Rudd's penchant for a 'big Australia' is behind his absurd record immigration policy. Population growth and congestion is out of control and is the common denominator driving up Australian land prices, electricity, water, inflation, consumer demand, interest rates, and consequently the costs of living of ordinary Australians.

Rudd's penchant for a 'big Australia' is behind his absurd record immigration policy. Population growth and congestion is out of control and is the common denominator driving up Australian land prices, electricity, water, inflation, consumer demand, interest rates, and consequently the costs of living of ordinary Australians.

Our state and federal public infrastructure cannot cope - roads, public transport, health, education, housing, you name it!

Our state and federal public infrastructure cannot cope.

The cost of living for ordinary Australians is becoming desperate!

BIGGER ELECTRICITY BILLS

Today, Origin Energy chief executive, Grant King, warned the Committee for the Economic Development of Australia in Sydney that Electricity prices across Australia were likely to triple over the next 10 years.

He blamed the combination of the federal government's mandatory renewable-energy targets, energy policy uncertainty, higher electricity transmission and distribution costs, and higher fuel costs would drive the increase.

King attributed the rise in electricity demand to booming sales in energy-inefficient flat-screen televisions and air-conditioners. ['Energy prices to triple', The Australian April 14, 2010] This is clearly a consequence of new housing development driven by population growth laregley fueld by record immigration. And the growth lobby like the Urban Taskforce are lapping up the new cash!

Last month, that dodgy NSW Government euphemism 'The Independent Pricing and Regulatory Tribunal (IPART)' approved electricity price rises of up to 64% over the next three years, with "those living outside the main cities will bear the brunt of the increases."

'Country Energy, which provides all of rural NSW customers with their electricity, has been allowed to raise its prices by the steepest amount, with an increase of $918 if the scheme is introduced; otherwise, the rise will be $601.

'Overall, Energy Australia customers will see prices rise by a total of 46 per cent, for Integral Energy 60 per cent, and for Country Energy 64 per cent.

Welfare groups have warned that the price rises will force many low-income households into ''energy poverty'', and they will not be able to afford to pay their bills.'

[Brisbane Courier Mail, 'Households to feel pinch as price of power soars', 19th March 2010]

BIGGER WATER RATES

Across Australia, water rates are on the rise as each capital city spends big on desalination plants to cope with their swelling populations.

Last April (2009) it was reported by the Essential Services Commission that Melbourne households faced water price hikes of up to 84% over five years. The key drivers were claimed to be the global economy (standard excuse) as well as government not keeping water infrastructure up to demand and so deferring infrastructure works for years. [The Age (Melb), 21 Apr 2009]

Just two days ago, (12th April 2010), with Melbourne's extravagant new desal plant blowing out to cost a whopping $5.7 billion, Melbourne's water prices will further escalate to pay the bill and because of the extravagant dependency of desalination for electricity, which is also going up in price.

'Over the past five years the price of electricity has increased 13 per cent a year in Victoria - and in NSW prices have risen 28 per cent a year in each of the past two years.'

['Water plans drift behind a veil of secrecy', The Age April 12, 2010]

BIGGER HOUSING PRICES

In 2009 Australian capital city house prices rose by 12.1%. Meanwhile Australia's homeless stands at 16,000. Key drivers for house prices surging are the government’s first-home owners’ grant boost.

['Web alert - warning on 'crazy' house prices', Sydney Morning Herald, 16th February 2010]

Other drivers are the inflow of new immigrants seeking accommodation and foreign nationals permitted to invest in Australia's residential housing market.

BIGGER MORTAGE INTEREST RATES

Last December, interest rates were predicted to rise 1% during 2010. But the drivers were the surge of capital projects in the next few years and China growth.

['Business, brace for 1% rise in interest rates in 2010', Sydney Moring Herald, 24th December 2009]

This month, all the banks followed the Reserve Bank in raising their mortgage rates by 25 basis points, making this the 5th interest rate rise since October and has pushed up mortgage costs by a total of almost $250 a month.

Treasurer Swan said the rise was “a painful reminder” the economy was improving. How out of touch is Swan?

Economists warned there could be at least one more rate rise before the end of the year.

['CBA, ANZ, Westpac follow as Reserve Bank raises official cash rate to 4.25%', Herald Sun , 6th April 2010]

BIGGER GROCERIES BILLS

It was confirmed just last November that Australians "are paying the fastest-rising food prices of any major developed nation. The cost of feeding a family has shot up more than 40 per cent this decade, new OECD figures reveal.

Experts say the explanation for our pricey produce and soaring staples is not drought, currency movements or transport costs. University of NSW associate professor Frank Zumbo said comparing costs over 10 years eliminated such variables and exposed our "cosy" supermarket duopoly as the main reason.

[Daily Telegraph, 'Australia has fastest-rising food prices of any major developed nation', 9th November 2009]

BIGGER MEAT PRICES

Wholesale butcher Kevin Masterton says the days of expensive cuts at cheap prices are over for Australian meat lovers. He's predicted Australian meat prices will never be the same again.

"Everyone is predicting Lamb will be the first Australian meat that is unaffordable. Some of the predictions I've seen is that lamb racks and cutlets will be one hundred dollars a kilo by the middle of this decade," Kevin said.

And it's all because we've been spoiled for choice. The drought has forced farmers' hands - they've had to off-load cattle to stay afloat. "They see that they are going to make more money on the cattle so they hold onto them for longer. There is also quite a bit of export, the economy has started to turn so there is less cattle in the market," Kevin said.

And it's a similar story when it comes to lamb. There's been a nine per cent jump in retail sales and a 10 per cent rise in national expenditure on the meat.

And this year the nation's sheep flock is forecast to hit its lowest point since 1905. "And we have got massive exports to the middle east, so if you take those factors into account they've had a pretty detrimental impact on the stock," Kevin said.

"Lamb has probably had the most spectacular increase - we are probably talking four to five dollars a kilo for the lamb cuts."

['Meat prices on the rise', Today Tonight, 3rd March 2010]

So there is not enough capacity in our meat livestock industry to cope with demand, hence meat prices are going up.

BIGGER PETROL COSTS

"Crude oil prices have surged to 18-month highs on the weekend and have swept petrol prices higher.

Oil prices could go to $US95 a barrel, warns analysts. Domestically, a litre of unleaded petrol costs $1.29, up 0.3 cents.

'Oil, which has been trading at between $US75 and $US85 a barrel for months, now appears to be in a new range that could go up to $95, according to oil trader and analyst Stephen Schork.'

[Perth Sunday Times, 'Petrol prices set to rise, 6th April, 2010]

The trend suggests that Australian petrol prices could be nudging $2 a litre in two years time and this time it will stay there in line with international prices. Ain't globalisation and free trade great for locals!

BIGGER POORER AUSTRALIA

The compounding cost of living for ordinary Australians is becoming desperate!

What the economic data doesn't report is the social consequences - like the growing depression, family breakdowns, homelessness, substance abuse, suicides and domestic violence.

The long term impacts on children are devastating for not only the children but the future society they become adults in.

More people into less space driving up living costs, only delivers a poorer Australia.

The drivers of these costs must be addressed as a national priority.

The BIG elephant in the room is starkly Rudd's immigration out of control!

Rudd's red herring Population Minister is just that, an election red herring.

Rampant Rudd and his immigration wrath must be stopped!

We’ve got a problem in Australia. For many decades our way of life has been under attack from within. A persistent voice via the mainstream media has ruled our dinner party conversations.

We’ve got a problem in Australia. For many decades our way of life has been under attack from within. A persistent voice via the mainstream media has ruled our dinner party conversations.

If politicians don’t include immigration numbers in their platforms, how can voters make their voices heard? Established theory explains why the pressure for faster population growth, driven by a minority that benefits commercially, is much more effective than the pressure against population growth from a majority that bears the costs.

If politicians don’t include immigration numbers in their platforms, how can voters make their voices heard? Established theory explains why the pressure for faster population growth, driven by a minority that benefits commercially, is much more effective than the pressure against population growth from a majority that bears the costs. Although more people are openly expressing opposition to Australia's extreme immigration numbers, some people are still afraid to speak out, or even to admit there is a problem. How has self-censorship become so effective in silencing objection to the excessive volume of immigration that is driving rapid population growth and cost of living increase in Australia?

Although more people are openly expressing opposition to Australia's extreme immigration numbers, some people are still afraid to speak out, or even to admit there is a problem. How has self-censorship become so effective in silencing objection to the excessive volume of immigration that is driving rapid population growth and cost of living increase in Australia? 11am-1pm, 12 July 2025 Event by

11am-1pm, 12 July 2025 Event by  Without a mature discussion on population growth, the housing crisis will extend for years to come, according to Sustainable Population Australia (SPA). SPA National president Peter Strachan says there is deep denial within the government that population is the main factor driving housing demand.

Without a mature discussion on population growth, the housing crisis will extend for years to come, according to Sustainable Population Australia (SPA). SPA National president Peter Strachan says there is deep denial within the government that population is the main factor driving housing demand. "The housing market is facing the worst housing affordability ever - yet house prices continue to show extreme strength. So what's the housing end game when the majority of people can't afford a home - what's the future for house prices. This video features sections from the video:

"The housing market is facing the worst housing affordability ever - yet house prices continue to show extreme strength. So what's the housing end game when the majority of people can't afford a home - what's the future for house prices. This video features sections from the video:  Every time I turn on ABC Melbourne radio I am confronted with problems about which I can do nothing. A friend of mine visiting from Thailand described this radio station as “a problem a day,” which resonated loudly with me. The latest problem which gets non-stop air time is “the housing crisis.” Then there is the problem of Melbourne's newer suburbs with only one way in and one way out, keeping cars waiting in long queues to exit on the way to work.

Every time I turn on ABC Melbourne radio I am confronted with problems about which I can do nothing. A friend of mine visiting from Thailand described this radio station as “a problem a day,” which resonated loudly with me. The latest problem which gets non-stop air time is “the housing crisis.” Then there is the problem of Melbourne's newer suburbs with only one way in and one way out, keeping cars waiting in long queues to exit on the way to work. The property development and construction industry is having a lend of Australia: By promoting massive migration numbers, it keeps housing and land costs high and it keeps its own costs low.

The property development and construction industry is having a lend of Australia: By promoting massive migration numbers, it keeps housing and land costs high and it keeps its own costs low.

The following is an excerpt from the Guardian, 14/03/2022, pertaining to Premier Daniel Andrews. Andrews also suggested the “great Australian dream” of owning a home was less important to younger generations, especially given the increasing cost of property – the median price of a home in Melbourne is now $1.1m.

The following is an excerpt from the Guardian, 14/03/2022, pertaining to Premier Daniel Andrews. Andrews also suggested the “great Australian dream” of owning a home was less important to younger generations, especially given the increasing cost of property – the median price of a home in Melbourne is now $1.1m. "The Affordable Housing Party: the single issue party dedicated to solving Australia's housing affordability crisis. Australians are now living with some of the most unaffordable housing in the world, but it doesn't have to be this way! Obscene tax incentives to invest in property. Our lawmakers profit from the status quo. We opened up our housing market to investors all over the world. Australia's rapid population growth. Home buyers are paying too much to try to compete with investors. This can't go on forever!" Former journalist, Andrew Potts, Sydney, registered the Affordable Housing Party (AHP) with the Australian Electoral Commission earlier this month. Policies include: Phasing out negative gearing and capital gains discount on investment property sales; Stopping overseas buyers from buying Australian properties; Taxing properties left empty by investors; Cutting down immigration to 70,000 annually; Banning full time Airbnb properties; Ending “no fault” evictions for rental properties. Facebook page is

"The Affordable Housing Party: the single issue party dedicated to solving Australia's housing affordability crisis. Australians are now living with some of the most unaffordable housing in the world, but it doesn't have to be this way! Obscene tax incentives to invest in property. Our lawmakers profit from the status quo. We opened up our housing market to investors all over the world. Australia's rapid population growth. Home buyers are paying too much to try to compete with investors. This can't go on forever!" Former journalist, Andrew Potts, Sydney, registered the Affordable Housing Party (AHP) with the Australian Electoral Commission earlier this month. Policies include: Phasing out negative gearing and capital gains discount on investment property sales; Stopping overseas buyers from buying Australian properties; Taxing properties left empty by investors; Cutting down immigration to 70,000 annually; Banning full time Airbnb properties; Ending “no fault” evictions for rental properties. Facebook page is  Chinese investors

Chinese investors

"For more than a decade, the Productivity Commission has debunked the common myth that immigration can overcome population ageing. [...] If Australia was truly a ‘clever’ country like Japan, it would manage population ageing by: 1) better utilising existing workers, given there is significant spare capacity in the labour market; and 2) where required resort to technological solutions. The last thing that Australia should be doing is running a mass immigration program which, as noted many times by the PC, cannot provide a long-term solution to ageing, lowers wages, and places increasing strains on infrastructure, housing and the natural environment." This article first published at

"For more than a decade, the Productivity Commission has debunked the common myth that immigration can overcome population ageing. [...] If Australia was truly a ‘clever’ country like Japan, it would manage population ageing by: 1) better utilising existing workers, given there is significant spare capacity in the labour market; and 2) where required resort to technological solutions. The last thing that Australia should be doing is running a mass immigration program which, as noted many times by the PC, cannot provide a long-term solution to ageing, lowers wages, and places increasing strains on infrastructure, housing and the natural environment." This article first published at

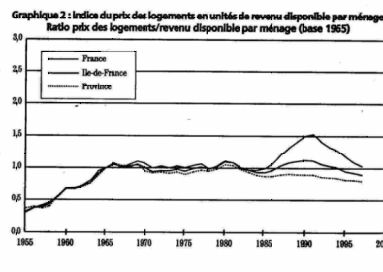

A growing number of French people own their own homes. Ownership runs at 64% today, and is expected to grow to 68% in the next six years. France is well behind other European countries though in home ownership. The champions are in Eastern Europe. 96% of people own their own homes in Romania. 70% own their own homes in Italy. Seven out of ten French home owners have entirely paid off their home loan. For people purchasing today, the average time to pay off a home is 17 years. This is a situation to dream of for Australian home-buyers, who are only second to Hong Kong's in suffering under a terrible system. The French system discourages land-speculation in a number of ways which therefore deter the flourishing of a malignant property and growth lobby there. This article is based on a France2 news item

A growing number of French people own their own homes. Ownership runs at 64% today, and is expected to grow to 68% in the next six years. France is well behind other European countries though in home ownership. The champions are in Eastern Europe. 96% of people own their own homes in Romania. 70% own their own homes in Italy. Seven out of ten French home owners have entirely paid off their home loan. For people purchasing today, the average time to pay off a home is 17 years. This is a situation to dream of for Australian home-buyers, who are only second to Hong Kong's in suffering under a terrible system. The French system discourages land-speculation in a number of ways which therefore deter the flourishing of a malignant property and growth lobby there. This article is based on a France2 news item  Five million people in France own more than one property. 700,000 own more than four properties. Bricks and mortar are the preferred investment - more than the National savings account (le Livret A), bank shares, life insurance or gold.

Five million people in France own more than one property. 700,000 own more than four properties. Bricks and mortar are the preferred investment - more than the National savings account (le Livret A), bank shares, life insurance or gold. "Address population growth, tax concessions and foreign buyers." (Sustainable Population Party). The federally registered Sustainable Population Party says Australia’s housing affordability crisis is largely driven by demand-side factors, rather than supply-side issues. The party will take its message to the street at upcoming auctions across Melbourne, including The Block Auction on Sunday October 11.

"Address population growth, tax concessions and foreign buyers." (Sustainable Population Party). The federally registered Sustainable Population Party says Australia’s housing affordability crisis is largely driven by demand-side factors, rather than supply-side issues. The party will take its message to the street at upcoming auctions across Melbourne, including The Block Auction on Sunday October 11. William Bourke, President of the

William Bourke, President of the  The Vietnam War led by the US spanned most of the 1960s through to 1975. The famous motto “All the way with LBJ” developed as a result of Australian PM Harold Holt’s commitment to military support of the US led War in collaboration with Lyndon Baines Johnson, the US President.

The Vietnam War led by the US spanned most of the 1960s through to 1975. The famous motto “All the way with LBJ” developed as a result of Australian PM Harold Holt’s commitment to military support of the US led War in collaboration with Lyndon Baines Johnson, the US President.

They are buying houses and farms in order to exploit opportunities for profit, including removal of food from Australia. We have empty houses throughout the suburbs of capital cities that may have been purchased to diversify some foreigner's asset portfolio.

They are buying houses and farms in order to exploit opportunities for profit, including removal of food from Australia. We have empty houses throughout the suburbs of capital cities that may have been purchased to diversify some foreigner's asset portfolio.

Ageist ABC

Ageist ABC

Recent comments