionate mortgages (but not the ability to own it outright because population growth has inflated its cost).[5a]

Immigration and Population Growth

Right at the beginning, Laura Tingle loads a gun with a big bullet that she never shoots - which I thought any writer knew was a no-no. She says that "constant mass migration" " more than anything else" pushed the Australian economy and the population through waves of rapid change. The whole time I was reading her essay I was waiting for the gun to go off and for Detective Tingle to say two obvious things:

1. High immigration is a major factor in our loss of control over cost of living, [notably land (especially for housing), water and fuel prices and all the things that depend on these - i.e. everything] and

2. Immigration numbers are one thing that the government CAN still control, [but it only seeks to grow them].

Instead of pointing out that "constant mass migration" can still be controlled by government, Tingle concludes her essay with the general idea that Australian governments have lost control over most processes in this country and that now there needs to be some kind of discussion about what governments can actually do for Australians and what Australians want and can ask for from governments. How such a discussion could proceed is not obvious, unless it is to be via the usual media-theatre, like Rudd's 2020 summit, where journalists and a few talking heads from pseudo-academia, peak growth lobby groups and parliament, have a pseudo proxy discussion purportedly on behalf of the rest of us and decide to go on with more of the same. Tingle rubbishes Julia Gillard's idea for a Citizens Assembly and the mainstream press made out that Australians rejected it (using a newspaper commissioned poll), but why would Australians reject some means of democratic control?

The fact is that Australia, unlike my example of France, has no effective system of delegates to represent citizens. All opinions are manufactured from the 'top' down. We don't have real democracy. If we had had real democracy we would not have lost control of the significant powers and processes in this country. Australians have shown that, given the democratic opportunity, they will always vote against privatisation and deregulation. The problem is, as Laura Tingle and James Sinnamon, "Privatisation Backlash," make clear, they are rarely or never given the opportunity in time for it to make a difference. Government and the press unite to keep these matters off the agenda. Laura Tingle's essay is surprising because she admits these things as losses that the corporate agenda of the Australian Financial Review, which provides her media voice, supports and markets as if they were public benefits. It seems to be the case of shutting the stable door after the horse has bolted, or more accurately, crying "Fire" after the house has burned down.

Unaffordable land for housing

Unsaid in Tingle's essay, however, is that a major complication of high population growth is high housing prices. The property development lobby with mines and building materials upstream and banks, solicitors, and state governments addicted to stamp duty taxes downstream, constantly demands more immigration via its lobby groups, which include the absolutely huge Property Council of Australia, the Real Estate Institute of Australia, the Housing Industry of Australia, the Australian Population Institute (APop), the Multicultural Foundation of Australia, the Institute of Global Movements, and veritable legions of others. This is a long established problem which has greatly worsened as the Australian housing market has been opened up to the world with the Foreign Investment Review Board removing nearly all barriers to foreign purchasers and investors. [6] With the rise of the internet, every solicitor, real estate agent, migration agent, mall rental agent, and foreign student tout has been able to market individually to the world.[7]

Tingle on housing prices and foreign debt

The most obvious ills that have come from the loss of control that Tingle does describe are those related to open economy/market and high housing prices, as Tingle does admit. (pp42-43):

"Yet, after attacking Labor for years for not reining in foreign debt, Howard presided over an increase in it at a time when Australia's terms of trade were the best they had been for a generation. A country's foreign debt funds the cost for the difference between what it exports and what it imports. Even if governments cut their debt by not spending as much, someone still has to borrow overseas to cover the difference. Under Howard, however unwittingly, it was households that started to raise foreign debt via their demands for credit from banks that borrowed overseas on their behalf.

Rod Tiffen and Ross Gittins point out in the 2009 edition of their book How Australia compares that Australian household debt in relation to disposable income almost doubled during the Howard years. Some other countries have even higher levels of household indebtedness, but Australia is now considerably above the average. A central reason for this was the increasing price of housing, with Australia experiencing one of the sharpest rises in prices worldwide, so that mortgages in relation to income grew prodigiously during the Howard years. This suggested increased financial stress for many people, despite the relatively good economic growth.

But, as Tiffen and Gittins also observe, current account balances, household debt and house prices were outcomes of markets. Government had limited influence over the decisions of the individuals and companies who traded in those markets. (...)

Howard's response to the increasingly difficult politics of housing was to offer subsidies for first-home buyers (which only inflated prices further) and general tax cuts, and to blame the states for a lack of developed land leading to higher prices."

[See also Greg Wood's "How much further can developer-debts drag us down?"]

Tingle does not mention, however, though surely she has by now figured it out, that both these things could be controlled through a reduction in immigration, long residence tests for citizenship, and protection of land and housing for citizens with leasing only to foreigners.

Tingle never returns to this major factor she describes as more influential than anything else - constant mass migration - in our loss of control over our democratic processes, our economy and the natural environment which is their envelope.

Open economy means open borders to Australian elite

Left unsaid is that Tingle's idea of an open economy does not just mean the passage of commodities and products across borders, but includes the passage of people as well. In the Fairfax and Murdoch views of the world, and those of Hawke, Keating, Howard, Rudd, Gillard and Abbott (all of the latter are members of the Multicultural Foundation of Australia) open economy means open borders for anyone with money. All that hoo-ha about asylum seekers is just a smokescreen for open slather on economic immigration and foreign ownership to both of which almost no barriers now exist in Australia. Not only has government deconstructed Australia's institutions and the rights they accorded to its citizens, government has also deconstructed our borders and so the very notion of citizenship. Open economy is also code for open borders. Under such circumstances, the social contract those on this continent might get will be whatever they can pay for in a global auction.

Oil shocks and Countershocks

In her curiously discursive narrative, Tingle does not situate the systemic economic changes she documents within the larger geopolitical picture - after the oil-shocks of the early and late 1970s. It seems that, for her, they just kind of emerged as logical imperatives of a market that came out of nowhere.

In fact, oil and gas producing colonial economies, including Australia and the Middle Eastern ones, sought independence and self-sufficiency during the 1970s when they saw what was coming. The global marketing of oil was a countershock strategy by the oil-importing countries.

Whitlam tried to ensure an independent energy basis for the Australian economy in anticipation of the first oil shock.

"The national policy on minerals and energy approved at the 1971 Launceston Conference of our party has proved to be not only singularly relevant but even historically visionary in the light of subsequent events. We anticipated the world energy crisis (1973), have dealt with international currency turmoil, established a sound export pricing policy, checked the inroads into Australia of the multinational corporations, and secured the respect and understanding of our trading partners."[8]

On December 13, 1974 the executive council of the Commonwealth of Australia, made up of Prime Minister Whitlam, Attorney-General Murphy, Treasurer Cairns, and the Minister for Minerals and Energy, Rex Connor met to seek funding for Rex Connor's project for a natural gas pipeline to make Australia energy-self-sufficient and to fund unemployment reduction. For this they sought $US 4,000,000,000 (four billion US dollars). The minute of the meeting stated,

"The Australian government needs immediate access to substantial sums of non-equity capital from abroad for temporary purposes, amongst other things to deal with exigencies arising out of the current world situation and the international energy crisis, to strengthen Australia's external financial position, to provide immediate protection for Australia in regard to supplies of minerals and energy and to deal with current and immediately foreseeable unemployment in Australia." [9]

If Whitlam had not been overthrown it is quite likely that the economic changes that have disempowered Australian citizens would not have happened.

The backlash was incredible: Rex Connor and Whitlam's energy and employment policies caused a political countershock in the Australian parliament whereby the Liberal opposition, representing big business, manipulated those in the Whitlam government not able to understand the implications of the oil shock, and caused a situation whereby Whitlam was painted as incompetent and overthrown. Primeminister Fraser's spending was greater than Whitlam's, but Fraser also sold off equity. Tingle does not mention Fraser, except to suggest that his 'razor cuts' [Howard was his treasurer] were possibly exaggerated. My own research documents that Fraser began the process of breaking down Australia's foreign investment barriers, however.[10]

In the rest of the world a division occurred between the Anglophone economies and the Continental European ones, with Reagan-Thatcher economics in the Anglophone countries - which borrowed to continue growth in population and consumption - and softer more democratic economies emerging in Continental Europe, which consolidated a democratic social contract and reined in population growth and consumption.[11] Fraser, Hawke and Keating, ushered in these Anglo-style economic changes to Australia.

Breaking the state

"The great political battles of the 1980s and 1990s were fought over the idea that government intervention in markets was bad and removing it was good.(p.33)

"State paternalism is what politicians do. It is a hard habit to break." (Tingle, p.33.)

Tingle marks the beginning of the dismantlement of the system in 1983, when Hawke floated the dollar.

She says how the Hawke government floated the doallar in 1983, without any political warning or electoral mandate. Her explanation for this float excuses Hawke and puts blame on Whitlam: "It was set off by newly powerful financial markets putting irresistible pressure on the exchange rate following the election of a Labor government, which, to the markets, had overtones of a return to the financial chaos and excessive spending of the Whitlam years."

"The push to undo the Australian settlement - for that was what the floating of the dollar triggered - was politically bipartisan."

Tingle uses the loaded term of 'reform' here:

"Pressure for this reform had been resisted for decades, with the renovation of many economic institutions and structures long overdue."

She says that state regulation of parts of the economy prevented there being uniform rules for doing business throughout Australia and the highly regulated financial system "could not provide the flexible finance to underpin economic growth."

"Few argued that we shouldn't deregulate the economy (and those few that did were howled down); most debate was about the speed with which it happened and how to protect people through the change."

The people were not consulted. When she says that 'few argued against this' and that they were 'howled down' she is talking about those politicians and journalists anointed as talking heads by the mainstream media. The electorate itself was excluded from consultation over these institution and government threatening changes.

Tingle gives the game away:

"Yet, here is the crucial point: voters weren't consulted about the changes - except belatedly at the ballot box, when both major parties were in fundamental accord."

She also says that the states were not consulted much either.

But it is the consequences of those changes that her article is about.

Deregulation made it hard to retain our standards because, as Laura writes, "Previously, if you brought money into Australia as an investor, it was hard to get it out again. Now money could come and go as international investors saw opportunities and assessed how competitive we were with other countries."

She ascribes what Hawke did to pressure from the 'markets', as if the markets had a life of their own.

The government was now playing to the markets:

"There was suddenly a new constituency to win over: the financial markets."

She describes a situation where government began to run scared of the financial markets and their technocratic interpreters,

"Hawke and Keating [the treasurer] found themselves not only trying to explain the benefits of deregulating markets to the electorate in political lingo that everyone could understand, but also having to deal with constant demands to prove their bona fides to sceptical bankers, brokers and international financiers."

As she says, voting polls on government went up and down according to the value of the Australian dollar.

In 1986 economics became the 'new political topic' and Australians lost confidence in their own values, due to propaganda from Hawke and Keating. Tingle's observations reflect this in a nuanced way:

"The polls at the time suggested that while voters didn't like this new uncertainty - so far removed from the relatively safe world they had lived in until this point - they were persuaded that Australia needed to change."

I am reminded of a question recently put to me by a friend, "What did they talk about on the radio and television before they began to talk constantly about population growth?"

Well, from 1986, they talked constantly of the dollar. It was only after about 2000 that the push by the growth lobby for population growth became an open obsession.

Keating showed himself to be a skilled propagandist:

Tingle:

"Keating's lectures worked, and they gave the electorate some ownership of the reform process."

(This highjacking of the electorate's ownership of governance over financial regulation is also nuanced as a 'reform' process by Tingle.) She writes,

"Australians endured this period of reform because they were persuaded that it would produce better outcomes for their kids for the future."

Her other words, however, which show that the electors were not consulted and had no choice and that given the authoritarian - sorry, paternalistic - nature of Australian government, they had no means to prevent what was happening, belie this observation.

Government and Trade Unions

Per capitas were told to put 'national interest' ahead of their own benefits.

Tingle:

"It was the era of 'peak body' summits. The Accord struck between the government and the trade union movement during the 1980s and early 1990s harnessed the centralised wage system to buy the deals that helped Australia make the economic transition. The Accord bought wage restraint and, as a result, lower inflation. In return there were individual tax cuts, targeted welfare assistance and increased superannuation. There was also the 'social wage' - all the elements of state paternalism prepackaged: an implicit contract that, in return for wage restraint, there would be new services and help from the government."

[This change would exert downward pressure on wages.]

With the 1990s crash people lost their savings and the government made things worse for them by failing to protect jobs. Tingle seems to suggest that high housing prices are perceived as a good by Australians when in fact they are only perceived as a good by a minority who can afford to invest in housing and who do not care or do not understand about the impact on the environment and the cost of living of population growth. As mentioned, under Howard the price of housing rose along with credit debt. The rate of immigration also rose and fed the housing inflation but, as I have said, Tingle does not mention this.

As part of her presentation of Australians as apparently reasonable but really unreasonable, Tingle (p.8) talks about all the things that Australians expect of governments - quite reasonable things most of us would suggest, such as accessible hospitals, good schools, roads, public transport, childcare, protection for neglected children and for the rest of us from violence and crime. She also suggests that Australians want the government to intervene in industrial disputes that are causing 'the rest of us inconvenience' as well as to support workers left without their entitlements by collapsing businesses. But then she says that we also object to alcohol and tobacco laws and, furthermore, to governments attempting to find ways of "allocating water among millions of users that is sustainable and priced rationally."

See the manipulative conflation?

Tingle (p.8) fails to note that water is a vital resource and its allocation is complicated by population growth, but governments in Australia have forced population growth on Australians and it is only because of this that frequently predicted problems have arisen with relation to our water supplies. The governments of Fraser, Hawke, Keating, Howard, Rudd and now Gillard have brought this great ill on Australians. By burying the water problem in a list of social goods and values, and lesser gripes, Tingle seems to want to disguise its real rank. Water is not a social good; it is a geophysical attribute without which humans cannot survive, inside or outside of a society. Governments should not endanger its supply through overshoot. That is the least, the very least we should expect of our leaders. If Australians are really the passive and demanding dolts that Tingle frames us as, they would go along with the situation that has created expensive water rationing and the associated life-threatening vulnerability their politicians have allowed the Market to create. Instead they protest, but they have no rights.

Conclusion:

For all my disagreement with the social theory in this essay, which I find childish, I do admire Ms Tingle for writing something so broad and sweeping for us all to use as a jumping off pad. That takes some get up and go. She has summed up a lot of what is happening. Of course I am also afraid that, instead of simply launching discussion, it will be taken as a prescription pad and used as pre-emptive medication by government and the media. The Financial Review, of course, has quoted it uncritically and I listened to some (not all, I admit) of a Philip Adams interview with Laura on the subject and Adams seemed to swallow it whole, like a delicious pill. Furthermore, the comments on his site were all similarly approving and uncomprehending.

At the beginning of the essay Tingle makes the point that

"we have not sat down and worked out exactly what we expect 'the government' - by which I mean its administrative side, as well as the politicians of the day - to be and to do."

I agree with her that we need to sit down, however I am much less vague about what needs to happen after that. There is a model out there that has worked for two centuries in Europe. It is the European Civil Code, also known as the Napoleonic Code. In the EU, only Britain has failed to adopt this Roman Law based model. Australia needs a Civil code of citizens' rights, legally defendable, modelled on the French one to combat the disorganising forces of the markets. We need to abandon our ad hoc British system.

NOTES

[1] Tingle p.7: "Governor Arthur Phillip insisted that the children of the First Fleet's convicts should be educated. Phillip's pragmatic rationale was that education might stop the first generation of free-born white New South Welshmen following in the criminal footsteps of their parents. It was not meant to rewrite the rulebooks for what government did even though it meant, from the very start, that children born in a penal colony would gain an education that was not available to their contemporaries in the country from which their parents came."

[2] Isobel Barrett Meyering, "Contesting Corporal Punishment, Abolitionism, Transportation and the British Imperial Experiment," B.A. Hons History, University of Sydney, 2008, pp 15-16.

[3.] Watkin Tench, 1788, Comprising a Narrative of the Expedition to Botany Bay and A Complete Account of the Settlement at Port Jackson, first published in 1789; this edition edited by Tim Flannery, Text Publishing Company, Melbourne, 1996, p.102.

[4.] Watkin Tench, op.cit., p.119. An illustration of the extreme situation was that the officers of the first settlement plied Baneelon, an Aborigine captured for anthropological study, with all the scarce rations he could eat in order to keep up a pretence to the Aborigines all around them that the British invaders were not actually close to starvation. They feared that if Baneelon escaped he would alert his clansmen to their weakened condition and the Aborigines would finish them off. Tench recorded that their rations for a week were insufficient to keep Baneelon for a day and the starving settlers felt obliged to hunt and fish for extra, entirely on his behalf. Nevertheless Baneelon became increasingly unhappy and managed to escape. Watkin Tench, op.cit., pp.125-6.

[5] She cites Paul Kelly, p. 31: "Kelly defines it as 'individual happiness through government intervention' and notes its origins in 1788. 'The individual looked first to the state as his protector, only secondly to himself,' he writes, going on to quote the earlier history of Keith Hancock, who wrote in 1930 that 'to the Australian, the State means collective power at the service of individualistic 'rights'. Therefore he sees no opposition between his individualism and his reliance upon government.' She cites Donald Horne as having noted in The Lucky Country, 'the general Australian belief is that it's the governments' job to see that everyone gets a fair go.'"

She goes on: "The idea of state paternalism is embedded in our relationship with government, and has been since the time our convict forefathers expected Governor Phillip to fix the small problem of starvation rather than do anything about it themselves." In the Essay, this is her second remark indicating a belief that the first settlers were in some way inferior and unreasonable. This is a bizarre point of view attributing authority, powers and skills to British prisoners which they did not have, and in the absence of tools.

[5a] As part of the process of determining what governments can offer and what we want of them, we need to take stock of what we still have, although these are in the process of being attenuated and corporatised: government prisons, schools, universities, and hospitals.

[6] See Foreign ownership.

[7] See for instance, on the growth lobby: "Property Council of Australia 2010 campaign to contrast with 2012 spin""Transcript of Growth Lobby video-shocker, "Straightening out B.A.N.A.N.A.S""http://candobetter.net/node/2960; "Land and Rent Costs to Business make Australia uncompetitive"

[8] Wilkinson, A Thirst for Burning, op.cit., p. 138. Wilkinson comments, on page 139, "There is little doubt that some of Connors's ideas were far-sighted. ... He was correct in predicting the 1973 oil crisis and then, at a time when people world wide had overcome the fright of the OPEC moves, Connor continued to champion conservation of energy. Unfortunately he was denied the mean of achieving it. ..."

[9] Paul Kelly, The Unmaking of Gough, Allen & Unwin, 1994, p. 191, cited in Sheila Newman,The Growth Lobby and its Absence in Australia and France, Swinburne University, 2002, Chapter 7, subtitle, "Initial Reaction in Australia to the First Oil-Shock."

The Governor General later signed the minutes of this meeting and those of a later one that reduced the loan sought two billion.

(Kelly and Tom Uren, Straight Left, Vintage, 1995 pp. 209, 222, 223, 236-7, describe Rex Connor as having an impressive knowledge of the mining industry. Apparently Gough Whitlam had no knowledge of the industry at all but believed that Connor was a visionary.)

[10] Prime Minister Fraser liberalised foreign investment rules under the Foreign Takeovers Act (1975). Successive amendments have progressively removed barriers for foreigners to purchase land in Australia. Few restrictions remain. From less than 10% in 1972-75 under Whitlam, foreign investment in Australia increased to 49% of GDP in 1990-91. By 1986 more than half was destined for real-estate investment. Sheila Newman,The Growth Lobby and its Absence in Australia and France, Swinburne University, 2002, Chapter 3, "Public and Private Housing Policy," citing from R.H. Fagan, "Foreign Investment", in Australian Encyclopaedia, Terry Hills, NSW, Australian Geographic, Pty. Ltd, 1995, pp.1393-1394. By 2012, this figure was close to 90%. See graph from www.debtdeflation.com/blogs, which uses RBA data.

[11] Sheila Newman,The Growth Lobby and its Absence in Australia and France, Swinburne University, 2002, Part Two, Chapters 7 and 8.

Called, "DiEM TV: Another Now with Yanis Varoufakis," this, one of several Varoufakis videos, focuses on how to break up Amazon dot com - but then passes on to how to break up the feudal world order. Varoufakis has unique experience of the global financial-political system, and so he does a good analysis of Amazon's engulfment of the real world and of feudal capitalism. Most interesting is his advice on how to break this behemoth down to size via Lilleputian-style exploitation of the financial system. Part of the video involves Varoufarkis reading from a novel he recently published about a global-democratic revolution after the 2008 financial collapse, Another Now: Dispatches from an Alternative Present. You may or may not hold Varoufakis's communistic value solutions, but his methodology could also play out with many different new kinds of polities. I enjoyed this mixture of Socratic style and Swiftian analogies. You may wonder at his aiming ammunition at Amazon dot com, when his books sell there, but he says his publishers choose to market them there. This does not detract from his analysis. You may also wonder about his understanding of alternative energy resource-limits, but that also should not prevent you from learning from this analysis. Video inside article.

Called, "DiEM TV: Another Now with Yanis Varoufakis," this, one of several Varoufakis videos, focuses on how to break up Amazon dot com - but then passes on to how to break up the feudal world order. Varoufakis has unique experience of the global financial-political system, and so he does a good analysis of Amazon's engulfment of the real world and of feudal capitalism. Most interesting is his advice on how to break this behemoth down to size via Lilleputian-style exploitation of the financial system. Part of the video involves Varoufarkis reading from a novel he recently published about a global-democratic revolution after the 2008 financial collapse, Another Now: Dispatches from an Alternative Present. You may or may not hold Varoufakis's communistic value solutions, but his methodology could also play out with many different new kinds of polities. I enjoyed this mixture of Socratic style and Swiftian analogies. You may wonder at his aiming ammunition at Amazon dot com, when his books sell there, but he says his publishers choose to market them there. This does not detract from his analysis. You may also wonder about his understanding of alternative energy resource-limits, but that also should not prevent you from learning from this analysis. Video inside article.

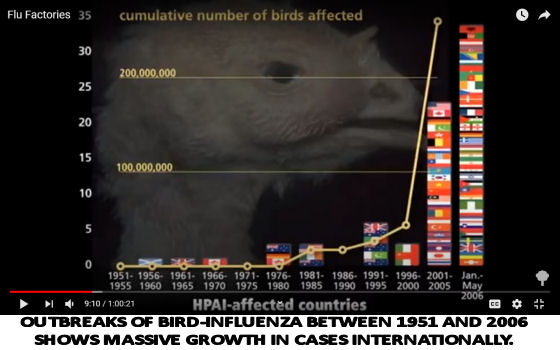

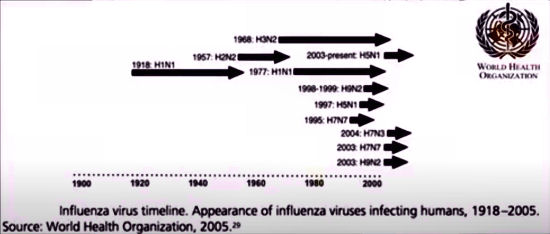

Will governments buy back vital resources and essential services from the embattled private sector, or will they allow the wealthy to pick up resources and monopolies cheaply, pressing the unemployed and endebted into slave-like conditions? Can we adapt to or avoid a future that appears to hold more and worse pandemics? If COVID-19 is a pandemic designed for elite purposes to cull the aged and weak, why have some governments tried to protect their vulnerable populations? We have obviously become too economically dependent on the model of continuous accelerated growth in human numbers and human activities globally to be able to protect ourselves from the pandemics that come with this economic model. At the same time the long-predicted oil-resources breakdown in supply is looming. Can any good come of this? Is this an opportunity?

Will governments buy back vital resources and essential services from the embattled private sector, or will they allow the wealthy to pick up resources and monopolies cheaply, pressing the unemployed and endebted into slave-like conditions? Can we adapt to or avoid a future that appears to hold more and worse pandemics? If COVID-19 is a pandemic designed for elite purposes to cull the aged and weak, why have some governments tried to protect their vulnerable populations? We have obviously become too economically dependent on the model of continuous accelerated growth in human numbers and human activities globally to be able to protect ourselves from the pandemics that come with this economic model. At the same time the long-predicted oil-resources breakdown in supply is looming. Can any good come of this? Is this an opportunity?

In Australia ordinary environmentalists have seen a rising resistance to the protection of our natural environment from the very people they thought they could rely on – The Australian Greens and various big environmental NGOs. There has been a similar strange distancing from representing the economic and social interests of ordinary Australians. Among spokespeople for the Greens, this resistance has manifested as a militant effort to support Lib/Lab policy of massive population growth through planned and commercial immigration by conflating refugees with ordinary immigrants, and calling any attempt to reign in immigration "racist". Currency speculator, George Soros, was long suspected to be the source of this creeping political confusion. The hacking of the multi-billionaire’s Open Societies files has recently confirmed him to be the organising force for the new-age ideology of open borders and the illogical stigmatisation of all care for national interests and cohesion.

In Australia ordinary environmentalists have seen a rising resistance to the protection of our natural environment from the very people they thought they could rely on – The Australian Greens and various big environmental NGOs. There has been a similar strange distancing from representing the economic and social interests of ordinary Australians. Among spokespeople for the Greens, this resistance has manifested as a militant effort to support Lib/Lab policy of massive population growth through planned and commercial immigration by conflating refugees with ordinary immigrants, and calling any attempt to reign in immigration "racist". Currency speculator, George Soros, was long suspected to be the source of this creeping political confusion. The hacking of the multi-billionaire’s Open Societies files has recently confirmed him to be the organising force for the new-age ideology of open borders and the illogical stigmatisation of all care for national interests and cohesion. What motivates George Soros, the multibillionaire, to prosecute open borders? Much has been written about George Soros and his multipronged attempts to subvert national political processes. Many have suggested that he is psychopathic, enjoys chaos, and makes money out of what he does – but, as someone wrote:

What motivates George Soros, the multibillionaire, to prosecute open borders? Much has been written about George Soros and his multipronged attempts to subvert national political processes. Many have suggested that he is psychopathic, enjoys chaos, and makes money out of what he does – but, as someone wrote: Update 1 June 2015: See new related articles:

Update 1 June 2015: See new related articles:  We believe that some Australian universities may be sending away Russian PhD students, as under new sanctions they are not allowed to teach some of them.

We believe that some Australian universities may be sending away Russian PhD students, as under new sanctions they are not allowed to teach some of them.  Republished from the Australian investigative program,

Republished from the Australian investigative program,

The United States and United Kingdom have even more inegalitarian domestic economies than many of the countries they trade with. Fifty-eight per cent of the nations that Australia's consumption depends on have greater internal equality than Australia. Nine per cent of countries we trade with have more egalitarian economies. This counters the overall trend of developed countries having more egalitarian domestic economies than those they trade with. Russia, however, despite high inequality within its border, in 2010 had the lowest inequality footprint in the world because approximately 62 percent of its international trade was with Europe and the Commonwealth of Independent States, where inequality is low. Commodities producing countries tend also to produce inequality. Globalisation does not have a positive effect on inequality. The findings come from the first ever ‘inequality footprint’ of nations, created by researchers at the University of Sydney, demonstrating the link that each country’s domestic economic activity has to income distribution elsewhere in the world.

The United States and United Kingdom have even more inegalitarian domestic economies than many of the countries they trade with. Fifty-eight per cent of the nations that Australia's consumption depends on have greater internal equality than Australia. Nine per cent of countries we trade with have more egalitarian economies. This counters the overall trend of developed countries having more egalitarian domestic economies than those they trade with. Russia, however, despite high inequality within its border, in 2010 had the lowest inequality footprint in the world because approximately 62 percent of its international trade was with Europe and the Commonwealth of Independent States, where inequality is low. Commodities producing countries tend also to produce inequality. Globalisation does not have a positive effect on inequality. The findings come from the first ever ‘inequality footprint’ of nations, created by researchers at the University of Sydney, demonstrating the link that each country’s domestic economic activity has to income distribution elsewhere in the world. See also, BBC 2012 article by Charlotte Pritchard, "Is one in eight Australians really poor?", from which this photo comes.

See also, BBC 2012 article by Charlotte Pritchard, "Is one in eight Australians really poor?", from which this photo comes.

The political left-of-center is losing the war; learn from Scandinavian states "We are losing the war. And by we, I mean the politically left-of-centre; I mean the Labor Party and other social democratic parties around the world, I mean the trade unions, and I mean the environmental movement. We sometimes win battles, but overall we are not winning. I repeat, we are losing the war. We sometimes win elections, but usually on the terms of our opposition. We are in office, but not in power. And at all times we are fighting defensive, rearguard actions to protect the things we have achieved and built up—the social welfare safety net; industrial relations and workplace rights and protections; environmental protections and national parks; publicly owned assets; rules against the abuse of market power. Our opponents are emboldened and enjoy unprecedented media power." From a speech by

The political left-of-center is losing the war; learn from Scandinavian states "We are losing the war. And by we, I mean the politically left-of-centre; I mean the Labor Party and other social democratic parties around the world, I mean the trade unions, and I mean the environmental movement. We sometimes win battles, but overall we are not winning. I repeat, we are losing the war. We sometimes win elections, but usually on the terms of our opposition. We are in office, but not in power. And at all times we are fighting defensive, rearguard actions to protect the things we have achieved and built up—the social welfare safety net; industrial relations and workplace rights and protections; environmental protections and national parks; publicly owned assets; rules against the abuse of market power. Our opponents are emboldened and enjoy unprecedented media power." From a speech by

(Original Source by John Kozy, Global Research, February 13, 2012:

(Original Source by John Kozy, Global Research, February 13, 2012:  On May 18, 2010 I was severely brain-injured in a collision which occurred when I was cycling to my job as a Patient Support Officer (cleaner) at the Royal Brisbane and Women's Hospital. This was the tragic end to my absence from my real career choice and qualifications in computer science, forced on me because of misinformation given to me by my last employers in that field. At the time of the accident I was seriously attempting to return to my career, having learned, to my utter disgust, that the project from which I was sacked after two years, which I was told was a complete failure, had not failed at all. I may have forgotten a lot due to my brain injury, but I have not forgotten this. The injustice is seared in my memory and I am now publishing the documents that record the truth of my pre-injury predicament. They may also help others in this cut-throat industry. This will be the first in a number of contemplated articles on my experience of brain injury. Sheila Newman has also written a book about it which will probably be published late this year or the next.

On May 18, 2010 I was severely brain-injured in a collision which occurred when I was cycling to my job as a Patient Support Officer (cleaner) at the Royal Brisbane and Women's Hospital. This was the tragic end to my absence from my real career choice and qualifications in computer science, forced on me because of misinformation given to me by my last employers in that field. At the time of the accident I was seriously attempting to return to my career, having learned, to my utter disgust, that the project from which I was sacked after two years, which I was told was a complete failure, had not failed at all. I may have forgotten a lot due to my brain injury, but I have not forgotten this. The injustice is seared in my memory and I am now publishing the documents that record the truth of my pre-injury predicament. They may also help others in this cut-throat industry. This will be the first in a number of contemplated articles on my experience of brain injury. Sheila Newman has also written a book about it which will probably be published late this year or the next.

The author of the article suggests that the rule of law and federalism are no longer operating in Australia. As a result of three decades of Australian governments enthusiastically embracing neo-liberal capitalist policies, power is now concentrated at the central level. Government captured by the few: the two major parties in collusion with big business nationally and internationally. With no indication from the Australian people that they seek the radical systemic reforms required to reinstate federalism and reclaim a fairer and more just society, only small steps towards reform appear realistic. The revision of the Preamble to the Constitution as a precursor to further constitutional change and the reassertion of state powers supporting of local power are suggested as first steps.

The author of the article suggests that the rule of law and federalism are no longer operating in Australia. As a result of three decades of Australian governments enthusiastically embracing neo-liberal capitalist policies, power is now concentrated at the central level. Government captured by the few: the two major parties in collusion with big business nationally and internationally. With no indication from the Australian people that they seek the radical systemic reforms required to reinstate federalism and reclaim a fairer and more just society, only small steps towards reform appear realistic. The revision of the Preamble to the Constitution as a precursor to further constitutional change and the reassertion of state powers supporting of local power are suggested as first steps.

(Article by Sheila Newman and Tony Boys.) Burma, now known as Myanmar, nationalised its oil and gas industries after a long history of foreign exploitation. Now the new government seems to be making friends with globalists and, Australian-style, setting up to sell their resources for what looks like the final gasp of the growth/industrial economy. Comments from Tony Boys, regional specialist, on how the locals may fare.

(Article by Sheila Newman and Tony Boys.) Burma, now known as Myanmar, nationalised its oil and gas industries after a long history of foreign exploitation. Now the new government seems to be making friends with globalists and, Australian-style, setting up to sell their resources for what looks like the final gasp of the growth/industrial economy. Comments from Tony Boys, regional specialist, on how the locals may fare.

In her Quarterly Essay piece, "Great Expectations," Laura Tingle loads a gun with a big bullet that she never shoots - which I thought any writer knew was a no-no. She says that "constant mass migration" " more than anything else" pushed the Australian economy and the population through waves of rapid change. The whole time I was reading her essay I was waiting for the gun to go off and for Detective Tingle to say two obvious things ...

In her Quarterly Essay piece, "Great Expectations," Laura Tingle loads a gun with a big bullet that she never shoots - which I thought any writer knew was a no-no. She says that "constant mass migration" " more than anything else" pushed the Australian economy and the population through waves of rapid change. The whole time I was reading her essay I was waiting for the gun to go off and for Detective Tingle to say two obvious things ...

This article identifies a tendency internationally to desensitize the public to the mass-murder by Western-supported governments of whole peoples whom they find inconvenient. Australia has a history of cultivating 'wilful blindness' to these events in our neighborhood, under the leadership of powerful government figures. Geoffrey Taylor here draws our attention to an example of such a complex attitude in an interview with Paul Keating last year. [This article started out as a response to

This article identifies a tendency internationally to desensitize the public to the mass-murder by Western-supported governments of whole peoples whom they find inconvenient. Australia has a history of cultivating 'wilful blindness' to these events in our neighborhood, under the leadership of powerful government figures. Geoffrey Taylor here draws our attention to an example of such a complex attitude in an interview with Paul Keating last year. [This article started out as a response to

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

I was moved to investigate further when on April 5th candobetter.net received an anonymous comment, entitled, "Koala left clinging to a tree after land clearing."

I was moved to investigate further when on April 5th candobetter.net received an anonymous comment, entitled, "Koala left clinging to a tree after land clearing."

This article comes from the background research for the Freewaves Feminist Magazine Show on 3RPP Radio Port Phillip, Victoria, Thursday, 20 August 2009. On the show with me was Catherine Manning, who wrote

This article comes from the background research for the Freewaves Feminist Magazine Show on 3RPP Radio Port Phillip, Victoria, Thursday, 20 August 2009. On the show with me was Catherine Manning, who wrote  On Wednesday, 12 August 2009 the Victorian Parliament Upper House passed a motion moved by the Liberal Nationals Coalition to disallow parts of a water regulation which would have seen the Brumby Labor Government break key water promises.

On Wednesday, 12 August 2009 the Victorian Parliament Upper House passed a motion moved by the Liberal Nationals Coalition to disallow parts of a water regulation which would have seen the Brumby Labor Government break key water promises.

Recent comments