We applaud the initiatives of the Gillard Federal Government today in refunding Aged Care. PM unveils $3.7bn overhaul of aged care, Friday April 20, 2012. We are particularly impressed to read that: "The [Gillard] government rejected a Productivity Commission recommendation that proposed allowing the use of reverse mortgage facilities to help fund care costs." Good on the Gillard government! Reverse mortgages steal inheritances, impoverish youth and render them homeless, and amount to double charges for old age care provision (on top of taxes). We republish a relevant and well-researched article on this matter. See also "Ageism" and ABC article on reverse mortgages.

We applaud the initiatives of the Gillard Federal Government today in refunding Aged Care. PM unveils $3.7bn overhaul of aged care, Friday April 20, 2012. We are particularly impressed to read that: "The [Gillard] government rejected a Productivity Commission recommendation that proposed allowing the use of reverse mortgage facilities to help fund care costs." Good on the Gillard government! Reverse mortgages steal inheritances, impoverish youth and render them homeless, and amount to double charges for old age care provision (on top of taxes). We republish a relevant and well-researched article on this matter. See also "Ageism" and ABC article on reverse mortgages.

Article by Sheila Newman with Jill Quirk. First published June 16, 2011. Republished for news relevance on April 20, 2012. Title changed at this time to include 'Reverse mortgage and other'.

Original 'teaser' for 2011 publication

This article applies to all Australians, including men. Women live longer, however, so age discrimination is actually also a feminist issue. The Australian system builds in a bias of financial vulnerability for women. Any property women may have accumulated despite this bias is at risk in old age due to discrimination against the aged for health care. If you have assets worth more than $39,000 you may be levied up to $30.55 per day. Unless the people who live in the house you occupied are your partner or relatives who qualify for some kind of income supplement, which is similarly assessed. There is a “financial hardship” provision but it is assessed on a case by case basis, which amounts to secretly, and, given the income criteria above, one would expect it to be Dickensian. And population pressure makes it all worse.

Main points

Women live longer so age discrimination is also a feminist issue

Any property ordinary people may have accumulated is at risk in old age due to discrimination against the aged for health care

• If you have assets worth more than $39,000 you may be levied up to $30.55 per day

• Unless the people who live in the house you occupied are your partner or qualify for income support, but then only if they qualify for some kind of income supplement, which is similarly assessed.

• There is a “financial hardship” provision but it is assessed on a case by case basis and, given the income criteria above, one would expect it to be Dickensian.

Aged Care robs the poor of their Land and Inheritance

• This algorithm obviously doesn’t take property inflation into account, either as a cost or as a so-called “asset” and it doesn’t ensure that your children and grandchildren will be protected and sheltered after you have gone. It makes it even easier for the banks to own everything and for everything you have worked for to go into the hands of private business interests.

How the government is making the elderly pay again for their health care

Nursing home care: The residential care facility becomes the chronically ill person's home. It counts as medical care for income tax purposes, but is not counted as medical care for other purposes. Arguably this is a breach of citizens' rights to free public medical care in Australia, denied them on the basis of age.

High land costs erode affordability of nursing homes and shrink profit margins

What else is really wrong with the health care system: why so many elderly people occupy ?80% of beds

• Ambulances misused

• Lack of visiting nurses

• Lack of visiting GPs

• Lack of trained Personal Care Assistants

• Rental and Land costs erode funds for wages, so we cannot pay these people properly

• Many of the 80% elderly in hospital beds could be dealt with better and more cheaply at home

Some fixes for the Oz Health Care system within the limitations of the current [insufficient] paradigm

Recommendation: Close beds and divert the funds to community-based care.

Conclusion: Why the costs of aged health care are not the taxpayer or the elderly person’s responsibility, but the government’s. (Land costs and failure to provide services in the community)

Women live longer so Age-Discrimination is a Feminist issue:

Although this article definitely concerns elderly men, age discrimination affects more women than it does men and they are materially more vulnerable to its effects. Why does age-discrimination affect more women? Simply because more women live longer, by a substantial margin.

We choose here to attract the attention of elderly women to this matter because it tends to take them unawares. We want men to read this article as well though because it directly concerns them as well. It also concerns peoples' children because it affects their inheritance rights to shelter in a country where most people can no longer guarantee indefinitely against homelessness.

The Australian System builds in a bias of financial vulnerability for women

Why are women more materially vulnerable to the effects of age-discrimination?

By materially vulnerable, we are referring to the average earnings, savings, shares, superannuation and property held by women. It is well-known that women earn less overall than men because women’s work is less well-paid. For elderly women this was actually true in legislation until 1972 when women were awarded equal pay for equal work, however 40% of women did not do work which was considered equal to men’s work, and this situation is still not entirely remedied. Many women also work fewer hours due to caring for children. Women are also less likely to be promoted into high management with higher pay in any workforce situation due to positive discrimination towards men in the work-force.

Any property Women accumulate is at risk in old age due to discrimination against the aged for health care

Some of the positive discrimination in the work force towards men is partly rectified by the tendency for wives to inherit from their deceased husbands. This however works against women whose husbands remarry, for it is likely to be the last wife who inherits what the husband has accumulated. Divorce also tends to leave women worse off than it leaves men if they have children, particularly if the married couple’s income relied on the man as the sole wage-earner. Although divorced couples are obliged to split up their property, they are not obliged to split up the wage ongoing. The man (or the woman’s wage) is their own. Courts will award payments to the children, but these tend to be rather inadequate. That means that if the woman is caring for the children and cannot work, she must rely on subsistence allowances from Social Security. If she is a mother then her chances of having a history of equal wages, education and training are less than a man’s, as are her future chances of getting these.

Historically British territories and colonies have tended to have inheritance laws favouring males, notably in Britain where, until 1922, only the first born male could inherit land. Although parents may now leave their estates to whomever they please, the tendency is still to leave more to boys than to girls. This situation puts women at an immediate disadvantage in life and is one of the reasons that women are intrinsically more dependent on marriage to raise children in our society than in France, for instance, where equal inheritance by children is the law.

Where a person marries more than once, the tendency of the law is to award all the estate to the latest spouse. This usually leaves any earlier wives, including de facto wives, in the cold, along with their children, who are very poorly protected under Australian law. These situations increase the bias against female property accumulation and mean that when women are old they have lesser means to enjoy their retirement and to pay for health care.

[There are exceptions which you can read about in a good 2010 transcript and interview on the ABC Law Report http://www.abc.net.au/rn/lawreport/stories/2010/3016770.htm] Note however, that few ordinary women can afford to pay a lawyer, let alone go to court.

Women and Age Discrimination in our Medical Care System

There is a lot, a lot wrong with the way that our medical system treats the elderly - male and female. Women however bear the brunt of this medical system age discrimination.

We are born in a women'’s hospital, a general hospital or at home. At this point in our lives all efforts are made to give us the best start in life. New babies are screened for medical and sensory defects and early intervention is commenced where any needs are detected. Whilst maternal care is probably not as luxurious as it was a few decades ago when mothers were relieved of normal responsibilities and full care of their babies for about 10 days after the birth, they are still at least cared for in hospital for a day or two, funded through the medical system.

During childhood, serious illnesses and accidents are dealt with through the medical system and children’s' hospitals. Of course where long term care is needed for a disability, the system is seriously inadequate. Institutions and processes caring for the seriously disabled are universally underfunded and under-resourced.

Treatment of other accidents or injuries are paid for through Medicare national medical insurance –(up to a point) in the public hospital system or the private hospital system where, ironically, if you carry private insurance, you end up paying far more in out of pocket expense than you would if you carried no insurance and were treated in the public system. Still - one has a choice – if one has the money!

How the situation changes when you are elderly

When you are classified as elderly, the situation changes. You go into hospital as a normal adult, with, for example, a leg break from a fall at home. When hospital treatment has gone as far as it can you are then assessed by a team of medical and social work professionals in conjunction with your family (if you have one). If, following this, you are unable to go home again you will need to go into long term care.

At this point your whole accumulated wealth over a lifetime and income will be assessed in determining how much you now pay for essential medical care.

If you have no wealth apart from your house, this may need to be sold or remortgaged to pay a deposit on a place in an aged care facility. Medicare does not care for your next hospitalization - the nursing home. The Act that provides for this is The Aged Care Act 1997. The exceptions for low-income earners are truly Dickensian:

According to Elderly Rights Advocacy (www.era.asn.au):

“The following people are not required to pay an accommodation charge:

• residents whose assets are worth less than 2.25 times the annual single age pension ($39,000 as at 20/3/11);

• users of respite care;

• anyone who is suffering financial hardship (this is decided by the Department of Health and Ageing);

• residents entering low level care or an extra service facility to receive either low or high level care (these residents may be asked to pay an accommodation bond instead): and

• “concessional” residents.”

Aged Care robs the poor of their Land and Inheritance

Whatever the thresholds and grab-back clauses, an important consideration that is never canvassed is the effect on peoples’ inheritance. Land and housing go out of the family and into private business. In a context of rising housing prices family homes and other assets which might have compensated children for the harsh economic conditions they have been born into, are not available to them.

What do people pay taxes for? Most people pay somewhere around one third of their income in income tax. On top of this there are rates and charges for services, and on top of these, the Goods and Service Tax (GST).

What do we get in return?

Before the second world war the rate of income tax was a great deal less – perhaps around 10%. Income tax was introduced to Australian states between 1880 and 1907. In 1849 in NSW income tax was introduced at the rate of 6 pence in the pound. (A pound contained 240 pence]

Overall we work harder for many less basics and we need more costly items, such as cars for travel. The major cost which has risen is the cost of land, which underpins all other costs and cuts profits.

The care of elderly people and of disabled people used to be provided mainly by the state, using crown land, for which no rent was charged. The state did not need to make a profit and costs were paid for by income tax. The state has since sold off most of the land where buildings with suitable services were provided to private developers. Most of those developers have turned this land over to private housing. So the services it once provided have disappeared. As population has increased in this country (due to government policies to increase it through immigration) the price of land for any building or business, including agriculture, has greatly increased – to levels among the highest in the world.

Nursing care and special accommodation is now provided by private business, which needs to make a profit.

Now old age care providers complain that they not only cannot make sufficient profits, but they cannot even make ends meet. All sorts of adjustments have been made to the supply and remuneration of labour in order to mitigate this problem. For instance doctors and nurses have been imported from other countries and these people are taxed at a much higher rate than Australian nationals. In this way the government actually cuts the cost of wages in some government facilities. Another instance is where registered nurses and state enrolled nurses have been replaced by Personal Service Attendants, with no professional health delivery training, who are placed in charge of frail and elderly persons with medical problems and who need their medication supervised.

The one adjustment that needs to be made is the reduction in the cost of land and rent.

This discriminatory treatment of a whole class of citizens has far-reaching undesirable consequences for most of our population, but it advantages the property development and conveyancing industry. Probably due to their enormous influence over Australian governments, this economically and socially unsustainable situation continues to consolidate.

Ageist growth-spruikers normalise dispossession and unfair imposts

For instance Bernard Salt, of KPMG, and Andrew MacLeod, of The Committee for Melbourne, with the help of Murdoch's Herald Sun, recently tried to market the idea of older people selling their low density properties to make way for higher density ones for younger people.

"If they are an empty-nester living near a school they are actually taking a role that from a society's perspective would be better taken by a family." (Andrew MacLeod)

See the article, "Should Jeannie Pratt and Elisabeth Murdoch downsize to high rises in Activity Centers to give young people more room?" There was no acknowledgement that, in the normal course of life, old peoples' properties go to their children or other relatives who survive them. For the property industry, this traditional legacy is undesirable because it cuts down on their potential opportunities to make money on property transactions. It does this by avoiding a commercial transaction in the transmission of property. The state still makes a quid, through death duties, but the State and the property development hanger-ons (conveyancers/lawyers, subdividers, builders, agents etc) get few or no bites at the property of the deceased.

“Now Australia's "Productivity Commission," is advocating so-called "reforms" for the $10.1 billion sector, which would force people to pay between 5% and 25% of their incomes towards old-age care, and which would include their actual homes as part of their incomes. This proposal has been called "HECS for the elderly."” (April 22, 2011, Herald Sun

In fact this proposal does not seem much different from what is already happening. Basically no person with any assets above $39,000 can keep ownership of their home and get aged care unless those who live in their house are pensioners of some kind with similarly small asset bases.

Such measures entail mortgages being taken on the family home, to be paid after the death of the home-owner. This makes the bank the owner of the home and capable of dispossessing any future inheritors or that they simply inherit colossal debts.

Serfdom for Australians

This is a form of serfdom.

It is all part of a trend toward dispossession of a larger and larger class of people. Ask yourself what will happen when - as in feudal times - only a very few people in society own all the property, all the assets and all the means of production. Everyone else will have only their labour and skills to sell in an employers' market.

Why would any free people allow such a thing to happen? If Australia were really a democracy, how could any government auspiced commission dare to propose such abrogation of basic rights through enslavement and theft? The excuse is always 'economic efficiency', but this is really only an excuse. It does not stand up to examination because economic efficiency in Australia is constantly undermined by huge land and housing prices which erode profit margins. The only give in the system involves legislating for undemocratic wealth transfer - robbing the poor to give to the rich. Since the property moguls are constantly making laws and policies to push property prices up, that only leaves wages that can be pushed down and privately owned homes that can be acquired through debt induced by such government policies as mortgaging elderly peoples' homes by threatening to leave them with no services as they near death.

Under European law, the State not only has the duty of providing health care for people of all ages, but it also has the duty to provide shelter. And, when a person dies, if their property does not go to their nearest kin, taxes penalise those who acquire it. We need such laws in Australia.

What happens to elderly peoples' property when they go into homes? What happens to their children's inheritance? How much does it contribute to homelessness?

What can we do about it?

Can we demand back our rights to property?

Some fixes for the Oz Health Care system within the limitations of the current [insufficient] paradigm

80% of public hospital beds are taken up with people over 65 years old, of which a good proportion are over 75 years old. Private hospitals are different because people are admitted for elective surgery and discretionary treatments. Private hospitals can also pick and choose who they take.

Most hospitalisation for any person is in the last two years of life. Medically the most expensive time of anyone's life is in the last two years, regardless of age.

The aim of the nursing home care is to keep the person as independent as possible. Often the services they are paying for would cost less if they were delivered in their real homes.

Unfortunately, health cover - public and private - doesn't cover home care, except where it is provided by medical practitioners. Some private insurers do cover some post-hospitalisation care, such as rehabilitation.

Most chronic conditions could be treated preventatively and conservatively in the community. Take, for instance, the need of many diabetics for frequent continuing podiatry. With medicare you can get five visits per year, but this is often insufficient. Because podiatry access is insufficient, complications become more serious and require expensive and extensive hospitalisations for problems like ulcers, resistive infections and amputations. Those complications affect blood sugar and increase the risks of blindness, cardiac complications and muscle wastage.

People with chronic or end of life illnesses, like respiratory problems and heart failure, can live in the community for years with occasional medical crises and readjustments. When they have these crises in the community, their options boil down to General Practitioners, ambulances, hospitals and nursing homes. GPs are flat out and almost never make home visits any more. In many cases outside of big Australian cities, you just cannot get a G.P. if you don't already have one. You also cannot change to another if you don't like the first.

Ambulance services spend a lot of their very expensive time and taxpayer funds attending to crises caused by simple handicaps of age or disability - such as falls which interrupt the person's capacity to care for themselves only because the person is unable to get up unaided, even though they are not injured. These do not require specialist attention, but simple mechanical help. Just imagine if you could call 000 or another number and ask for prompt and necessary assistance from a non-specialist person employed by the council for residents. This could solve a lot of problems.

Respiratory problems and heart failure need good oversight in partnership with the patient in the home, as well as crisis plans. The person with such a slowly deteriorating condition should be able to ring their GPs if necessary. Because GPs are so busy, however, they ring 000, end up in a public emergency department, in an acute system, and the hospital goes into overdrive with admission, treatment, and tests.

Allied health professionals, such as physiotherapists, can be very useful for keeping people mobile. There are not enough allied health providers working in the community. For example, one large regional center might have only one physiotherapist for 10,000 people which is not sufficient, compared to three physiotherapists for six thousand, in an inner Melbourne suburb.

Personal Carers are skilled to help in all kinds of non-medical situations that can cause problems for people with medical conditions like frailty or poor balance. They can help with gardening, cooking, cleaning, tidying, posting letters, etc. Local government provides Personal Carers, but they are in high demand, badly distributed, and low-paid (of course). Wealthy people have greater access to them through private agencies, but it is very hard for ordinary people to get enough of these services. For this reason many people finish up in hospital with avoidable problems like malnutrition, falls, severe depression from isolation and helplessness.

In most states of Australia Community Care is very fragmented. You might get someone something through one scheme and someone else something through another scheme, but you need to know the ropes intimately. The knowledge and skills to source and find funding for scarce services is not available to everyone, which means that people often don't get access to things that are available and which they need, although often enough those things are not even available.

There is a crisis of insufficiency. It's not just a matter of coordination. Coordinating nothing does not lead to something. There is a catch-cry of "Stop Duplication," but why not have duplication if that is what is needed? Multiply services by four or five and you might begin to provide what is needed

Recommendation: Close beds and divert the funds to community-based care.

20 per cent of the population are admitted to Australian hospitals in any one year. This is much higher than in other countries.

It is obviously very costly to have lots of elderly people with mild problems taking up acute hospital beds. If we diverted the funds from a proportion of those beds to the training and deployment of usefully skilled non-medical staff in the community, so much more could be achieved, saving elderly Australians and their children from losing their homes to pay for unnecessarily expensive residential care.

So, why should Australians pay, not just with their taxes, but with their homes and inheritances, for aged care when the high costs of hospital care are ridiculous, avoidable, and not very effective?

Article by Sheila Newman with Jill Quirk, based on their presentation on 3RPP's Freewaves Feminist program, on 16 June 2011.

A candobetter.net article written in 2011

A candobetter.net article written in 2011

"Any encroachment into our green spaces is irreversible. On the other hand, remaining faithful to the original intention of the green wedges, would give us all a more disciplined, sustainable, and welcoming city for the future." (Lady Hamer on 29 August 2012 as the Libs prepare to give bulldozers open slather on our green wedges, destroying wildlife and natural amenity.) Labor and the Liberals response is less than edifying and does not solve the problem. Basically both parties are in cahoots with the developers against the people of Melbourne.

"Any encroachment into our green spaces is irreversible. On the other hand, remaining faithful to the original intention of the green wedges, would give us all a more disciplined, sustainable, and welcoming city for the future." (Lady Hamer on 29 August 2012 as the Libs prepare to give bulldozers open slather on our green wedges, destroying wildlife and natural amenity.) Labor and the Liberals response is less than edifying and does not solve the problem. Basically both parties are in cahoots with the developers against the people of Melbourne.

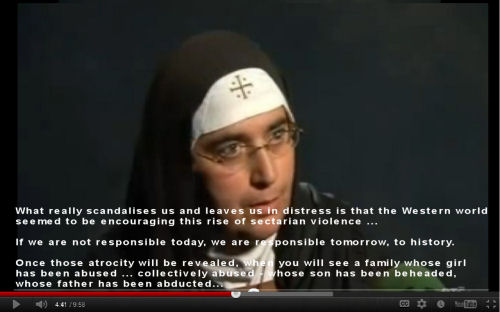

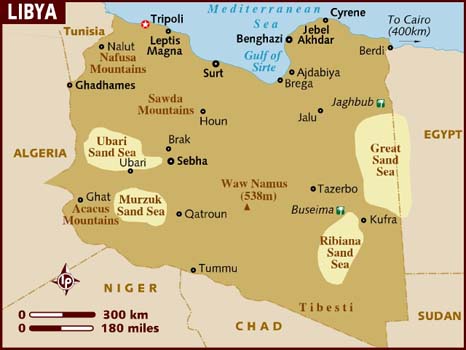

Attention Avaaz, Amnesty International, NATO, Hilary...

Attention Avaaz, Amnesty International, NATO, Hilary...

"What are they doing in Aleppo? Why are they doing? Why are they funded and helped and fueled with weapons and why are they introducing themselves in between the civilian population?"

"What are they doing in Aleppo? Why are they doing? Why are they funded and helped and fueled with weapons and why are they introducing themselves in between the civilian population?" It is great to see two politically engaged women speak out about Syria. On the one hand we have

It is great to see two politically engaged women speak out about Syria. On the one hand we have

Got 6 mins 25 secs to see this video about how Japanese women feel about nuclear power? Forget Hollywood. This is the Japanese reality!!This 6 min. 25 sec. will show you how Japanese women feel about nuclear power and how the Japanese male bureaucracy is trying to foist the deception of the century on the Japanese people by suddenly deciding to hold meetings behind closed doors!

Got 6 mins 25 secs to see this video about how Japanese women feel about nuclear power? Forget Hollywood. This is the Japanese reality!!This 6 min. 25 sec. will show you how Japanese women feel about nuclear power and how the Japanese male bureaucracy is trying to foist the deception of the century on the Japanese people by suddenly deciding to hold meetings behind closed doors!

We applaud the initiatives of the Gillard Federal Government today in refunding Aged Care.

We applaud the initiatives of the Gillard Federal Government today in refunding Aged Care.

It is surprising to pick up a book about wealth statistics and find that it segues so readily into another about psychopathology in young girls. The Spirit Level: Why Equality is Better for Everyone takes a revealing look at how wealth is distributed within different developed countries and Reviving Ophelia illustrates the decline of women's rights in the face of aggressive pornography and its effect on girls. Children and the general public were not widely exposed to explicit pornography and sexual sadism in the ‘traditional’ mass media of the industrial age, although these notions were commonly implicit in images and concepts used for marketing all kinds of things. Between that time and now, in 2011, the depiction of women almost exclusively as victims and objects of violence and pornography, explicitly and for that sole reason, has become a global business which operates 24/7. The implicit violence and sexualisation of women in ordinary marketing has also continued. At the same time, the official message is that western women don’t need Feminism anymore because equality has prevailed.

It is surprising to pick up a book about wealth statistics and find that it segues so readily into another about psychopathology in young girls. The Spirit Level: Why Equality is Better for Everyone takes a revealing look at how wealth is distributed within different developed countries and Reviving Ophelia illustrates the decline of women's rights in the face of aggressive pornography and its effect on girls. Children and the general public were not widely exposed to explicit pornography and sexual sadism in the ‘traditional’ mass media of the industrial age, although these notions were commonly implicit in images and concepts used for marketing all kinds of things. Between that time and now, in 2011, the depiction of women almost exclusively as victims and objects of violence and pornography, explicitly and for that sole reason, has become a global business which operates 24/7. The implicit violence and sexualisation of women in ordinary marketing has also continued. At the same time, the official message is that western women don’t need Feminism anymore because equality has prevailed.

The islamist Libyan 'rebels',

The islamist Libyan 'rebels',

This article was adapted from a radio program I hosted on 3RPP with Jenny Warfe as my guest, called "Women in Politics, Why don't more participate?" The program found that participation rates depend on definition. Indeed, we found that women dominate politics in Victoria, Australia - they just don't draw salaries. Inside we look at three classical theories for why women participate less in politics than men; argue that the Real Politics are outside Parliament, (Indian theory); give examples of Victorian women in politics outside Melbourne's parliament; analyse these women's political roles as more reactive and militant than planned-for and careerist. We also note that women led the French Revolution and we ask, "Are Female environmental activists in Victoria leading a new political movement?"

This article was adapted from a radio program I hosted on 3RPP with Jenny Warfe as my guest, called "Women in Politics, Why don't more participate?" The program found that participation rates depend on definition. Indeed, we found that women dominate politics in Victoria, Australia - they just don't draw salaries. Inside we look at three classical theories for why women participate less in politics than men; argue that the Real Politics are outside Parliament, (Indian theory); give examples of Victorian women in politics outside Melbourne's parliament; analyse these women's political roles as more reactive and militant than planned-for and careerist. We also note that women led the French Revolution and we ask, "Are Female environmental activists in Victoria leading a new political movement?" Illustration: "Boadicea Haranguing the Britons,"

Illustration: "Boadicea Haranguing the Britons,"

International Women's Day will once again be celebrated in all its darkness and its lightness at the Women's House at 3 Lyons Street Rye, on 8 March 2011. As usual there will be debates with women at the microphone. This time a feature will be women and Sharia Law. Known as "That Purple Place," the Women's Resource Centre was founded in 1982 by Elida Radig, a local and international tower of strength and force for good in Australia. Elida is also known for her creation of the Women's House program, where different female voices present "Freewaves" on 3RPP, Thursdays, 3-4pm. Rye Victoria's Women's Resource Centre is one of very few totally independent forces for women. It receives no government funding but is self-supporting, mostly through sales at its second hand store, which is one of the best loved in Victoria. There is also a cafe on the premises. The centre also provides hands-on support for women and their children in crisis.

International Women's Day will once again be celebrated in all its darkness and its lightness at the Women's House at 3 Lyons Street Rye, on 8 March 2011. As usual there will be debates with women at the microphone. This time a feature will be women and Sharia Law. Known as "That Purple Place," the Women's Resource Centre was founded in 1982 by Elida Radig, a local and international tower of strength and force for good in Australia. Elida is also known for her creation of the Women's House program, where different female voices present "Freewaves" on 3RPP, Thursdays, 3-4pm. Rye Victoria's Women's Resource Centre is one of very few totally independent forces for women. It receives no government funding but is self-supporting, mostly through sales at its second hand store, which is one of the best loved in Victoria. There is also a cafe on the premises. The centre also provides hands-on support for women and their children in crisis.

It has become an unwritten rule of political correctness that in order to criticize people or their ideology one must share a biological characteristic of the people being criticized. The inherent racism or sexism of this assumption is lost on those who insist upon it. Nevertheless the rule, in all of its absurdity, persists. Good arguments are routinely dismissed not on their merits, but by the fact that they are waged by someone thought to be racially or sexually disqualified to comment on the issue. This cannot apply here, for Madeline Weld, President of the Population Institute of Canada, is a woman, and she reproaches the fem-left for its collusion in the crippling of the Program of Action as set out by the International Conference on Population and Development in Cairo 16 years ago. Ms. Weld asserts that the feminist wing of the so-called "Environmental Justice" movement be held to account for their part in scuttling effective population stabilization programs in developing countries. Take this Betsy Hartmann!

It has become an unwritten rule of political correctness that in order to criticize people or their ideology one must share a biological characteristic of the people being criticized. The inherent racism or sexism of this assumption is lost on those who insist upon it. Nevertheless the rule, in all of its absurdity, persists. Good arguments are routinely dismissed not on their merits, but by the fact that they are waged by someone thought to be racially or sexually disqualified to comment on the issue. This cannot apply here, for Madeline Weld, President of the Population Institute of Canada, is a woman, and she reproaches the fem-left for its collusion in the crippling of the Program of Action as set out by the International Conference on Population and Development in Cairo 16 years ago. Ms. Weld asserts that the feminist wing of the so-called "Environmental Justice" movement be held to account for their part in scuttling effective population stabilization programs in developing countries. Take this Betsy Hartmann!

“ In sisterhood is our strength” Monday March 8 is International Women's Day. The Rye Women's House at 3 Lyons Street, Rye, Victoria, Phone 59 855 955, on the Mornington Peninsula will be celebrating its silver anniversary. Founded by Elida Radig, It is perhaps the oldest independent feminist institution of its kind in Victoria and it does an awesome International Women's Day. Please come along and experience the intellects, the humour, the politics, the music, the food... They mean what they say when they say, "The microphone is open to all women all day".

“ In sisterhood is our strength” Monday March 8 is International Women's Day. The Rye Women's House at 3 Lyons Street, Rye, Victoria, Phone 59 855 955, on the Mornington Peninsula will be celebrating its silver anniversary. Founded by Elida Radig, It is perhaps the oldest independent feminist institution of its kind in Victoria and it does an awesome International Women's Day. Please come along and experience the intellects, the humour, the politics, the music, the food... They mean what they say when they say, "The microphone is open to all women all day".

This article comes from the background research for the Freewaves Feminist Magazine Show on 3RPP Radio Port Phillip, Victoria, Thursday, 20 August 2009. On the show with me was Catherine Manning, who wrote

This article comes from the background research for the Freewaves Feminist Magazine Show on 3RPP Radio Port Phillip, Victoria, Thursday, 20 August 2009. On the show with me was Catherine Manning, who wrote  "As a nurse, I was in contact with the ill and the infirm. I knew something about the health and disease of bodies, but for a long time, I was baffled at the tremendous personal problems of life, of marriage, of living, and of just being. Here indeed was a challenge to “build beyond thyself.” Where was I to begin? I found the answer at every door. [...]

"As a nurse, I was in contact with the ill and the infirm. I knew something about the health and disease of bodies, but for a long time, I was baffled at the tremendous personal problems of life, of marriage, of living, and of just being. Here indeed was a challenge to “build beyond thyself.” Where was I to begin? I found the answer at every door. [...]

Recent comments